February 10, 2026

Current Self-Employed Mortgage Rates in Toronto: Best Deals for February 2026

Share this article:

Finding competitive mortgage rates as a self-employed borrower in Toronto has historically been challenging. Traditional lenders often view self-employed applicants as higher risk, leading to stricter requirements and less favorable terms. However, February 2026 brings encouraging news for entrepreneurs, freelancers, contractors, and small business owners seeking homeownership or refinancing opportunities in Canada’s largest city.

The Current Self-Employed Mortgage Rates in Toronto: Best Deals for February 2026 reveal a landscape transformed by recent Bank of Canada policy decisions and increased lender competition. With 5-year fixed rates dropping to as low as 3.69% for high-ratio mortgages and variable rates reaching 3.35%—the lowest since summer 2022—self-employed Torontonians now have access to financing options that rival those available to traditionally employed borrowers[2][3].

Understanding the nuances between insured and uninsured mortgages, fixed versus variable products, and the documentation requirements specific to self-employed applicants can mean the difference between securing an excellent rate and paying thousands more over your mortgage term. This comprehensive guide breaks down everything self-employed professionals need to know about accessing the best mortgage deals available this month.

Key Takeaways

✅ Record-low rates for self-employed: The lowest 5-year fixed rate in Ontario stands at 3.69% for high-ratio mortgages, while variable rates have dropped to 3.35%—the most competitive rates since summer 2022[2]

✅ Significant savings with brokers: Posted bank rates remain 2-3% higher (6.11%-6.49%) than rates available through mortgage brokers and online lenders, making professional guidance essential for self-employed borrowers[3]

✅ Documentation is critical: Self-employed applicants must provide tax returns, Notices of Assessment, business licenses, proof of monthly income, and maintain a minimum credit score of 620 to qualify[1]

