May 27, 2025

Unlocking Your Dream Home: A Comprehensive Guide on How to Get Approved for a Mortgage Using Your Business Income

Share this article:

For many entrepreneurs and self-employed professionals in Canada, the dream of owning a home is a powerful one. You’ve poured your heart and soul into building your business, achieving financial independence, and creating your own success story. However, when it comes to applying for a mortgage, the path can sometimes feel a bit different for business owners compared to those with traditional employment. Lenders often look at business income through a unique lens, and what might seem like a strong financial position to you could require a specific approach to be seen similarly by a bank.

At Everything Mortgages, we understand the unique challenges and incredible strengths of self-employed individuals. We believe that your entrepreneurial spirit should open doors, not close them, when it comes to homeownership. This comprehensive guide is designed to demystify the process of getting approved for a mortgage when your income comes from your business. We’ll explore what lenders look for, the documents you’ll need, strategies to boost your chances, and how a trusted mortgage broker can be your greatest ally on this exciting journey. Get ready to turn your business success into the keys to your dream home! 🔑🏡

Key Takeaways

- Lenders View Business Income Differently: Unlike steady paychecks, business income can be complex due to deductions and varying monthly earnings. Lenders focus on your net income (what you actually take home after expenses) and look for stability over two years.

- Documentation is Your Best Friend: Be prepared with detailed tax returns (T1 Generals, T2s), financial statements, and proof of consistent business activity. An organized approach makes a huge difference.

- Strategic Financial Planning Matters: To improve your chances, focus on strong credit, a healthy down payment, and temporarily minimizing business write-offs before applying.

- Explore All Your Options: Don’t just stick to big banks. Alternative lenders and specialized self-employed mortgage programs exist. A mortgage broker can help you find the best fit.

- A Mortgage Broker is Crucial: For self-employed individuals, a broker acts as your advocate, navigating complex rules, finding suitable lenders, and streamlining the entire application process.

Understanding Business Income for Mortgage Lenders: A Different Lens 🧐

When you work for an employer, getting a mortgage usually involves showing your pay stubs and a letter from your boss. Your income is generally clear and consistent. But when you own a business, things are a bit more detailed. Lenders don’t just see your gross sales; they need to understand your true, stable income that can reliably cover mortgage payments.

Why is Business Income Viewed Differently?

The main reasons lenders treat business income uniquely are:

- Income Fluctuation: Business income can go up and down. Some months might be great, others slower. Lenders want to see a consistent, reliable income over time.

- Business Expenses and Deductions: As a business owner, you likely take advantage of many tax deductions (like home office expenses, vehicle costs, supplies). While these are smart for tax purposes, they reduce your net income – the amount lenders use to qualify you for a mortgage.

- Proof of Stability: Lenders need to be sure your business will continue to be successful and generate enough income to pay your mortgage for years to come. They look for a track record, not just a snapshot.

What Do Lenders Look For?

Lenders are essentially looking for answers to a few key questions:

- Is your income stable? They want to see consistent earnings over at least two years.

- Is your business healthy and growing (or at least stable)? They’ll look at your financial statements to judge the overall health of your operations.

- Can you prove your income? They need official documents that verify everything you claim.

- What is your true qualifying income? This is often your net income after deductions, and sometimes they’ll “add back” certain expenses.

It’s not about how much money your business makes but how much money your business allows you to reliably qualify with for a mortgage. This distinction is crucial for self-employed individuals seeking home financing.

Types of Business Structures and Their Impact on Your Mortgage Application 🏢

The way your business is set up legally can have a big effect on what documents you need and how lenders assess your income. Let’s break down the common business structures in Canada and how they relate to getting a mortgage.

1. Sole Proprietorship

- What it is: This is the simplest business structure. You are the business, and there’s no legal separation between you and your company. Many freelancers, consultants, and small business owners start here.

- How it impacts your mortgage: Your business income and expenses are reported directly on your personal tax return (T1 General, Schedule T2125 Statement of Business or Professional Activities).

- Lender’s view: Lenders will primarily look at your net business income from your T1 General, usually averaged over two years. Because you’re personally responsible for the business, they’ll also look closely at your personal credit history.

- Key documents: T1 General (with T2125) and Notices of Assessment (NOAs) for the past two years.

2. Partnership

- What it is: Similar to a sole proprietorship, but two or more people share ownership and responsibility for the business.

- How it impacts your mortgage: Each partner reports their share of the business income and expenses on their personal tax return (T1 General, T2125).

- Lender’s view: The lender will assess your individual share of the net business income, similar to a sole proprietorship, again, usually averaged over two years. They’ll also consider the stability of the partnership itself.

- Key documents: T1 General (with T2125) and NOAs for the past two years for each partner applying. A partnership agreement might also be requested.

3. Corporation (Inc.)

- What it is: A corporation is a separate legal entity from its owners. This structure offers liability protection, but it also means more complex accounting and tax rules. Many growing businesses choose to incorporate.

- How it impacts your mortgage: As a shareholder and director of your corporation, you might pay yourself in a few ways:

- Salary: Treated like regular employment income.

- Dividends: Payments from the company’s profits.

- Shareholder Loans: Money borrowed from the company.

- Lender’s view: This is where it gets tricky.

- If you pay yourself a consistent salary, some lenders might treat it similarly to employment income, though they’ll still want to see the corporation’s financial health.

- If you pay yourself dividends, lenders will often look at the corporation’s financial statements (T2, Income Statement, Balance Sheet) to determine the company’s ability to continue paying those dividends. They’ll assess the net income of the corporation before taxes, or sometimes the salary/dividends paid out.

