May 2, 2025

How to Save and Buy Your First Home: A Complete Guide for First-Time Buyers

Share this article:

Down Payment Savings Calculator

Buying your first home is one of life’s most significant milestones. As someone who’s guided countless first-time homebuyers through this journey, I can tell you that the path to homeownership is both exciting and challenging. The good news? With proper planning, disciplined saving, and informed decision-making, your dream of owning a home is absolutely achievable.

In today’s housing market, becoming a homeowner requires more strategic planning than ever before. This comprehensive guide will walk you through every step of how to save and buy your first home—from building your down payment fund to closing the deal on your dream property.

Understanding the True Cost of Homeownership

Before diving into saving strategies, let’s get clear on what you’re actually saving for. The cost of buying a home extends far beyond the listing price.

The Full Financial Picture 💰

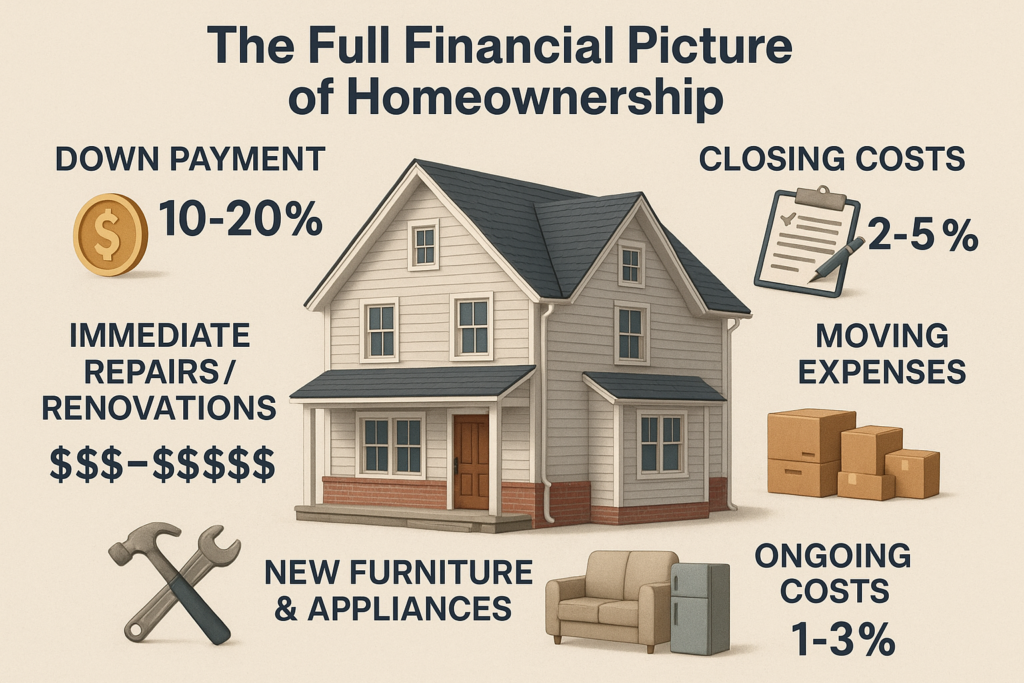

When budgeting for your first home, account for:

- Down payment: Typically 5-20% of the purchase price

- Closing costs: Legal fees, land transfer taxes, title insurance (2-5% of purchase price)

- Moving expenses: $1,000-$5,000 depending on distance and volume

- Immediate repairs/renovations: Variable, but budget at least $5,000 as a buffer

- New furniture and appliances: $3,000-$15,000 depending on what you need

- Ongoing costs: Property taxes, insurance, utilities, maintenance (1-3% of home value annually)

“The biggest mistake first-time homebuyers make isn’t about the house they choose—it’s underestimating the total cost of homeownership beyond the mortgage payment.”

First-time homebuyers often make critical mistakes that can be avoided with proper preparation. Understanding all costs involved is the first step toward successful homeownership.

Setting Your Homebuying Budget

Before you start saving, you need a target. How much house can you actually afford?