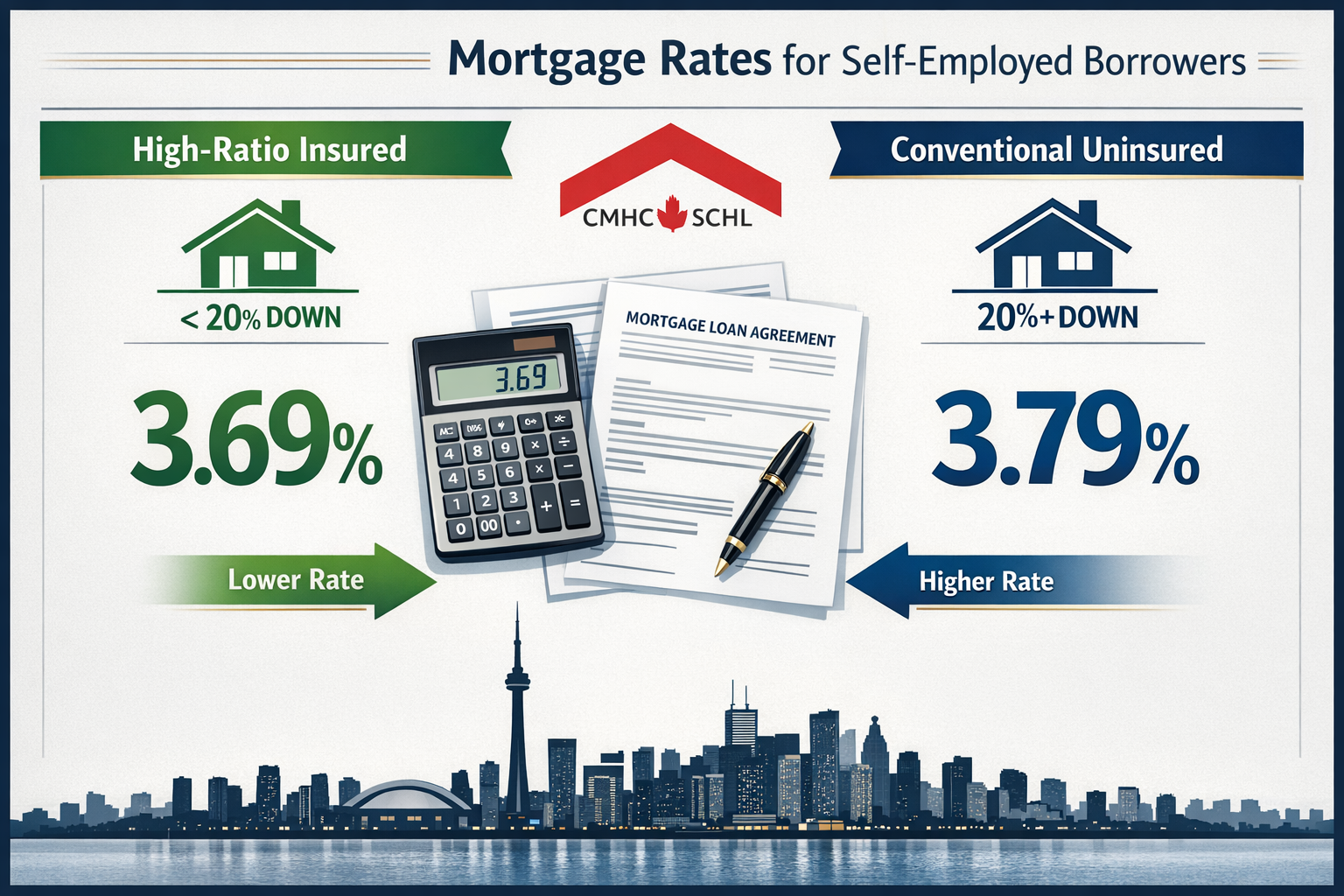

✅ Insured vs. uninsured matters: High-ratio insured mortgages (less than 20% down) offer rates approximately 0.10% lower than conventional uninsured mortgages due to reduced lender risk[2][4]

✅ Rate stability expected: The Bank of Canada’s overnight rate is projected to hold at 2.25% through early 2026, meaning current rates represent a favorable window for locking in financing[7]

Understanding Current Self-Employed Mortgage Rates in Toronto: Best Deals for February 2026

The Rate Landscape for Self-Employed Borrowers

The mortgage rate environment in February 2026 presents exceptional opportunities for self-employed individuals in Toronto. Canada’s average 5-year fixed conventional mortgage rate stands at 3.79%, representing a significant decline from the elevated rates seen in 2023 and early 2024[4]. For self-employed borrowers specifically, accessing these competitive rates requires understanding the distinction between different mortgage categories.

High-ratio insured mortgages (those with down payments below 20%) currently offer the lowest available rates at 3.69% for 5-year fixed terms[2]. These mortgages require default insurance from CMHC, Sagen, or Canada Guaranty, which protects the lender if borrowers default. While this insurance adds an upfront cost (typically 2.8%-4% of the mortgage amount), it provides access to the most competitive rates available.

Conventional uninsured mortgages (those with 20% or larger down payments) carry slightly higher rates, averaging 3.79% for 5-year fixed terms[4]. The rate premium reflects the additional risk lenders assume without default insurance protection. For self-employed borrowers with substantial equity or larger down payments, this small rate difference may be worthwhile to avoid insurance premiums.