- They typically want to see two years of corporate tax returns (T2) and financial statements prepared by an accountant.

- Key documents:

- For you: T1 General, NOAs (showing salary/dividends received).

- For your corporation: T2 Corporate Income Tax Returns, Notice of Assessment for the corporation, Financial Statements (Income Statement, Balance Sheet) for the past two years, ideally prepared by a Certified Public Accountant (CPA).

- Proof of ownership (Articles of Incorporation).

Understanding your business structure is the first step in knowing what documents you’ll need to gather. Don’t worry if it seems complicated; a good mortgage broker can help you navigate these details.

Essential Documents for Self-Employed Mortgage Applicants 📁

Getting approved for a mortgage with business income means providing clear, organized proof of your financial health. Think of it as telling your financial story to the lender. The more complete and clear your story, the better your chances. Here’s a detailed list of the documents you’ll typically need:

1. Personal Tax Returns and Notices of Assessment (NOAs)

- What they are: Your T1 General is your personal income tax return. The Notice of Assessment (NOA) is the official document from the Canada Revenue Agency (CRA) that confirms your income, deductions, and taxes owing or refunded for a specific tax year.

- Why they’re needed: These are the most important documents for verifying your reported income. Lenders usually ask for two years of T1 Generals and corresponding NOAs. They use these to calculate your average qualifying income.

- For Sole Proprietors/Partnerships: Your T1 General will include Form T2125, Statement of Business or Professional Activities, which details your business income and expenses.

- For Corporations: Your T1 General will show any salary or dividends you’ve received from your corporation.

2. Business Financial Statements

- What they are: These are official reports that show the financial health of your business.

- Income Statement (or Profit & Loss Statement): Shows your revenues, expenses, and net profit over a period (e.g., annually).

- Balance Sheet: Provides a snapshot of your business’s assets, liabilities, and owner’s equity at a specific point in time.

- Why they’re needed: Especially crucial for corporations. Lenders use these to understand the overall profitability and stability of your company, even if you pay yourself dividends. They usually require statements for the past two fiscal years.

- Important Note: Lenders prefer financial statements prepared by a Certified Public Accountant (CPA). This adds credibility and ensures accuracy.

3. Corporate Tax Returns (T2)

- What they are: These are the tax returns filed for your corporation with the CRA.

- Why they’re needed: If you’re incorporated, lenders will ask for two years of your T2 Corporate Income Tax Returns and corresponding corporate NOAs. This helps them verify the corporation’s income and tax payments.

4. Business Registration and Licensing

- What they are: Documents proving your business is legally registered and holds any necessary licenses to operate (e.g., business name registration, professional licenses).

- Why they’re needed: To confirm your business is legitimate and operating legally.

5. Business Bank Statements

- What they are: Monthly statements from your business bank accounts.

- Why they’re needed: Lenders may ask for 3-6 months of business bank statements to see the flow of funds, verify income deposits, and ensure you have sufficient operating capital. This helps them see the day-to-day reality of your business income.

6. Personal Bank Statements

- What they are: Monthly statements from your personal bank accounts.

- Why they’re needed: To verify your down payment funds, show consistent personal savings, and demonstrate responsible money management. Lenders typically ask for 3-6 months.

7. Letters from Your Accountant

- What they are: A formal letter from your accountant confirming your self-employment status, the nature of your business, and your average gross and net income over a specific period (usually two years).

- Why they’re needed: This provides an independent, professional verification of your income and business stability, which can be very reassuring to lenders. It often highlights “add-backs” that improve your qualifying income.

8. Proof of Ongoing Business Activity (Optional but Helpful)

- What they are: Contracts with clients, recent invoices, proof of repeat business, or a portfolio of work.

- Why they’re needed: While not always mandatory, these can strengthen your application by showing that your business has a steady stream of work and is likely to continue generating income. This is especially useful if your business is relatively new (less than 2 years established) or if your income is highly variable.

9. Credit History and Debt Information

- What they are: Your credit report (showing your credit score and history of borrowing/repaying) and details of any existing debts (car loans, credit cards, lines of credit).

- Why they’re needed: Lenders need to assess your overall financial responsibility and your debt-to-income ratio. A good credit score is vital.

Pull Quote:

“Being organized with your documents is half the battle. A well-prepared application sends a clear message to lenders: you’re responsible and ready for homeownership.” 📚✅

Gathering these documents can seem like a lot, but it’s a crucial step. Starting early and working with your accountant to ensure everything is in order will make the process much smoother.

Calculating Your Qualifying Income: The Self-Employed Math 🧮

This is often the most confusing part for self-employed individuals. You might earn a lot of money, but your qualifying income for a mortgage could be much lower than your gross revenue. Here’s why and how it’s calculated:

The Challenge of Net vs. Gross Income

- Gross Income: This is the total money your business brings in before any expenses or deductions.

- Net Income: This is what’s left after you’ve paid all your business expenses and taken your tax deductions.

For tax purposes, you want to minimize your net income to pay less tax. For mortgage purposes, you want to maximize your reported net income to qualify for a larger mortgage. This creates a bit of a balancing act.

**Lenders primarily use your *net income* to qualify you.** Why? Because that’s the money that’s actually available to you personally to pay your mortgage and other living expenses.

The “Add-Backs” That Can Help

Sometimes, lenders are willing to “add back” certain business expenses to your net income if those expenses don’t truly represent a personal cash outflow that impacts your ability to pay your mortgage. Common add-backs include:

- Depreciation: This is an accounting expense for the wear and tear of assets (like a company car or equipment). It reduces your taxable income but isn’t an actual cash expense you’re paying out each month.