The 28/36 Rule

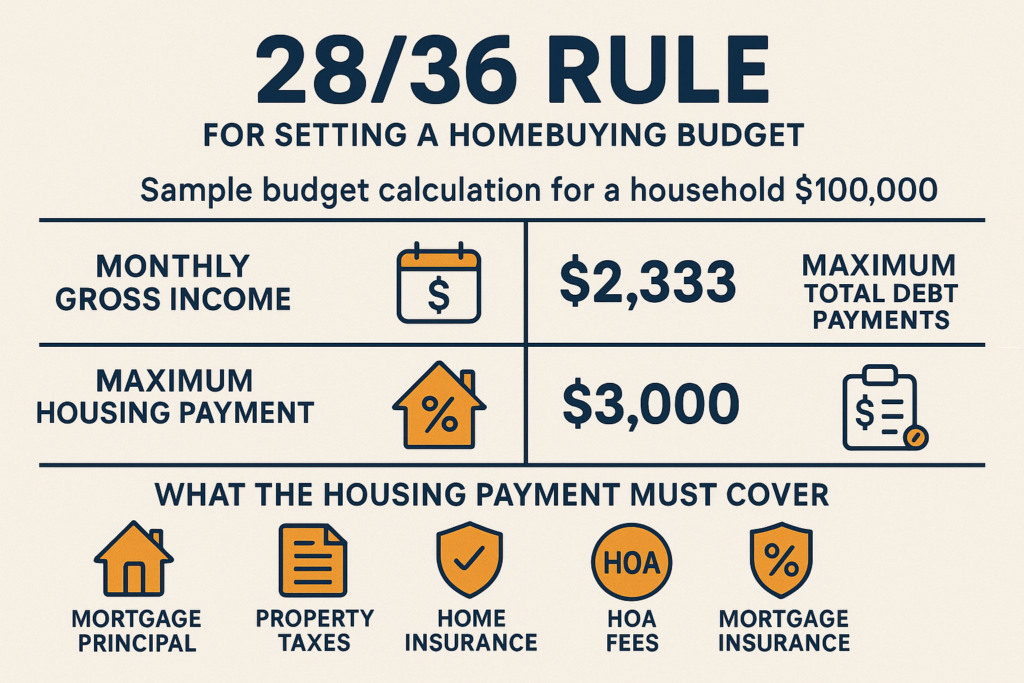

Financial experts recommend:

- Housing costs should not exceed 28% of your gross monthly income

- Total debt payments (including housing) should not exceed 36% of your gross monthly income

Sample Budget Calculation

For a household with $100,000 annual income:

- Monthly gross income: $8,333

- Maximum housing payment (28%): $2,333

- Maximum total debt payments (36%): $3,000

This housing payment must cover:

- Mortgage principal and interest

- Property taxes

- Home insurance

- HOA fees (if applicable)

- Mortgage insurance (if down payment is less than 20%)

Saving Strategies for Your Down Payment

Now that you have a target, let’s explore effective strategies to build your down payment fund.

1. Create a Dedicated Down Payment Account

Open a separate high-interest savings account specifically for your home fund. This separation creates psychological barriers against “borrowing” from your house fund and helps you track progress.

2. Automate Your Savings

Set up automatic transfers to your down payment fund on payday. What you don’t see, you won’t spend.

Pro tip: Increase your automatic savings amount whenever you receive a raise or bonus.

3. Reduce Major Expenses

Look at your three biggest monthly expenses (typically housing, transportation, and food) and find ways to reduce them:

- Current housing: Consider a roommate, negotiate rent, or downsize temporarily

- Transportation: Use public transit, carpool, or trade in for a less expensive vehicle

- Food: Meal plan, cook in batches, reduce dining out

4. Implement the 50/30/20 Budget

Allocate your after-tax income as follows:

- 50% for needs (housing, food, transportation, utilities)

- 30% for wants (entertainment, dining out, hobbies)

- 20% for savings (including your home down payment)

5. Leverage Government Programs

Canada offers several programs to help first-time homebuyers:

First Home Savings Account (FHSA) This tax-sheltered account allows Canadians to save up to $40,000 toward their first home purchase with tax-deductible contributions and tax-free withdrawals for eligible home purchases.

The First Home Savings Account is an excellent tool that combines the tax advantages of both RRSPs and TFSAs specifically for first-time homebuyers.

Home Buyers’ Plan (HBP) The HBP allows first-time homebuyers to withdraw up to $35,000 from their RRSP tax-free to put toward a home purchase.

First-Time Home Buyer Incentive This shared equity mortgage program offers 5-10% of the home’s purchase price to put toward a down payment, reducing monthly mortgage payments.