Fixed vs. Variable: Current Self-Employed Mortgage Rates in Toronto

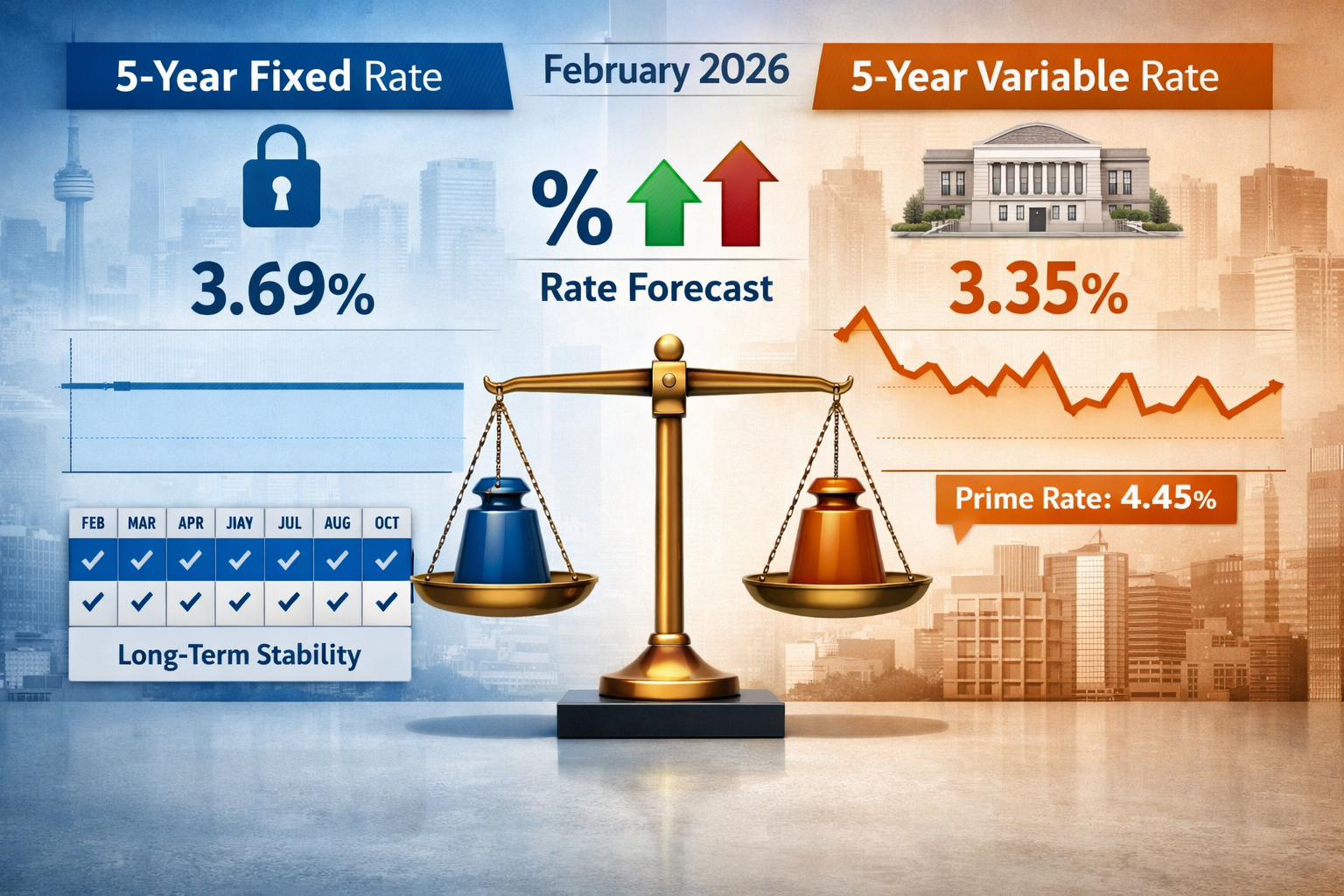

The choice between fixed and variable rates represents one of the most important decisions self-employed borrowers face. In February 2026, the spread between these products has narrowed considerably:

5-Year Fixed Rates: Starting at 3.69% for insured mortgages[2]

- Provides payment certainty and protection against future rate increases

- Ideal for borrowers with variable income who need predictable housing costs

- Currently near historic lows following Bank of Canada rate cuts

5-Year Variable Rates: Starting at 3.35%[2]

- Offers the lowest current payment option

- Fluctuates with the prime rate (currently 4.45%)[2]

- Carries risk if the Bank of Canada reverses course and raises rates

For self-employed professionals in Toronto, the 0.34% savings with variable rates translates to approximately $57 per month on a $400,000 mortgage—or $684 annually. However, this savings could evaporate quickly if economic conditions change and the Bank of Canada raises its overnight rate.

Working with a best self-employed mortgage broker in Toronto can help you evaluate which option aligns with your risk tolerance and business income stability.

How Bank of Canada Decisions Impact Your Rate

The Bank of Canada’s overnight rate directly influences the prime rate, which determines variable mortgage rates. As of February 9, 2026, the overnight rate sits at 2.25%, with the prime rate at 4.45%[2]. Variable-rate mortgages are typically priced as prime minus a discount (e.g., Prime – 1.10% = 3.35%).

According to current forecasts, the Bank of Canada is expected to hold rates steady at 2.25% for several months, with the next announcement scheduled for March 18, 2026[7]. Economists predict a rate hold is the likeliest scenario, meaning variable rates should remain stable in the near term.

Fixed mortgage rates, conversely, are influenced by bond yields rather than the overnight rate. The 5-year Government of Canada bond yield serves as the benchmark for 5-year fixed mortgage pricing. These rates are unlikely to move significantly lower in 2026 unless economic conditions weaken substantially or inflation falls below the Bank of Canada’s target range[2].

For self-employed borrowers evaluating the ultimate guide to securing a mortgage for self-employed Canadians, understanding these rate dynamics is essential for timing your application and choosing the right product.

Insured vs. Uninsured Mortgages: What Self-Employed Toronto Borrowers Need to Know

High-Ratio Insured Mortgages Explained

High-ratio insured mortgages require down payments of less than 20% of the property’s purchase price. For self-employed borrowers in Toronto’s expensive housing market—where the average home price exceeds $1 million in many neighborhoods—accumulating a 20% down payment can take years. Insured mortgages provide an alternative path to homeownership.

Key characteristics of insured mortgages for self-employed borrowers:

📊 Down payment: 5%-19.99% of purchase price

💰 Insurance premium: 2.8%-4% of mortgage amount (can be added to mortgage)

📉 Interest rates: Lowest available (currently 3.69% for 5-year fixed)[2]

✅ Qualification: Must meet standard debt service ratios and income verification

🏠 Property limit: Purchase price must be under $1 million

The insurance premium varies based on your down payment percentage:

| Down Payment | Insurance Premium |

|---|---|

| 5%-9.99% | 4.00% |

| 10%-14.99% | 3.10% |

| 15%-19.99% | 2.80% |

For a self-employed borrower purchasing a $900,000 Toronto condo with a 10% down payment ($90,000), the mortgage amount would be $810,000. The insurance premium of 3.10% ($25,110) could be added to the mortgage, bringing the total to $835,110. At a rate of 3.69%, the monthly payment would be approximately $4,160.

Conventional Uninsured Mortgages for Established Professionals

Conventional uninsured mortgages require down payments of 20% or more, eliminating the need for default insurance. For established self-employed professionals with significant equity or those refinancing, these mortgages offer flexibility despite slightly higher rates.

Advantages of uninsured mortgages for self-employed borrowers:

🏡 No property price limit: Can finance properties over $1 million

💵 No insurance premium: Saves 2.8%-4% upfront cost

📈 Equity access: Refinance up to 80% of property value

🔄 Flexibility: More lender options and product variations

The current rate for 5-year fixed conventional mortgages averages 3.79%[4]—just 0.10% higher than insured rates. For a $600,000 mortgage, this translates to approximately $17 more per month compared to an insured mortgage rate.

Self-employed borrowers considering mortgage refinancing and switching lenders at renewal should evaluate whether the rate difference justifies staying with conventional products or switching to access better terms.

Which Option Makes Sense for Self-Employed Torontonians?

The decision between insured and uninsured mortgages depends on several factors specific to self-employed situations:

Choose insured mortgages if:

- You have less than 20% down payment available

- You’re purchasing a property under $1 million

- You want to preserve cash for business operations or emergencies

- You qualify for the lowest advertised rates (3.69%)[2]

Choose uninsured mortgages if:

- You have 20% or more equity/down payment

- You’re purchasing a property over $1 million

- You want to avoid insurance premiums

- You’re refinancing to access equity for business or debt consolidation

For contractors and specialized self-employed professionals, reviewing options for self-employed mortgages for contractors can provide industry-specific guidance on maximizing approval odds and securing competitive rates.

Documentation Requirements and Qualification Criteria for Self-Employed Mortgage Rates

Essential Documents for Self-Employed Mortgage Applications

Securing the Current Self-Employed Mortgage Rates in Toronto: Best Deals for February 2026 requires meticulous documentation. Unlike traditionally employed borrowers who can verify income with recent pay stubs, self-employed applicants must provide comprehensive evidence of business income and financial stability.

Required documentation for self-employed mortgage applications:

📄 Tax Returns and Notices of Assessment (NOA): Most lenders require 2-3 years of complete tax returns, including all schedules and statements. The Canada Revenue Agency’s Notice of Assessment confirms the information you reported[1]

🏢 Business Documentation: Business license, articles of incorporation, or partnership agreements proving your business is legitimate and established

💳 Proof of Monthly Income: Bank deposit slips, customer invoices, contracts, and business bank statements demonstrating consistent revenue streams[1]

💰 Asset and Liability Statements: Documentation of current assets (savings, investments, property) and liabilities (business debts, credit cards, loans)[1]

📊 Financial Statements: For incorporated businesses, lenders may request balance sheets, income statements, and cash flow statements prepared by an accountant

🆔 Personal Identification: Government-issued ID, proof of Canadian residency or citizenship

The quality and completeness of your documentation directly impacts both approval odds and the rates you’ll receive. Lenders offering the lowest rates (3.35%-3.69%) typically have the strictest documentation requirements[2].

Income Calculation Methods for Self-Employed Borrowers

Lenders use different approaches to calculate qualifying income for self-employed applicants. Understanding these methods helps you prepare accurate applications and set realistic expectations.

Common income calculation approaches:

Two-Year Average Method: Lenders average your net business income (Line 15000 on personal tax returns) or net self-employment income over the most recent two years. This method smooths income fluctuations common in self-employment.

Add-Back Method: Certain business expenses that reduce taxable income but don’t represent actual cash outflows can be “added back” to increase qualifying income. Common add-backs include:

- Depreciation and amortization

- Non-cash expenses

- One-time extraordinary expenses

- Home office expenses (portion)

Stated Income Programs: Some alternative lenders offer programs where self-employed borrowers with excellent credit and larger down payments can qualify based on stated income without full tax return verification. These typically carry higher rates (4.5%-6%) than traditional programs.

For detailed strategies on income optimization, consult resources on how to get approved for a mortgage using your business income.

Credit Score and Debt Service Ratio Requirements

Beyond income documentation, self-employed borrowers must meet specific credit and debt ratio thresholds to access the best rates.

Credit Score Requirements:

The minimum credit score for self-employed mortgages is 620[1], though this typically qualifies you only for alternative lenders with higher rates. To access the advertised rates of 3.35%-3.79%, most lenders require:

- 680+: Minimum for A-lender competitive rates

- 700+: Preferred score for best available rates

- 750+: Optimal score providing access to all products and lowest rates

Debt Service Ratios:

Lenders evaluate your ability to manage mortgage payments alongside other debts using two key ratios:

Gross Debt Service (GDS) Ratio: Housing costs (mortgage payment, property taxes, heating, 50% of condo fees) divided by gross income

- Maximum: 32-39% depending on lender[1]

Total Debt Service (TDS) Ratio: All debt obligations (housing costs plus credit cards, car loans, lines of credit) divided by gross income

- Maximum: 32-42% depending on lender[1]

For example, if your gross annual income is $120,000:

- Maximum housing costs: $38,400-$46,800 annually ($3,200-$3,900 monthly)

- Maximum total debt payments: $38,400-$50,400 annually ($3,200-$4,200 monthly)

Self-employed borrowers often benefit from working with specialists who understand how to structure applications to maximize qualifying income while maintaining favorable debt ratios. The self-employed mortgage approval in Ontario interview provides insider perspectives on navigating these requirements.

Special Considerations and Restrictions

Self-employed mortgage applications come with additional considerations that can impact approval and rates:

Tax Arrears: Applicants must be completely free of tax arrears[1]. Outstanding balances owed to the Canada Revenue Agency are automatic disqualifiers for most traditional lenders.

Borrowing Limits: Some lenders impose maximum loan amounts for self-employed borrowers. For example, National Bank caps self-employed mortgages at $600,000[1], while other institutions make discretionary decisions without stated limits. In Toronto’s expensive market, these caps can significantly restrict property options.

Business Tenure: Most lenders require self-employed applicants to have operated their business for a minimum of 2-3 years to demonstrate stability and establish income history.

Industry Risk Assessment: Lenders evaluate the stability and viability of your industry. Seasonal businesses, emerging industries, or sectors experiencing disruption may face additional scrutiny or higher rates.

Understanding tax smarts and maximizing benefits for the self-employed in Canada helps balance the need for legitimate tax deductions with maintaining sufficient reported income for mortgage qualification.

Comparing Lenders: Where to Find the Best Self-Employed Mortgage Rates in Toronto

Traditional Banks vs. Mortgage Brokers: The Rate Gap

One of the most striking aspects of the Current Self-Employed Mortgage Rates in Toronto: Best Deals for February 2026 is the substantial difference between posted bank rates and broker-negotiated rates.

Posted Bank Rates (February 2026):

Major Canadian banks maintain significantly higher posted rates:

- BMO: 6.49% (5-year fixed posted rate)[3]

- CIBC: 6.11% (5-year fixed posted rate)[3]

- TD: 6.14% (5-year fixed posted rate)[3]

- Scotiabank: 6.49% (5-year fixed posted rate)[3]

These posted rates serve as starting points for negotiations and stress test calculations, but few borrowers actually pay these rates.

Broker and Online Lender Rates (February 2026):

Through mortgage brokers and online lenders, self-employed borrowers can access:

- 5-year fixed: 3.69%-3.79%[2][4]

- 5-year variable: 3.35%-3.55%[2]

The difference is staggering: 2.32% to 3.14% lower than posted bank rates. On a $500,000 mortgage, this translates to approximately $650-$900 less per month in mortgage payments—or $7,800-$10,800 annually.

Why Mortgage Brokers Offer Better Rates for Self-Employed Borrowers

Mortgage brokers provide several advantages specifically beneficial to self-employed applicants:

🔍 Lender Matching: Brokers work with dozens of lenders, including banks, credit unions, monoline lenders, and alternative lenders. They can match your specific self-employment situation with lenders most likely to approve and offer competitive rates.

📋 Application Optimization: Experienced brokers understand how different lenders calculate self-employed income and can structure your application to maximize qualifying income.

💡 Product Knowledge: Brokers stay current on which lenders offer the most favorable terms for specific self-employment situations (contractors, incorporated businesses, freelancers, etc.).

💰 Negotiating Power: Brokers submit high volumes of applications, giving them negotiating leverage to secure rate discounts not available to individual applicants.

🆓 No Cost to Borrowers: Lenders pay broker commissions, meaning you access this expertise without additional fees.

For self-employed Torontonians, partnering with specialists who understand the unique challenges of documenting business income can be the difference between approval and denial—or between a 3.69% rate and a 5.5% rate.

Top Lender Options for Self-Employed Mortgages in Toronto

Different lenders specialize in different self-employment scenarios. Understanding which institutions offer the most competitive rates and flexible qualification criteria helps you target your application effectively.

A-Lenders (Traditional Banks and Credit Unions):

Best for: Established self-employed borrowers with strong credit (700+), consistent income, and complete documentation

- Offer the lowest rates (3.69%-3.79%)[2][4]

- Strict documentation and income verification requirements

- May have borrowing limits for self-employed applicants

- Prefer 2-3 years of stable or increasing business income

Monoline Lenders:

Best for: Self-employed borrowers who meet standard qualification criteria but want more competitive rates than banks

- Offer rates comparable to or better than banks (3.69%-3.85%)

- Available only through mortgage brokers

- Often more flexible with income calculation methods

- May accept shorter business tenure (2 years vs. 3 years)

Alternative and Private Lenders:

Best for: Self-employed borrowers with credit challenges, irregular income, tax arrears, or unique situations

- Higher rates (4.5%-8%+) reflecting increased risk

- More flexible qualification criteria

- May accept stated income or alternative documentation

- Shorter terms (1-2 years) with plans to refinance to traditional lenders

Credit Unions:

Best for: Self-employed borrowers seeking personalized service and relationship-based lending

- Competitive rates (3.75%-4.0%)

- May be more flexible with unique self-employment situations

- Often consider full financial picture beyond just income ratios

- Membership requirements vary by institution

Comparing credit union vs bank mortgage Canada options helps self-employed borrowers understand the trade-offs between different institutional types.

Rate Shopping Strategies for Self-Employed Borrowers

Securing the best possible rate requires strategic shopping and timing:

1. Get Pre-Approved Early: Start the pre-approval process 90-120 days before you need financing. This provides time to address any documentation gaps or credit issues.

2. Compare Multiple Offers: Obtain rate quotes from at least 3-5 different sources (bank, broker, credit union) to establish the competitive landscape.

3. Understand Rate Holds: Most lenders offer 90-120 day rate holds. If you lock in a rate and rates drop before closing, many lenders will honor the lower rate.

4. Negotiate Beyond Rate: Consider the total package including prepayment privileges, portability options, penalty calculations, and refinancing flexibility.

5. Time Your Application Strategically: Apply when your business income is strongest and most stable. If you had a weak year, waiting until you have another strong year of tax returns may improve your qualifying income.

6. Monitor Economic Indicators: Watch Bank of Canada announcements and bond yields. If rate cuts are anticipated, variable rates may offer advantages; if rates are expected to rise, locking in fixed rates provides protection.

Starting your search with a comprehensive mortgage application through a broker gives you access to multiple lenders simultaneously, streamlining the comparison process.

Strategies to Secure the Lowest Rates as a Self-Employed Borrower

Optimizing Your Income Documentation

The way you present your income significantly impacts the rates you’ll receive. Self-employed borrowers who understand lender perspectives can structure their documentation for maximum approval odds.

Income Optimization Strategies:

💼 Balance Tax Deductions with Qualifying Income: While minimizing taxes is smart business practice, excessive deductions reduce your qualifying income for mortgages. Plan 2-3 years ahead if homeownership is a goal, potentially limiting discretionary deductions to maintain higher reported income.

📊 Highlight Income Trends: If your income is increasing year-over-year, emphasize this growth. Lenders view upward income trends more favorably than declining or volatile income.

🔢 Maximize Add-Backs: Work with your accountant to identify legitimate add-backs (depreciation, amortization, non-cash expenses) that can increase qualifying income without misrepresenting your financial situation.

📈 Demonstrate Income Stability: Provide contracts, recurring client agreements, or forward-looking revenue projections that demonstrate income consistency beyond what tax returns show.