- Amortization: Similar to depreciation, but for intangible assets.

- Home Office Expenses: If you deduct a portion of your rent, utilities, or property taxes for your home office, some lenders might add this back, arguing you’d be paying these costs anyway as a homeowner.

- Vehicle Expenses: If you deduct a portion of your personal vehicle expenses used for business, some lenders might add back the personal portion.

- Capital Cost Allowance (CCA): This is the tax deduction for the depreciation of capital assets.

Example:

Let’s say your net business income (from your T2125) is \$50,000.

You also deducted:

- Depreciation: \$5,000

- Home office expenses: \$3,000

- Your accountant provides a letter stating these are common add-backs.

Your qualifying income could be: \$50,000 (Net Income) + \$5,000 (Depreciation) + \$3,000 (Home Office) = \$58,000. This makes a big difference!

Using a 2-Year Average

Most lenders will look at your net income (with eligible add-backs) for the past two years and then calculate an average. This helps smooth out any ups and downs in your business income and gives the lender a better sense of your consistent earning power.

- If your income is increasing: A rising income trend is great! Lenders might even consider your most recent year’s income if it’s significantly higher and sustainable.

- If your income is decreasing: This can be a red flag. You’ll need to explain why (e.g., a planned slowdown, one-time project ended) and show evidence that your current income level is stable.

Importance of Consistency

Lenders value consistency above all else. A business with steady, predictable income, even if it’s not sky-high, is often preferred over a business with wildly fluctuating earnings, even if the average is good.

Pull Quote:

“Your tax return tells one story for the CRA. Your mortgage application needs to tell another for the lender. Understanding the difference between net income and qualifying income, especially with ‘add-backs,’ is key.” 📈

This is where a knowledgeable mortgage broker becomes invaluable. They know which lenders are flexible with add-backs and how to present your financial information in the best possible light to maximize your qualifying income.

Strategies to Improve Your Mortgage Approval Chances 🚀

Getting a mortgage with business income isn’t just about having the right documents; it’s also about strategic planning and presenting your financial situation in the most favorable way. Here are key strategies:

1. Optimize Your Financial Health & Stability

- Consistent Income is King: Try to maintain a steady income flow for at least two years before applying. If your income fluctuates, demonstrate an upward trend or clear reasons for any dips.

- Minimize Deductions (Temporarily): This is a tricky one. While deductions are great for tax savings, they reduce your net income. For the one or two tax years before you apply for a mortgage, consider reducing aggressive write-offs. This will result in a higher reported net income on your T1 General, which directly translates to higher qualifying income for a mortgage. Discuss this strategy with your accountant well in advance.

- Build a Strong Credit Score: Your personal credit score is incredibly important. Pay all your bills on time, keep credit card balances low, and avoid applying for new credit just before a mortgage application. A score of 680 or higher is generally considered good, but aiming for 700+ is ideal.

- Reduce Your Debt-to-Income Ratio: Lenders look at how much of your gross income goes towards debt payments (mortgage, car loans, credit cards, lines of credit). The lower this ratio, the better. Try to pay down existing debts before applying.

- Save a Healthy Down Payment: A larger down payment reduces the amount you need to borrow, making you a less risky borrower. It also shows financial discipline. While 5% is the minimum for insured mortgages, 20% or more means you avoid mortgage loan insurance premiums (like CMHC).

- Internal Link Opportunity: Learn more about mortgage loan insurance and its benefits: Why Should We Have Mortgage Loan Insurance?

- Build Up Your Savings/Emergency Fund: Lenders like to see that you have a financial cushion outside of your down payment. This shows you can handle unexpected expenses without jeopardizing your mortgage payments.

2. Meticulous Documentation & Organization

- Keep Excellent Records: From invoices and receipts to bank statements and tax documents, keep everything organized and easily accessible. Digital records are a great option.

- Work Closely with Your Accountant: Your accountant is your best friend in this process. They can help prepare your financial statements, write the necessary letters, and advise on how to present your income in the best light for mortgage approval. They can also help identify those all-important “add-backs.”

3. Choosing the Right Lender & Partner

- Don’t Just Go to Your Bank: While your current bank knows you, they might not have the most flexible options for self-employed individuals. Different lenders have different rules and appetites for self-employed risk.

- Explore All Lender Types:

- A Lenders (Traditional Banks): These are the big banks (RBC, TD, CIBC, etc.). They often have the lowest rates but can be the strictest with self-employed income, focusing heavily on net income after all deductions.

- B Lenders (Alternative Lenders): These lenders are more flexible and often specialize in borrowers who don’t fit the traditional bank mold, including self-employed individuals with complex income situations or minor credit issues. Their rates might be slightly higher, but they offer more tailored solutions.

- Private Lenders (C Lenders): These are typically a last resort, offering very flexible terms but at significantly higher interest rates. They are often used for short-term financing or unique situations.

- Partner with a Mortgage Broker: This is arguably the most important strategy for self-employed individuals. A broker has access to dozens of lenders (A, B, and sometimes C) and knows their specific criteria for self-employed income. They can match you with the lender most likely to approve your application and help you prepare your file correctly. Pull Quote: “For self-employed individuals, a mortgage broker isn’t just helpful; they’re often essential. They bridge the gap between your unique financial situation and the lender’s requirements.” 🌉

4. Specialized Mortgage Programs

- Stated Income Mortgages (with caveats): In the past, “stated income” mortgages were more common, allowing self-employed individuals to state their income without as much verification. Today, these are much stricter and require strong supporting documentation (like proof of consistent business deposits, strong credit, and significant down payments). They are usually only available through alternative lenders and require a strong rationale.

