February 9, 2021

RRSP’s and Homeownership: How To Use Your RRSP

Share this article:

Investing in a registered retirement savings plan (RRSP) is a great way to save for retirement. But did you know there other useful things you can do with them?

By contributing to your RRSP, you are taking a step toward financial stability in the future. Of course, you want to have a comfortable lifestyle once you leave the workforce. But, RRSPs also offer immediate tax benefits that you can take advantage of.

If you are a homeowner you can use your RRSP to pay less income tax. If you are a first time homebuyer you can use your RRSP for a down payment on your first home.

March 1st, 2021 contribution deadline for the 2020 tax year so there is not much time to take advantage. Find out how you can best utilize use your RRSP to buy a house and reduce your net income this year.

READ: RRSP’s & The Home Buyer’s Plan – What You Need To Know

What is an RRSP?

First let’s first do a quick recap on what an RRSP is:

A Registered Retirement Savings Plan (RRSP). It’s a personal savings account that’s registered with the federal government. Its designed to encourage Canadians to save for retirement.

The RRSP benefits salaried and self-employed professionals for many reasons. First, it reduces your taxable income every year you contribute. Second, you’ll only pay tax on the funds at the time of withdrawal, where you’ll like fall into a lower tax bracket. Third, you will increase the value of your investment by collecting compound interest.

RRSPs are a great tool for retirement planning. But there are other reasons why you should consider investing in an RRSP.

Let’s go through how you can leverage your RRSP as a current homeowner and as a first time homebuyer so you can achieve your financial goals sooner.

Buy a house with the RRSP Home Buyers’ Plan

A quick refresher on a government program for first-time home buyers:

The Home Buyer’s Plan was introduced as an RRSP initiative to improve housing affordability. If you qualify to participate in the Home Buyers’ Plan, you and your partner can each withdraw up to $35,000 from your RRSP to put toward a down payment. Between the two of you, that is $70,000. When you take the money out of your RRSP as part of the HBP, your financial institution won’t withhold any taxes.

Essentially, you loan yourself the money, interest-free. You pay back the money you took out over 15 years. So, if you took out $35,000 from your RRSP, you’d owe back $2,333 each year ($35,000/15 years). If you weren’t able to make the payments, the $2,333 would be added to your income at the end of the year and you will have pay tax on it at your marginal tax rate.

So, yes, you are taking money from your long-term savings pot, but you’re doing so to purchase an asset that, one hopes, increases your net worth over time. More importantly, the goal is that the bigger your down payment, the less your mortgage will be and the more likely you’ll be able to afford your home. That means you can actually afford to keep saving for retirement and repay this loan.

Use Your RRSP to reduce your taxable income

Homeowners can still enjoy the benefits that an RRSP has to offer. If you currently own a home, you may consider accessing equity in your home to deposit into your RRSP.

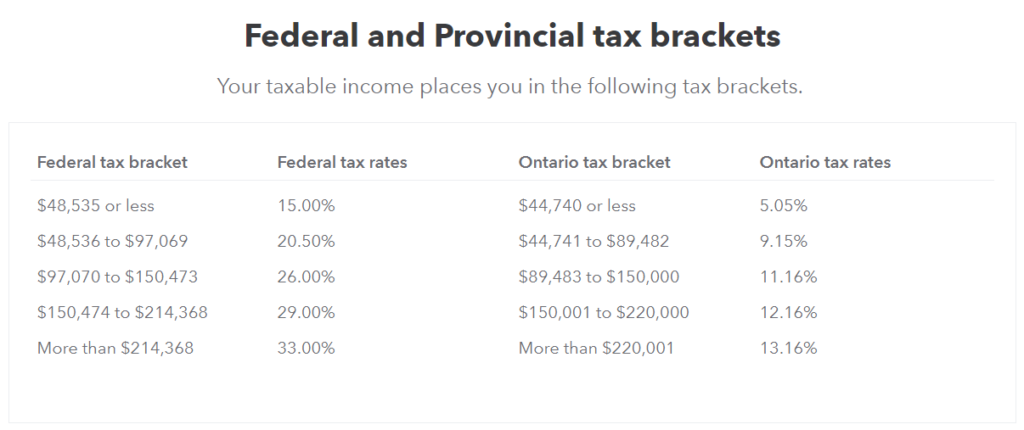

A look at marginal federal and provincial income tax rates explains why. Income under $44,000 is taxed at 20 percent. Rates rise as income rises to the point where anything over $220,000 is taxed at 53 percent.

As an example, a person earning less than $44,000 will get a tax refund of $20 for every $100 they contribute to an RRSP. A person earning an income of over $220,000 will get a refund of $53 per $100.

RRSP contributions are only taxed once withdrawn at retirement. So, we can assume that a lower-income contributor will pay around the same tax rate and a higher-income earner will pay a lower tax rate in the future, while benefitting from a tax break in the present.

This leads us to access equity through mortgage refinancing. A low-cost resource to cut your taxes, without having all the money upfront or taking it out of pocket.

If you are a high-income earner it makes sense to make a large contribution to lower your marginal tax rate. Your investment will grow year over year as it includes compound interest on the refund, and on the next refund – and so on.

Does this strategy make sense for you?

RRSP contributions can help change your tax outcome. But, it won’t have the same impact for everyone.

To get your RRSP strategy rolling you want to first determine how much taxable income you earned in 2020. This will show which tax bracket you fall into and your marginal tax rate, as indicated below:

If you are self-employed you can calculate this amount at any given time. If you are a salaried employee, you may not know until you receive your T4 at the end of February. But, you can use your December paystub to determine how much income you earn per month.

Next, you can use a handy RRSP calculator to calculate how much of a refund you will get on your contribution amount and whether it makes sense for you.

Your guide to investing in RRSPs

If you are a current homeowner or first time homebuyer, contributing to an RRSP may be beneficial for you. A comprehensive RRSP strategy can help you achieve your financial goals sooner. But, investing in an RRSP can be daunting and confusing. But, we’re here to help.

Don’t wait until it’s too late! Contact us today to get your RRSP strategy rolling with unbiased advice from a team of experts.