🏢 Consider Income Splitting Carefully: For incorporated borrowers, the mix of salary, dividends, and retained earnings impacts qualifying income. Consult with both your accountant and mortgage broker to optimize this structure.

Improving Your Credit Profile

Credit scores directly impact the rates you’ll receive. Self-employed borrowers should prioritize credit optimization well before applying for mortgages.

Credit Improvement Tactics:

✅ Pay All Bills on Time: Payment history accounts for 35% of your credit score. Set up automatic payments to ensure you never miss due dates.

✅ Reduce Credit Utilization: Keep credit card balances below 30% of limits, ideally below 10%. High utilization signals financial stress to lenders.

✅ Maintain Established Accounts: Length of credit history matters. Keep your oldest credit accounts open even if you don’t use them frequently.

✅ Limit New Credit Applications: Each application creates a hard inquiry that temporarily lowers your score. Avoid opening new credit in the 6-12 months before applying for a mortgage.

✅ Correct Errors: Review your credit reports from both Equifax and TransUnion. Dispute any errors or inaccuracies that could be lowering your score.

✅ Separate Business and Personal Credit: Maintain distinct business credit accounts to prevent business expenses from inflating your personal credit utilization.

For borrowers with past credit challenges, understanding options for bad credit mortgage Ontario solutions can provide pathways to homeownership even with imperfect credit histories.

Increasing Your Down Payment

Larger down payments unlock better rates and more favorable terms for self-employed borrowers:

Down Payment Benefits:

🏠 20%+ Down Payment: Eliminates insurance premiums (saving 2.8%-4% of mortgage amount) and qualifies for conventional mortgage rates

💰 25%+ Down Payment: Some lenders offer rate discounts for borrowers with substantial equity, viewing them as lower risk

📉 35%+ Down Payment: May qualify for specialized low-ratio programs with the absolute lowest rates available

🔓 Flexibility: Larger down payments reduce monthly payments, improving debt service ratios and making qualification easier

For self-employed borrowers, accumulating larger down payments may require specific strategies:

- Retain Earnings: Keep profits in business accounts earmarked for down payment rather than distributing all income

- Leverage RRSP: Use the Home Buyers’ Plan to withdraw up to $35,000 from RRSPs tax-free for down payment

- Gift Funds: Many lenders accept down payment gifts from immediate family members

- Equity from Current Property: If you own property, equity can be used for down payment on your next purchase

Choosing the Right Mortgage Term and Type

Beyond the rate itself, the mortgage structure significantly impacts your total costs and flexibility:

Term Selection Considerations:

📅 5-Year Terms: Most popular option, balancing rate competitiveness with reasonable commitment period. Currently offering 3.69%-3.79% fixed or 3.35% variable[2][4]

📅 Shorter Terms (1-3 Years): May offer slightly lower rates but require more frequent renewals. Suitable if you expect income to increase significantly, allowing you to refinance to better terms

📅 Longer Terms (7-10 Years): Provide extended rate security but typically carry rate premiums of 0.3%-0.6% above 5-year terms. Best for borrowers who highly value payment certainty

Fixed vs. Variable Decision Framework:

Choose Fixed Rates if:

- Your self-employment income fluctuates significantly

- You need predictable payments for budgeting

- You believe rates will increase in the next 2-3 years

- You have low risk tolerance

Choose Variable Rates if:

- Your income is stable and can absorb payment increases

- You want the lowest current payment

- You believe rates will remain stable or decrease

- You can tolerate some payment uncertainty

The current 0.34% spread between fixed (3.69%) and variable (3.35%) rates is relatively narrow compared to historical norms, making fixed rates particularly attractive in February 2026[2].

Understanding the nuances of fixed vs variable rates helps self-employed borrowers make informed decisions aligned with their business income patterns and risk preferences.

Working with Specialists Who Understand Self-Employment

Perhaps the most impactful strategy for securing the best rates is partnering with mortgage professionals who specialize in self-employed lending:

Benefits of Specialist Brokers:

🎯 Targeted Lender Selection: Specialists know which lenders are most favorable to specific self-employment situations (contractors vs. freelancers vs. incorporated businesses)

📋 Application Expertise: They understand how to present self-employed income in the most favorable light while maintaining complete accuracy

⚡ Faster Processing: Specialists anticipate lender questions and provide complete documentation upfront, reducing back-and-forth and speeding approvals

💡 Problem-Solving: When challenges arise (income calculation disputes, documentation gaps, credit issues), specialists have experience finding solutions

🔄 Ongoing Support: Self-employed situations evolve; specialists can advise on refinancing, renewals, and equity access as your business grows

The difference between a general mortgage broker and a self-employed specialist can be substantial—potentially 0.5%-1% in rate differences and significantly higher approval odds.