- CMHC/Genworth/Canada Guaranty Programs: These are mortgage insurers. If you have less than a 20% down payment, your mortgage must be insured. These insurers have specific programs for self-employed individuals that can make it easier to qualify, especially if you have a solid two-year history. They often have clear guidelines for how they assess self-employed income.

5. Get Pre-Approved (Crucial for Self-Employed)

- What it is: A pre-approval is a conditional commitment from a lender to lend you a certain amount of money, based on a review of your finances.

- Why it’s crucial: For self-employed individuals, a pre-approval is even more important because it confirms early on how a lender will view your income and how much you can truly afford. It gives you confidence when house hunting and makes your offers more attractive to sellers.

- Internal Link Opportunity: Understand the importance of qualifying for a mortgage before buying property: The Importance of Qualifying for a Mortgage Before Buying Property

By implementing these strategies, you significantly increase your chances of a smooth and successful mortgage approval using your business income.

Common Hurdles and How to Overcome Them 🚧

Even with the best preparation, self-employed individuals might face specific challenges during the mortgage application process. Knowing these hurdles beforehand can help you prepare and overcome them.

1. Inconsistent Income

- The Hurdle: Your income fluctuates significantly from month to month or year to year. Lenders prefer stability.

- How to Overcome:

- Explanation: Provide a clear, written explanation for the fluctuations. Was it a one-time large project? A planned sabbatical? Seasonal business?

- Proof of Future Income: If you have new contracts or a strong pipeline of work, gather evidence to show future stability.

- Longer History: If you have more than two years of history, showing a strong average over 3-5 years can sometimes help, especially with alternative lenders.

- Larger Down Payment: A higher down payment reduces the lender’s risk, making them more forgiving of income inconsistencies.

2. High Business Expenses/Deductions

- The Hurdle: You’ve been very smart about minimizing your taxable income through deductions, but this also lowers your net income for mortgage qualification.

- How to Overcome:

- Strategic Tax Planning: As mentioned, work with your accountant before applying to potentially reduce aggressive write-offs for the one or two tax years preceding your application.

- Identify “Add-Backs”: Ensure your accountant is aware of common add-backs (depreciation, home office, vehicle expenses) and can clearly outline them in a letter for the lender. This is your best defense!

- Alternative Lenders: Some B lenders are more flexible in how they assess income for self-employed individuals and may be more open to adding back certain expenses.

3. Short Business History

- The Hurdle: Most lenders want to see at least two years of consistent self-employment income. If your business is newer, it’s harder to prove stability.

- How to Overcome:

- Strong Related Experience: If you were previously employed in the same industry, highlight this. Lenders might consider it as part of your overall experience.

- Significant Down Payment: A larger down payment (e.g., 25-35%) can sometimes offset a shorter history, as it significantly reduces the lender’s risk.

- Excellent Credit Score: A spotless credit history shows financial responsibility, which can compensate for a newer business.

- Guaranteed Contracts/Strong Client Base: Provide evidence of secured contracts or a growing list of repeat clients that demonstrate future income potential.

- Alternative Lenders: B lenders are sometimes more willing to work with newer self-employed individuals, especially if other aspects of your financial profile are strong.

4. Poor Credit History

- The Hurdle: A low credit score or a history of missed payments raises concerns about your ability to repay debts.

- How to Overcome:

- Improve Your Credit Score: This takes time, but it’s essential. Pay bills on time, reduce credit card balances, and avoid new credit applications.

- Address Past Issues: If there are errors on your credit report, get them corrected. If you had financial difficulties, be prepared to explain them (e.g., divorce, illness).

- Secured Credit Cards: If your credit is very poor, a secured credit card can help rebuild it.

- Alternative Lenders: B lenders specialize in borrowers with less-than-perfect credit. While rates might be higher, they offer a path to homeownership.

- Internal Link Opportunity: Learn about stress testing in the Canadian mortgage market, which impacts how much you can borrow: Stress Testing in the Canadian Mortgage Market: Your Cheat Sheet

5. Lack of Clear Separation Between Personal and Business Finances

- The Hurdle: Mixing personal and business expenses and income in the same bank account makes it very difficult for lenders to assess your true business profitability and personal spending habits.

- How to Overcome:

- Separate Bank Accounts: Open dedicated business bank accounts and keep all business transactions separate from personal ones. This is fundamental for clear accounting.

- Clear Bookkeeping: Use accounting software or work with a bookkeeper to track all income and expenses meticulously.

- Pay Yourself a Consistent Salary/Draw: Even if it’s just a regular transfer from your business account to your personal account, showing a consistent “paycheck” makes your personal income clearer to lenders.

Overcoming these hurdles often requires a bit of planning, a lot of organization, and the right guidance. This is exactly where a mortgage broker shines.

The Power of a Mortgage Broker for Business Owners 🤝

You’ve worked hard to build your business, and now it’s time for that hard work to pay off in the form of a home. For self-employed individuals, navigating the mortgage landscape can feel like a full-time job in itself. This is precisely why partnering with an experienced mortgage broker, like Everything Mortgages, is not just helpful—it’s often the key to your success.

Expertise with Self-Employed Files

- They Speak Your Language (and the Lender’s): Mortgage brokers specializing in self-employed clients understand the nuances of business income, deductions, and financial statements. They know how to present your unique financial story in a way that resonates with lenders.

