May 27, 2025

Securing Your Home: A Comprehensive Guide on How to Get Approved for a Mortgage After Bankruptcy

Share this article:

For many, owning a home is a deeply cherished dream. It represents stability, security, and a place to call your own. However, life can sometimes throw unexpected financial challenges your way, and for some, this might include bankruptcy. The idea of getting a mortgage after such a significant financial event can feel like an impossible climb. Many people wonder, “how to get approved for a mortgage if bankrupted?” The good news is that while it presents a unique set of hurdles, it is absolutely possible to secure a mortgage and buy a home even after filing for bankruptcy. It requires time, discipline, and a strategic approach, but with the right steps and understanding, you can rebuild your financial health and achieve your homeownership goals.

This comprehensive guide will walk you through everything you need to know, from understanding the impact of bankruptcy on your credit to rebuilding your financial profile and navigating the mortgage application process. We’ll explore the waiting periods, the importance of a strong down payment, how different lenders view your situation, and the crucial role a mortgage broker plays in your journey.

Key Takeaways

- Time is Your Ally: After bankruptcy, there’s a mandatory waiting period before you can qualify for a traditional mortgage. Focus on rebuilding your credit and financial stability during this time.

- Rebuild Your Credit Strategically: Actively work on improving your credit score by using secured credit cards, making all payments on time, and keeping old accounts in good standing.

- Save a Substantial Down Payment: A larger down payment significantly reduces risk for lenders and can greatly improve your chances of approval, especially after bankruptcy.

- Seek Professional Guidance: A skilled mortgage broker specializing in complex financial situations can be invaluable, helping you find lenders willing to work with you and guiding you through the process.

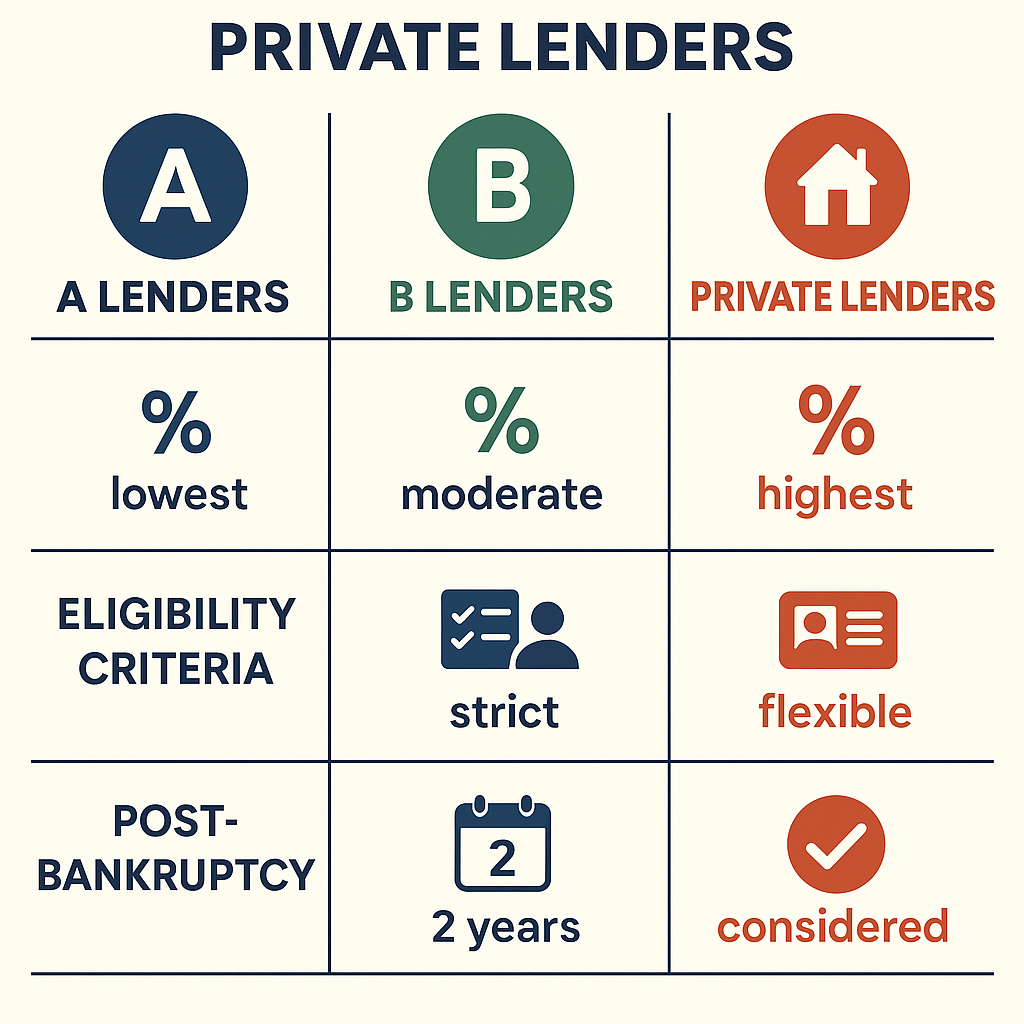

- Understand Lender Categories: Be prepared to work with B lenders or private lenders initially, as traditional A lenders have stricter criteria for individuals with a bankruptcy history.

Understanding Bankruptcy and its Mortgage Impact

Before diving into the “how-to,” it’s important to understand what bankruptcy is and how it affects your ability to get a mortgage.

What is Bankruptcy?

Bankruptcy is a legal process for individuals or businesses who are unable to pay their outstanding debts. It provides a fresh start by forgiving most unsecured debts, but it comes with significant consequences for your credit rating. In Canada, personal bankruptcy is governed by the Bankruptcy and Insolvency Act (BIA).

When you declare bankruptcy, a Licensed Insolvency Trustee (LIT) is appointed to manage your assets and liabilities. The goal is to ensure a fair distribution of your assets among your creditors while providing you with relief from your debts. Once the process is complete, you receive a “discharge,” meaning you are legally released from most of your debts.

How Bankruptcy Affects Your Credit Score

The immediate and most significant impact of bankruptcy is on your credit score. Filing for bankruptcy is considered a severe financial event and will cause your credit score to drop dramatically. It will appear on your credit report for a significant period:

- First-time bankruptcy: Stays on your credit report for 6 to 7 years from the date of your discharge.

- Second or subsequent bankruptcies: Can remain on your credit report for 14 years from the date of discharge.

This negative mark tells potential lenders that you’ve had trouble managing debt in the past, making them hesitant to lend you money. It signals a higher risk.

“Bankruptcy is a reset button, not a dead end. While it severely impacts your credit, it also opens the door to rebuilding a stronger financial future.”

The Waiting Period: How Long Until You Can Apply?

One of the most common questions for individuals exploring how to get approved for a mortgage if bankrupted is about the waiting period. You cannot immediately apply for a mortgage after declaring bankruptcy. Lenders need to see a period of responsible financial behaviour after your discharge.

The typical waiting periods vary depending on the type of lender:

- A Lenders (Major Banks and Credit Unions): These are the most traditional lenders and have the strictest rules. