April 26, 2021

Mortgage Document Checklist: What You Need to Apply for a Mortgage

Share this article:

Whether you are buying a new home or refinancing your existing one, the most daunting task can be getting approved for a mortgage.

If you are on the path to home ownership, your first step should be finding the right mortgage product and rate for you. Getting a mortgage is more complex than fixed vs. variable – it’s a major financial decision so you want to make sure you get it right!

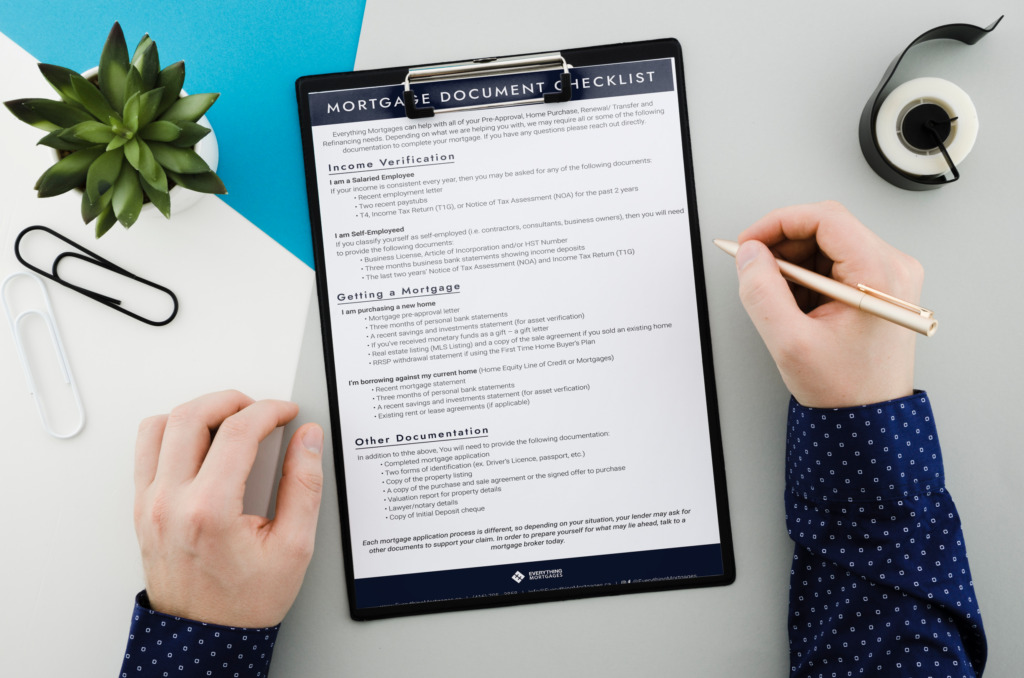

To start, we created a mortgage document checklist to help you gather all the documentation you’ll need to finalize the mortgage process quickly and efficiently. Every mortgage application is different but this is a standard list of requirements for most lenders.

Individual banks and lenders may have different requirements and may ask for additional documentation to support your application. That’s why you should always consult with a Mortgage Broker to help guide you through the mortgage process. Download the PDF version of the checklist at the end of this article.

The Mortgage Document Checklist

Financial Documentation

- A mortgage pre-approval letter

- Banking information

- A recent savings/investment statement

- Credit report

- If you’ve received monetary funds as a gift – a gift letter

- RRSP withdrawal statement if using the Home Buyer’s Plan (HBP)

- A copy of the sale agreement if you sold an existing home

- Recent mortgage statement (if refinancing)

- Existing rent or lease agreements

Employment Verification

- T4 or T4A Slip

- Copy of the latest pay slip/check

- Letter of Employment

- Notice of Assessment (NOA)

- If you are self-employed, you may need a T1 – General Notice of Assessment (NOA) letter or other evidence to show support income

- Articles of Incorporation or Business License

Other Important Mortgage Documents

- Two forms of identification (ex. Driver’s License, passport, etc.)

- Copy of the property listing (MLS listing)

- A copy of the purchase and sale agreement or the signed offer to purchase

- Valuation report for property details

- Lawyer/notary details

- Copy of Initial Deposit Check

Financial Documentation

1. Mortgage Pre-approval

It is in your best interest to get pre-approved for a mortgage prior to starting a mortgage application or looking at new homes. A pre-approval letter is valid for three months. It shows sellers you are ready to buy and gives you a better idea of your budget before you start your home search.

2. Banking Information

Your banking information (bank issued account documents) will be used to deposit the mortgage and then for repayment at the scheduled intervals in the future. It’s generally best practice to have the most recent six months of bank statements prepared but in most cases your last three statements will suffice.

3. List of Assets and Investments

Any additional assets and investments such as bonds, stocks, other securities or real estate should be disclosed as this will help increase your net worth and perhaps lower your interest rate.