6. Track Your Progress with Milestones

Break your savings goal into smaller milestones to maintain motivation:

| Milestone | Amount | Reward |

|---|---|---|

| 10% of goal | $X | Nice dinner out |

| 25% of goal | $X | Weekend getaway |

| 50% of goal | $X | New gadget or experience |

| 75% of goal | $X | Shopping trip |

| 100% of goal | $X | House-warming party fund |

Improving Your Credit Score for Better Mortgage Terms

While saving for your down payment, work on improving your credit score to secure better mortgage rates.

Credit Score Improvement Checklist:

- ✅ Check your credit report for errors and dispute any inaccuracies

- ✅ Pay all bills on time (set up automatic payments)

- ✅ Reduce credit card balances (aim for less than 30% of available credit)

- ✅ Avoid applying for new credit before applying for a mortgage

- ✅ Don’t close old credit accounts (length of credit history matters)

Improving your credit score in Canada can save you thousands of dollars over the life of your mortgage through better interest rates.

Understanding Mortgage Options

As you save for your home, educate yourself about different mortgage options so you can choose the best one for your situation.

Fixed vs. Variable Rate Mortgages

Fixed Rate:

- Interest rate remains constant throughout the term

- Predictable payments

- Typically higher initial rate than variable

- Best for: Budget-conscious buyers who prefer stability

Variable Rate:

- Interest rate fluctuates with the prime rate

- Potentially lower overall cost if rates remain stable or decrease

- Risk of payment increases if rates rise

- Best for: Buyers comfortable with some uncertainty for potential savings

Conventional vs. High-Ratio Mortgages

Conventional Mortgage:

- Down payment of 20% or more

- No mortgage insurance required

- Lower overall cost

High-Ratio Mortgage:

- Down payment between 5% and 19.99%

- Requires mortgage loan insurance from CMHC or private insurer

- Insurance premium adds 2.8-4% to mortgage amount

- Higher overall cost but allows for earlier entry into the housing market

Understanding why we need mortgage loan insurance is crucial for first-time buyers who may not have a 20% down payment.

The Homebuying Process: Step by Step

Once your finances are in order, here’s what the homebuying process looks like:

1. Get Pre-Approved for a Mortgage

Before house hunting, get pre-approved to understand exactly how much you can borrow. This step gives you credibility with sellers and clarifies your price range.

The importance of qualifying for a mortgage before buying property cannot be overstated—it prevents the heartbreak of falling in love with a home you can’t afford.

2. Find a Real Estate Agent

A good agent who specializes in helping first-time buyers can:

- Guide you through the process

- Help you identify suitable neighborhoods

- Negotiate on your behalf

- Spot potential issues with properties

- Connect you with inspectors, lawyers, and other professionals

3. House Hunting

Create a list of “must-haves” vs. “nice-to-haves” to focus your search. Consider:

- Location (commute, schools, amenities)

- Size (bedrooms, bathrooms, overall square footage)

- Property type (detached, semi-detached, townhouse, condo)

- Age and condition

- Future needs (family growth, work-from-home space)

4. Make an Offer

When you find “the one,” your agent will help you prepare an offer that includes:

- Purchase price

- Deposit amount

- Conditions (financing, home inspection, etc.)

- Closing date

- Inclusions/exclusions (appliances, fixtures, etc.)

5. Home Inspection

Always make your offer conditional on a satisfactory home inspection. A professional inspector will check for:

- Structural issues

- Electrical and plumbing problems

- Roof condition

- HVAC system functionality

- Evidence of water damage or mold

- Pest infestations

6. Finalize Financing

Once your offer is accepted, work with your mortgage broker or lender to finalize your mortgage approval. They’ll need:

- Purchase agreement

- Proof of down payment

- Employment verification

- Current debts and assets information

7. Closing Process

In the final weeks before taking possession:

- Hire a real estate lawyer to review documents

- Arrange home insurance

- Schedule utilities transfers

- Conduct a final walk-through

- Sign closing documents

- Deliver remaining down payment and closing costs

Common First-Time Homebuyer Mistakes to Avoid

Learning from others’ mistakes can save you significant stress and money:

1. Skipping Pre-Approval

Getting pre-approved before house hunting ensures you know exactly what you can afford and strengthens your position when making offers.