Conclusion: Taking Action on Current Self-Employed Mortgage Rates in Toronto

The Current Self-Employed Mortgage Rates in Toronto: Best Deals for February 2026 represent a remarkable opportunity for entrepreneurs, freelancers, contractors, and small business owners to access homeownership or refinance existing mortgages at historically competitive rates. With 5-year fixed rates starting at 3.69% and variable rates as low as 3.35%, self-employed borrowers can now secure financing on terms that rival or exceed those available to traditionally employed applicants[2].

The key to capitalizing on these favorable conditions lies in understanding the distinct requirements self-employed applicants face and preparing accordingly. Complete documentation—including multiple years of tax returns, Notices of Assessment, business licenses, and proof of monthly income—forms the foundation of successful applications[1]. Maintaining a credit score of 680 or higher, managing debt service ratios within 32-42% limits, and ensuring you’re free of tax arrears positions you to access the most competitive rates available[1].

The substantial 2-3% rate difference between posted bank rates and broker-negotiated rates underscores the value of working with mortgage professionals who specialize in self-employed lending[3]. These specialists understand how to navigate the unique challenges of documenting business income, matching you with lenders most likely to approve your application at favorable rates, and structuring your mortgage for maximum flexibility as your business evolves.

Your Next Steps

Ready to secure the best possible mortgage rate for your self-employment situation? Take these actionable steps:

1. Gather Your Documentation 📋

Collect 2-3 years of complete tax returns with Notices of Assessment, business licenses, recent bank statements, and proof of monthly income. The more organized your documentation, the smoother your application process.

2. Check Your Credit 💳

Obtain free credit reports from Equifax and TransUnion. Review for errors and identify opportunities to improve your score before applying. Aim for 700+ to access the best rates.

3. Calculate Your Debt Ratios 🧮

Determine your current GDS and TDS ratios to understand how much mortgage you can qualify for. Online calculators can help, but specialist brokers provide the most accurate assessments.

4. Consult a Self-Employed Mortgage Specialist 🤝

Connect with a broker who specializes in self-employed lending. They’ll review your specific situation, identify the best lender matches, and advise on strategies to maximize your qualifying income and secure optimal rates.

5. Get Pre-Approved ✅

Obtain a pre-approval with a 90-120 day rate hold. This locks in current rates while you search for properties and provides certainty about your budget.

6. Monitor Rate Trends 📊

Stay informed about Bank of Canada announcements and economic indicators that influence mortgage rates. If rates are trending downward, variable products may offer advantages; if stability or increases are expected, locking in fixed rates provides protection.

7. Plan for the Future 🎯

If you’re not quite ready to apply, work with your accountant to balance tax optimization with maintaining sufficient reported income for future mortgage qualification. Planning 2-3 years ahead dramatically improves your options.

The combination of record-low rates, increased lender competition, and growing acceptance of self-employed income verification methods makes February 2026 an exceptional time for Toronto’s self-employed professionals to pursue homeownership or refinancing goals. By understanding the requirements, preparing comprehensive documentation, and partnering with specialists who navigate self-employed lending daily, you can access the same competitive rates and favorable terms previously reserved for traditionally employed borrowers.

Don’t let outdated perceptions about self-employed mortgage challenges prevent you from exploring your options. The landscape has transformed, and the Current Self-Employed Mortgage Rates in Toronto: Best Deals for February 2026 demonstrate that self-employment is no longer the barrier it once was to securing excellent mortgage financing.

References

[1] Self Employed – https://rates.ca/guides/mortgage/self-employed

[2] Current Mortgage Rates Ontario – https://www.ratehub.ca/current-mortgage-rates-ontario

[3] Current Mortgage Rates – https://www.nerdwallet.com/ca/p/best/mortgages/current-mortgage-rates

[4] Mortgage Rates – https://www.nesto.ca/mortgage-rates/

[5] Mortgage Rates – https://www.desjardins.com/en/mortgage/mortgage-rates.html

[6] Rates – https://www.nbc.ca/personal/mortgages/rates.html

[7] Mortgage Rate Forecast – https://www.truenorthmortgage.ca/blog/mortgage-rate-forecast

[8] Posted Interest Rates Offered By Chartered Banks – https://www.bankofcanada.ca/rates/banking-and-financial-statistics/posted-interest-rates-offered-by-chartered-banks/