4. Credit Report

Although your credit report will be automatically pulled by the lender, it’s beneficial for you to have a rough idea of where you stand. This will help determine your interest rate and homebuying budget. As well, help you mend any discrepancies that may appear.

5. Gift Letter

As housing affordability increasingly becomes an issue, many first-time homebuyers in Canada receive funds from a family member for a down payment. A gift letter shows the lender that the funds received is a gift not a loan, and you are not required to pay it back.

6. RRSP Withdrawal Statement

First-time homebuyers in Canada are eligible to use money saved in their RRSP (Registered Retirement Savings Plan) for a down payment on their first home through the Home Buyer’s Plan. If you plan on using this, a withdrawal statement will be required by the lender.

7. Purchase and Sale Agreement

If you sold an existing home to purchase another, then a copy of the Agreement of Purchase and Sale for the property that will be used for the down payment will be required by the lender.

8. Mortgage Statements

If you plan on refinancing your existing mortgage, any lender will want to see a recent mortgage statement to help them with their debt servicing calculations.

9. Existing Lease or Rental Agreements

Income generated by investment and rental properties will be added towards your yearly income earned. If you are collecting rent on any property, the lender will want to see any current rent or lease agreements.

Employment Verification

1. T4 or T4A

If you have regular full-time, part-time or seasonal work then you are considered an employee and will be issued a T4 or T4A by your employer. If you are a commission-only or independent contractor, your employer will issue a T4A. Lenders use the information on a T4/T4A to validate the income that you claim on your mortgage application. For most mortgage applications, a borrower who is employed by a company will be required to present the lender with their T4 or T4A for the last two tax years.

2. Recent Paystubs

The paystubs you provide in your mortgage application is verification of the income you earn at your current job. This is important as the bank wants to confirm you have sufficient income to cover the mortgage. If you work as a part-time, full-time or seasonal employee, you will likely be required to provide paystubs for the most recent two pay periods.

3. Letter of Employment

A letter of employment is a letter which states the type of employment you have (full-time, part-time or seasonal), your rate (hourly or salary) and your role and title at the company. Ensure it is written on company letterhead and signed by your employer. This will help lenders confirm that you do work at the place and with the job title that you wrote on your application.

4. T1 General Tax Assessment

The T1 General Tax Form indicates how much cumulative income you made for the previous tax year. If you are self employed or own a corporation, you will likely be asked for your T1 General tax forms for the most recent two tax years.

5. Notice of Assessment

After successfully filing your taxes, the Canada Revenue Agency (CRA) will send you a Notice of Assessment (NOA). This will provide details on your reported income amounts and any outstanding taxes owing. Regardless of your income sources or type of employment, you will likely need to submit your NOA’s for the two most recent tax years.

6. Articles of Incorporation / Business License

If you are self-employed and have a corporation registered, then the Articles of Incorporation will be used by lenders to verify whether you have paid suppliers on time by running your business’ credit report. If you are a sole proprietor or simple partnership, then your business license will be required.

Details of the Property

1. Address of the property

Legal address of the property including postal code.

2. Real Estate Listing (MLS Listing)

If this is a new purchase, you will need to provide a copy of the MLS listing of the property you intend to purchase. Your real estate agent can provide this to you. It will be used to estimate property taxes, heating and utility costs, condo fees, etc.

3. Accepted Purchase and Sale Agreement

If this is a new purchase, once the agreement has been signed, the bank will want to know the exact value of the home to determine the principal amount of the mortgage and identify the appropriate down payment required.

4. Property Tax Bill

If you are doing a mortgage refinance, the property tax bill will help lenders ensure that there are no taxes owing on the property or they will pay off any outstanding property taxes from the mortgage refinance.

5. Other Properties Owned

Whether you are newly purchasing a property or refinancing an existing one, the lender will want to know whether you own or partially own any additional properties.

Physical Address

The full physical address including postal code for all additional properties owned or partially owned will be required. This is because the lender will want to know how much of your assets are tied up in real estate.

Mortgage Statements

The lender will require the most recent mortgage statement for any additional property that has a mortgage balance or HELOC (Home Equity Line of Credit) on the property. Lenders will use any mortgage and HELOC balances as part of their debt servicing calculations. They also want to verify that all of your mortgage payments are up to date.

Final Property Tax Bill

If you are doing a mortgage refinance, the lender will want to see that there are no property taxes outstanding on any properties owned.

A Final Word

Depending on the type of mortgage, the application process involves a lot of documentation and can be lengthy and tedious. That’s why it pays to have a Mortgage Broker in your corner. An independent mortgage agent has access to all lenders (banks and private) and will help guide you make the best, most informed decision based on your individual financial status.

Everything Mortgages can help with all of your Pre-Approval, Home Purchase, Renewal/ Transfer and Refinancing needs. Depending on what we are helping you with, we may require all or some of the following documentation, but your Mortgage Broker will always ensure you have everything you need to succeed.

To best prepare yourself for what lies ahead talk to a Mortgage Broker today.