- Understanding “Add-Backs”: They know which lenders are flexible with adding back expenses like depreciation, home office costs, or vehicle expenses to boost your qualifying income. This is a game-changer for many business owners.

- Knowing Lender Niches: Different lenders have different appetites for self-employed risk. Some might be great for incorporated professionals, while others prefer sole proprietors. A broker knows these specific niches and can quickly direct you to the most suitable options.

Access to Multiple Lenders

- Beyond the Big Banks: While your primary bank might seem like the obvious choice, they often have the strictest rules for self-employed applicants. A broker has relationships with over 35 lending institutions, including major banks, alternative lenders (B lenders), credit unions, and even private lenders. This means more options for you!

- Finding the Best Fit: Instead of you spending countless hours researching and applying to multiple lenders, a broker does the legwork. They can compare rates, terms, and approval criteria across various institutions to find the best mortgage product tailored to your specific business income situation.

Negotiation Power & Advocacy

- Your Personal Advocate: A mortgage broker works for you, not the lender. They will advocate on your behalf, highlighting your strengths and helping to explain any complexities in your financial profile.

- Getting the Best Rates: With access to many lenders, brokers can often secure more competitive interest rates and favorable terms than you might find on your own. Lenders value the volume of business brokers bring, sometimes offering better deals.

Streamlining the Process

- Simplified Document Collection: Your broker will provide a clear checklist of exactly what documents you need, saving you time and frustration. They’ll help you organize everything correctly.

- Application Preparation: They help you complete the lengthy application forms accurately, ensuring all necessary information is provided upfront, which speeds up the approval process.

- Navigating Hurdles: If challenges arise (e.g., a specific lender asks for more information, or an initial application is declined), your broker has the expertise to pivot, find alternative solutions, and guide you through.

- Internal Link Opportunity: Get a comprehensive overview of what to expect during the mortgage process: What to Expect During the Mortgage Process (Part 1)

Why Choose Everything Mortgages?

At Everything Mortgages, we pride ourselves on being your trusted partner.

- Award-Winning Brokerage: Our 4.9-star rating from over 100 reviews speaks to our commitment to client success.

- Expert Rate & Loan Matching: We evaluate options from over 35 lenders to ensure you get the best fit. “We can find the perfect mortgage for you in hours if you give us a few minutes of your time.”

- Committed Mortgage Brokers: “We advocate on your behalf. Throughout the entire process, your mortgage broker will assist you in finding the mortgage that best meets your unique circumstances and supports your goals.”

- Simple Online Process: “Put an end to the endless email exchanges and tedious phone calls… With our online approach, you may obtain a mortgage fast and simply while also saving time and reducing your stress levels.”

Pull Quote:

“Don’t go it alone. Your business is unique, and so is your path to homeownership. A mortgage broker is your expert guide, turning complexity into clarity.” 🧭

By leveraging the expertise of a mortgage broker, self-employed individuals can significantly reduce stress, save time, and dramatically increase their chances of securing the ideal mortgage using their hard-earned business income.

