July 6, 2023

Mortgage Monitor – Navigating the Latest Canadian Mortgage Rate Hike: Bank of Canada delivers quarter-point hike

Share this article:

Big news! The Bank of Canada has raised its key interest rate for the tenth consecutive time, bringing it to 5% – a level last seen in April 2001.

The Bank of Canada has once again raised its key interest rate, marking the tenth consecutive increase and bringing the rate to 5%, a level last seen in April 2001. This quarter-point increase was widely anticipated by analysts and is part of the Bank’s ongoing efforts to control inflation and balance the economy.

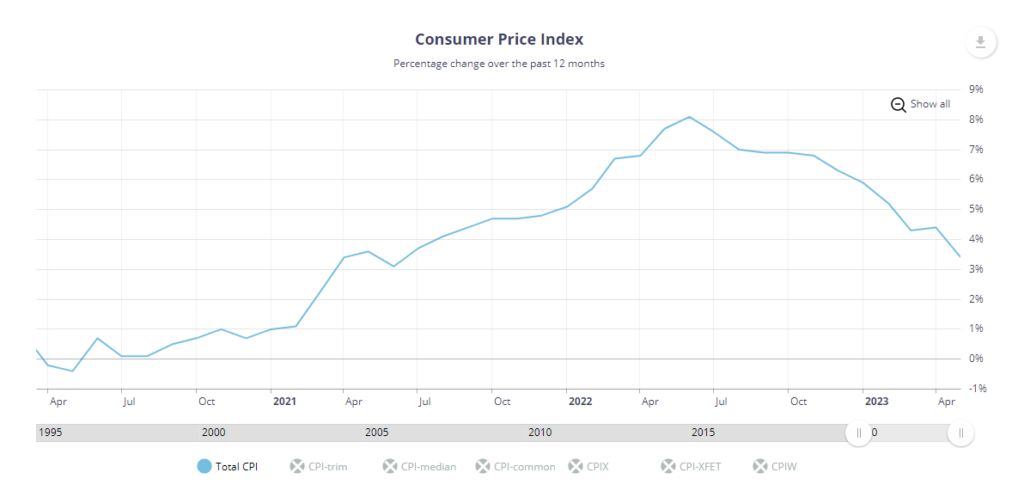

The Bank now expects inflation to remain at about 3% for the next year before declining to the bank’s 2% target by the middle of 2025. This is a slower return to target than was forecast in the January and April projections. The Bank has expressed concern that progress towards the 2% target could stall, jeopardizing the return to price stability.

So, what does this mean for Canadian homeowners and prospective buyers? Let’s dive into it.

What Triggered the Rate Hike?

The Bank of Canada’s decision to increase the interest rate is influenced by several factors. Despite the recent hikes, consumer spending and employment have proven surprisingly resilient to higher borrowing costs. The Bank concluded that interest rates weren’t “sufficiently restrictive to bring supply and demand back into balance and return inflation sustainably to the 2% target.”

Moreover, core inflation in Canada has been stubborn, suggesting that inflation may be more persistent than originally thought. While inflation has been declining due to falling energy prices, easing supply constraints, and interest rate hikes, it is predicted to remain elevated around 3% over the next year.

What Does This Mean for Mortgage Rates?

Mortgage rates are directly influenced by the key interest rate set by the Bank of Canada. Therefore, with this hike, we can expect an increase in mortgage rates across the country. This may affect both new mortgage applicants and those with variable-rate mortgages. If you are looking to renew your mortgage or purchase a new property, it may make sense to speak with a mortgage broker to evaluate your options and get the best possible rates.

Looking Ahead

In the coming months, the Bank of Canada will continue to assess the dynamics of core inflation and the outlook for CPI inflation. The next scheduled rate announcement will be on September 6, 2023.

The Bigger Picture

While mortgage rates and economic fluctuations naturally incite concern, it’s important to step back and look at the bigger picture. It is important to remember that the present interest rate hikes aren’t occurring in isolation – they are part of an extensive and meticulous approach by the Bank of Canada to stabilize and control inflation.

In June 2022, Canada’s Consumer Price Index (CPI), a standard measure of inflation, was sitting at 8.1. Fast forward a year later to June 2023, and we’ve seen a notable reduction to 3.4. This decrease reflects the effectiveness of the recent rate hikes and signals an encouraging trend towards rate stabilization.

Based on these observations, we can anticipate the interest rates to continue on a downward trajectory over the next 1.5 to 2 years, with a realistic expectation of the rates settling around the 4% mark. It’s a testament to the resilience of the Canadian economy and the efficacy of the Bank of Canada’s monetary policies in ensuring balanced economic growth and stability.

Stay tuned to our blog for the latest news, insights, and advice on navigating the Canadian mortgage landscape. And, as always, if you have any questions, don’t hesitate to reach out to our team of experts.

At Everything Mortgages, we are a team of licensed experts who are ready to help find the mortgage solution that’s right for you. What drives our motivation to succeed is not the loan we secure but the difference we make. Whether it’s helping the first-time home buyer purchase their first home, the small business owner looking for a better solution, or the hardworking professional break free from high-interest debt, we work hard to help you become mortgage-free sooner and build wealth creation faster.

*Note: This article is intended for informational purposes only and does not constitute financial advice. Please consult a financial advisor or mortgage professional before making decisions about your mortgage.

Get more homeowner tips

Subscribe to get more homeowner tips and advice delivered right to your inbox.