2. Draining All Savings for the Down Payment

Always maintain an emergency fund separate from your down payment. Unexpected repairs and expenses are common with new homeownership.

3. Underestimating Closing Costs

Budget 2-5% of the purchase price for closing costs to avoid last-minute financial scrambling.

4. Ignoring Resale Potential

Even as a first-time buyer, consider how appealing the property will be to future buyers when you eventually sell.

5. Skipping the Home Inspection

A few hundred dollars for an inspection can save you tens of thousands in unexpected repairs.

6. Making Large Purchases Before Closing

Avoid buying furniture or appliances on credit before closing—new debt can affect your mortgage approval.

Creative Ways to Enter the Housing Market

If traditional homebuying seems out of reach, consider these alternatives:

Co-Buying with Friends or Family

Pooling resources with trusted individuals can help you enter the market sooner. Ensure you have a legal agreement outlining ownership percentages, responsibilities, and exit strategies.

Rent-to-Own Programs

These programs allow you to rent a property with the option to purchase it later, with a portion of rent payments going toward your future down payment.

Purchase a Property with Income Potential

Consider properties with rental potential, like homes with basement apartments or duplexes, where rental income can offset mortgage costs.

Establishing a mindset for your financial goals and savings is crucial for success in today’s challenging housing market.

Long-Term Financial Planning for Homeowners

Once you’ve purchased your home, continue smart financial practices:

Build an Emergency Fund

Aim for 3-6 months of housing expenses to cover unexpected repairs or income disruptions.

Consider Biweekly Mortgage Payments

Making payments every two weeks instead of monthly results in one extra payment per year, reducing your amortization period and saving thousands in interest.

Regularly Review Your Mortgage

As interest rates change and your financial situation evolves, review your mortgage annually to ensure it still meets your needs.

Plan for Maintenance

Budget 1-3% of your home’s value annually for maintenance and repairs to prevent small issues from becoming costly problems.

The Emotional Journey of First-Time Homebuying

The path to homeownership isn’t just financial—it’s emotional too:

Managing Expectations

The perfect home within your budget may not exist. Prioritize needs over wants and be prepared to compromise.

Dealing with Disappointment

In competitive markets, you may lose out on properties you love. Remember that the right home will come along.

Celebrating Milestones

Acknowledge and celebrate each step toward homeownership, from saving your first $5,000 to getting your keys.

Interactive Calculator: How Long Will It Take to Save Your Down Payment?

<!DOCTYPE HTML>

Down Payment Savings Calculator

Target Home Price ($):Down Payment Percentage (%):Current Savings ($):Monthly Savings Amount ($):Annual Interest Rate on Savings (%):Calculate

Conclusion: Your Path to Homeownership

Buying your first home is a journey that requires patience, planning, and persistence. By following the strategies in this guide, you’re well on your way to achieving this important milestone.

Remember that homeownership isn’t just about having a place to live—it’s about building equity, creating stability, and establishing roots in your community. The effort you put into saving and preparing now will pay dividends for years to come.

Start where you are, use what you have, and do what you can. Every dollar saved brings you one step closer to the moment you’ll turn the key in the door of your very first home.

FAQs About Saving and Buying Your First Home

Q: How much should I save before buying my first home? A: Aim to save at least 5% of the purchase price for a down payment, plus an additional 2-5% for closing costs, moving expenses, and an emergency fund.

Q: Should I wait until I have 20% for a down payment? A: While 20% down avoids mortgage insurance costs, waiting might mean missing out on building equity and potential property appreciation. Balance the extra costs against the benefits of earlier homeownership.

Q: Can I use gifted money for my down payment? A: Yes, gifted funds from family are acceptable to most lenders, but you’ll need documentation proving it’s a gift, not a loan.

Q: How long does it typically take to save for a down payment? A: On average, first-time homebuyers take 5-7 years to save a down payment, but this varies widely based on income, expenses, savings rate, and local housing costs.

Q: Should I use a mortgage broker or go directly to a bank? A: Mortgage brokers can shop multiple lenders to find you the best rate and terms, while banks can only offer their own products. A broker is often advantageous for first-time buyers.

SEO Title: How to Save and Buy Your First Home: Complete Guide for First-Time Buyers

Meta Description: Learn proven strategies to save and buy your first home with our comprehensive guide. From down payment tips to mortgage options, discover everything first-time homebuyers need to know.