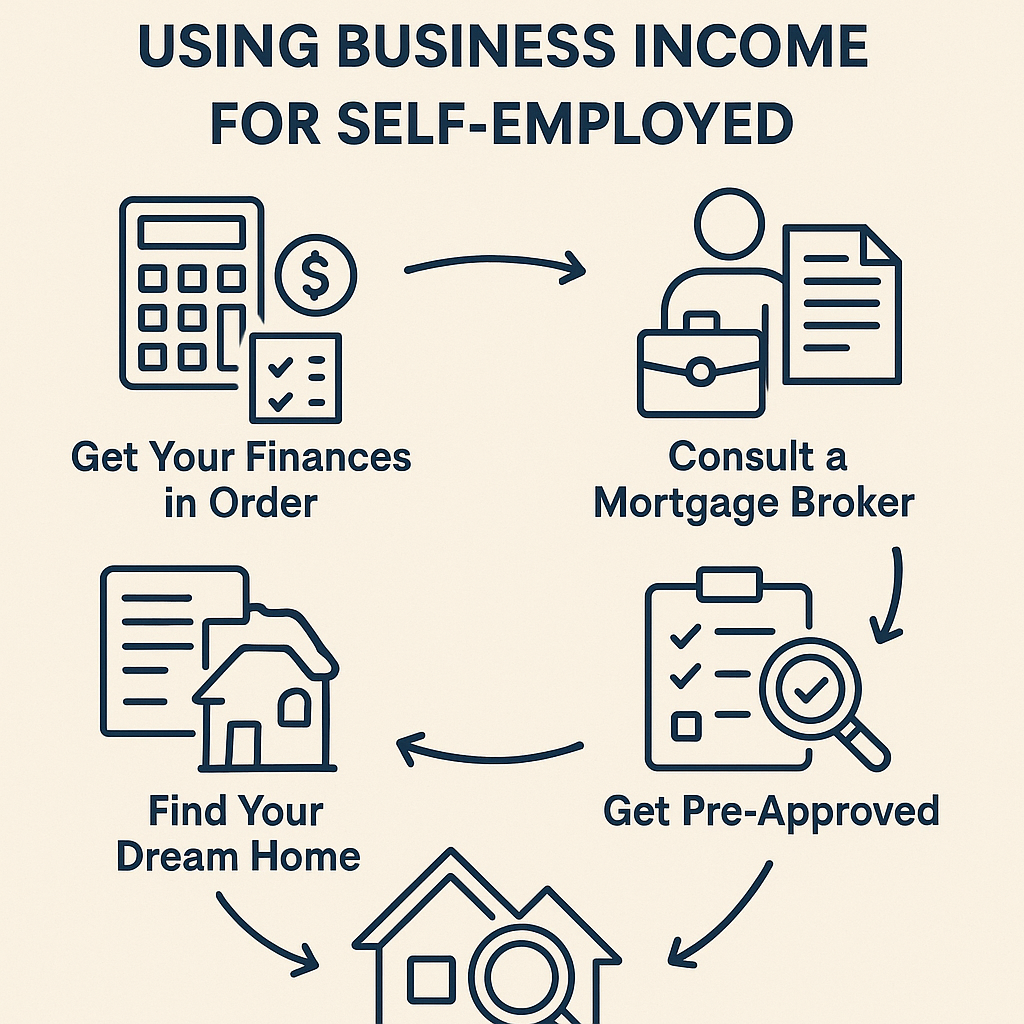

Step-by-Step Guide: Getting Approved with Business Income 🚶♂️➡️🏠

Now that you understand the details, let’s break down the mortgage approval process for self-employed individuals into clear, manageable steps.

Step 1: Get Your Finances in Order (The Planning Phase)

This is the most critical preparatory step for self-employed individuals. Start this well in advance of when you plan to buy.

- Review Your Business Structure: Understand how your business is set up (sole prop, partnership, corp) and how it affects your tax filings.

- Consult Your Accountant: This is paramount. Discuss your homeownership goals and ask them to:

- Review your past two years of tax returns (T1 Generals/T2s) and financial statements.

- Identify potential “add-backs” that can boost your qualifying income.

- Advise on strategic tax planning for the next 1-2 years if you’re not applying immediately (e.g., temporarily reducing aggressive write-offs).

- Be prepared to write a formal letter confirming your income and business stability.

- Improve Your Credit Score: Check your credit report. If your score is below 700, work on improving it by paying bills on time, reducing debt, and avoiding new credit inquiries.

- Separate Finances: If you haven’t already, open dedicated business bank accounts. Keep personal and business expenses strictly separate.

- Build Your Down Payment & Savings: Start saving aggressively for your down payment and an emergency fund. The more you save, the stronger your application.

Step 2: Gather Your Documents (The Proof Phase)

Once you’ve done your financial homework, it’s time to collect the necessary paperwork. Use the detailed list from earlier in this guide.

- Personal Tax Documents: T1 Generals and NOAs for the past two years.

- Business Tax Documents (if incorporated): T2 Corporate Income Tax Returns and corporate NOAs for the past two years.

- Financial Statements: Income Statements and Balance Sheets for the past two fiscal years, ideally prepared by your accountant.

- Bank Statements: 3-6 months of both personal and business bank statements.

- Accountant’s Letter: A formal letter from your accountant confirming your income and business stability, including any eligible add-backs.

- Business Registration: Proof of your business’s legal registration.

- Proof of Ongoing Activity (Optional): Contracts, invoices, client testimonials, etc.

Have these documents organized and ready to share.

Step 3: Consult a Mortgage Broker (The Expert Guidance Phase)

Don’t go it alone! This is where Everything Mortgages comes in.

- Initial Consultation: Schedule a free consultation. Be open and honest about your financial situation, including any challenges.

- Review and Assessment: Your broker will review your gathered documents and assess your qualifying income based on lender criteria. They’ll identify the best path forward.

- Lender Matching: Based on your profile, your broker will identify the most suitable lenders from their network (A, B, or specialized lenders for self-employed).

- Strategy Session: They’ll discuss the best strategies for your application, whether it’s focusing on certain add-backs, exploring specific programs, or addressing any potential hurdles.

Step 4: Get Pre-Approved (The Confidence Booster Phase)

Once your broker has assessed your situation and found potential lenders, they will help you apply for pre-approval.

- Formal Application: You’ll complete a mortgage application with your broker’s help.

- Document Submission: Your broker will submit your organized documents to the chosen lender(s).

- Income Verification: The lender will review your income, credit, and overall financial health.

- Conditional Approval: If approved, you’ll receive a conditional commitment outlining the maximum mortgage amount, interest rate, and any conditions you need to meet.

Step 5: Find Your Dream Home (The Fun Phase!)

With a pre-approval in hand, you can now confidently shop for a home within your approved budget.

- Real Estate Agent: Work with a trusted real estate agent who understands your budget and needs.

- Making an Offer: When you find the right home, your pre-approval makes your offer stronger and shows sellers you’re a serious buyer.

Step 6: Final Approval & Closing (The Finish Line)

Once your offer is accepted, your broker will work to finalize your mortgage.

- Property Appraisal: The lender will usually require an appraisal of the property to ensure its value supports the loan amount.

- Condition Fulfillment: You’ll work with your broker to satisfy any remaining conditions from the pre-approval (e.g., providing updated documents, fulfilling specific requests).

- Legal Review: Your lawyer will handle the legal aspects of the home purchase.

- Mortgage Funding: Once all conditions are met and legal work is done, the mortgage funds are released.

- Closing Day: You get the keys to your new home! 🎉

This structured approach, especially with the guidance of a professional mortgage broker, makes the process of getting approved for a mortgage using your business income much more manageable and significantly increases your chances of success.

Case Studies/Scenarios: Real-World Examples 💡

Let’s look at a few common scenarios to illustrate how different self-employed situations are handled and what strategies can help.

Scenario 1: The Brand New Entrepreneur with Low Initial Income

- Applicant: Sarah, a talented graphic designer who just started her own freelance business 10 months ago after leaving a corporate job. Her business income is growing, but her first year’s tax return (when filed) will show low net income due to start-up costs and fewer clients initially.

- Hurdle: Short business history, low initial net income.

- Strategy:

- Leverage Previous Experience: Sarah’s broker will emphasize her 5+ years of experience as an employed graphic designer, showing continuity in her field.

- Strong Down Payment: Sarah has saved 25% for a down payment, which significantly reduces the lender’s risk.

- Excellent Credit: Her credit score is 780, demonstrating strong financial responsibility.

- Show Growth: Provide bank statements showing a clear upward trend in business deposits over the 10 months, along with new client contracts.

- Target B Lender: Her broker will target an alternative lender who is more flexible with newer self-employed individuals, especially with a high down payment and strong credit.

- Outcome: With the broker’s help, Sarah gets approved for a mortgage, albeit with a slightly higher interest rate than a traditional bank might offer, but it’s a stepping stone to homeownership.

Scenario 2: The Established Business Owner with High Deductions

- Applicant: Mark, who has owned a successful landscaping company for 7 years. He’s very good at minimizing his taxable income through various business expenses and deductions, resulting in a low reported net income on his T1 General (e.g., \$45,000 net income on \$200,000 gross revenue). He wants a \$500,000 mortgage.

- Hurdle: High deductions leading to low qualifying income.

- Strategy:

- Accountant’s Letter with Add-Backs: Mark’s accountant provides a detailed letter outlining significant non-cash expenses like depreciation on equipment and vehicle amortization, which total \$30,000 annually.

- Consistent Gross Revenue: His broker highlights the consistent and strong gross revenue of his business over many years, proving its stability.

- Target Flexible Lenders: The broker approaches lenders known for their flexibility with self-employed “add-backs” and a deeper understanding of business financial statements.

- Consider Temporary Tax Changes: For future mortgage renewals or larger purchases, Mark’s broker advises him to discuss with his accountant the possibility of reducing aggressive write-offs for 1-2 years to boost his reported net income.

- Outcome: By effectively using add-backs, Mark’s qualifying income is boosted to \$75,000 (\$45,000 net + \$30,000 add-backs), allowing him to qualify for the desired mortgage amount through a specialized self-employed program.

Scenario 3: The Entrepreneur with Good Income but Past Credit Issues

- Applicant: Emily, a successful online course creator for 3 years, with a consistent net income of \$80,000. However, she had some credit issues 4 years ago (missed credit card payments due to a personal crisis) that resulted in a lower credit score (620).

- Hurdle: Past credit issues affecting her score.

- Strategy:

- Explanation of Credit Issues: Emily provides a clear, concise explanation of the past credit issues, highlighting that they were due to a specific, resolved personal crisis and that her financial habits have been excellent since.

- Recent Positive Credit History: Her broker emphasizes her perfect payment history on all debts for the past 3 years.

- Strong Income & Down Payment: Her consistent income and a healthy 15% down payment are strong compensating factors.

- Target B Lender: Her broker steers clear of traditional A lenders who are very strict on credit scores and instead works with a B lender who is more willing to look at the overall financial picture and the recency of credit issues.

- Outcome: Emily secures a mortgage with a B lender. While her interest rate is slightly higher initially, her broker advises her that with continued excellent credit behaviour, she can likely refinance to a lower rate with an A lender in 1-2 years.

- Internal Link Opportunity: Learn more about mortgage refinancing: All About Mortgage Refinancing

These scenarios highlight that there’s often a solution for self-employed individuals, but it requires strategic thinking and a strong understanding of lender criteria, which a mortgage broker provides.

Long-Term Financial Planning for Self-Employed Homeowners 💰🏡

Getting your mortgage approved is a huge milestone, but it’s also the beginning of a new financial chapter. As a self-employed homeowner, ongoing financial planning is crucial to maintain your financial stability and grow your wealth.

1. Build and Maintain a Robust Emergency Fund

- Why it’s crucial: Your income might fluctuate. An emergency fund (3-6 months of living expenses, including mortgage payments) acts as a buffer during slow periods, unexpected business costs, or personal emergencies.

- Action: Set up an automatic transfer from your business income to a dedicated savings account.

2. Strategic Cash Flow Management

- Why it’s crucial: Understand your business’s seasonal patterns and plan for them. Ensure you always have enough cash on hand to cover both business operating costs and personal expenses, including your mortgage.

- Action: Create a detailed budget for both your business and personal finances. Consider setting aside a portion of each large payment for taxes and future expenses.

3. Continue to Monitor and Improve Your Credit Score

- Why it’s crucial: A good credit score will be beneficial for future financial needs, such as renewing your mortgage at a better rate, securing lines of credit, or other loans.

- Action: Keep paying all bills on time, keep credit utilization low, and review your credit report regularly for errors.

4. Review Your Mortgage Regularly

- Why it’s crucial: Life changes, and so do interest rates. Your mortgage is likely your biggest financial commitment.

- Action: Reconnect with your mortgage broker every 1-2 years, or definitely a few months before your mortgage renewal date. They can help you:

- Assess if your current mortgage still meets your needs.

- Explore options for refinancing if rates have dropped significantly.

- Discuss using home equity for renovations or debt consolidation.

- Internal Link Opportunity: Understand the difference between HELOC and Home Equity Loan: HELOC vs. Home Equity Loan

- Plan for your mortgage renewal to ensure you get the best terms.

5. Plan for Retirement and Investments

- Why it’s crucial: As a self-employed individual, you don’t have an employer-sponsored pension. You are responsible for your own retirement savings.

- Action: Work with a financial advisor to set up Registered Retirement Savings Plans (RRSPs), Tax-Free Savings Accounts (TFSAs), or other investment vehicles. Prioritize consistent contributions.

6. Keep Excellent Records (Always!)

- Why it’s crucial: Your business income and expenses will continue to evolve. Maintaining meticulous records simplifies tax season, makes future financing easier, and provides clear insights into your financial health.

- Action: Use accounting software, keep digital backups, and work closely with your accountant year-round, not just at tax time.

Becoming a homeowner as a self-employed individual is a testament to your hard work and dedication. By continuing to apply that same discipline to your personal and business finances, you can ensure long-term stability and success in your new home.

Frequently Asked Questions (FAQs) 🤔

Here are some common questions self-employed individuals ask about getting a mortgage:

Q1: How long do I need to be self-employed to get a mortgage?

A: Most traditional lenders (A lenders) prefer to see a minimum of two years of consistent self-employment income, as evidenced by your tax returns. Some alternative lenders (B lenders) might consider a shorter history (e.g., 12-18 months) if you have strong compensating factors like a large down payment, excellent credit, and prior experience in the same field.

Q2: Can I get a mortgage if I have a brand-new business?

A: It’s very challenging with traditional lenders, as they require a track record. However, it’s not impossible. If you have significant prior experience in the same industry, a substantial down payment (e.g., 25-35%), and an excellent credit score, a mortgage broker might be able to find an alternative lender willing to consider your application. You’ll need to demonstrate strong future income potential.

Q3: What if my net income is very low due to deductions?

A: This is a common challenge! Lenders primarily use your net income to qualify you. However, some non-cash business expenses (like depreciation, amortization, and certain home office or vehicle expenses) can often be “added back” to your net income by lenders. Your accountant can provide a letter detailing these add-backs. A mortgage broker is crucial here, as they know which lenders are flexible with these calculations.

Q4: Do I need a 20% down payment if I’m self-employed?

A: No, not necessarily. Like traditionally employed individuals, self-employed borrowers can qualify for a high-ratio mortgage with as little as a 5% down payment. However, these mortgages must be insured by CMHC, Genworth, or Canada Guaranty. Having a larger down payment (20% or more) can make your application stronger and allows you to avoid mortgage loan insurance premiums.

Q5: How important is my credit score?

A: Your personal credit score is very important, regardless of your employment status. A strong credit score (generally 680+ is good, 700+ is excellent) demonstrates financial responsibility and reduces the perceived risk for lenders. If your score is lower, work on improving it before applying, or be prepared to explore alternative lenders who may be more flexible but might charge slightly higher rates.

Q6: Can I use my gross business income for mortgage qualification?

A: Generally, no. Lenders look at your net income (what you actually take home after expenses and deductions) because that’s the money available for your personal use and mortgage payments. The only exception is sometimes for very specific “stated income” programs offered by alternative lenders, where your gross revenue might be considered alongside other factors, but these still require significant proof of income and strong financial health.

Q7: What’s the biggest mistake self-employed people make when applying for a mortgage?

A: The biggest mistake is often not preparing adequately and not working with a specialist mortgage broker. Many self-employed individuals apply to their bank without understanding how their business income will be assessed, leading to frustration and rejection. Failing to provide complete and organized documentation, or aggressively deducting expenses right before applying, are also common pitfalls.

Q8: How can Everything Mortgages help me specifically?

A: Everything Mortgages specializes in helping self-employed individuals secure mortgages. We:

- Understand your unique income structure and how to present it effectively.

- Access a wide network of lenders (including traditional and alternative) who are self-employed friendly.

- Help you identify eligible “add-backs” to maximize your qualifying income.

- Guide you through the entire process, from document gathering to final approval, saving you time and stress.

- Advocate on your behalf to get you the best possible terms and rates.

Conclusion: Your Path to Homeownership is Within Reach 🔑

Getting approved for a mortgage using your business income might seem like a complex journey, but it is absolutely achievable. As a self-employed individual, your dedication, hard work, and financial savvy are assets that lenders recognize and value—you just need to present them in the right way.

The key to unlocking your dream home lies in understanding how lenders view your unique financial situation, meticulously preparing your documents, and strategically planning your finances. From optimizing your tax deductions (temporarily!) to building a strong credit history, every step you take contributes to a stronger application.

But you don’t have to navigate this path alone. At Everything Mortgages, we are more than just brokers; we are your dedicated partners and advocates. We specialize in demystifying the mortgage process for entrepreneurs like you, connecting you with the right lenders, and ensuring your business success translates into the homeownership you deserve. Our expert team is committed to making your financing experience simple, stress-free, and successful.

Don’t let the complexities of self-employed mortgages hold you back from your homeownership aspirations. Your entrepreneurial spirit is a strength, and with the right guidance, it will open the door to your new home.

Ready to Turn Your Business Income into Homeownership?

Don’t wait any longer! Get a free consultation today with the award-winning team at Everything Mortgages. We’re here to understand your unique situation, answer all your questions, and help you find the perfect mortgage solution.

Call or Text Now:

📞 416-840-6368

📱 416-850-5153

Or visit our website to learn more and apply online:

www.everythingmortgages.ca

Let Everything Mortgages simplify your financing experience and help you step into the home of your dreams. Your trusted mortgage broker company in Canada is ready to help you every step of the way!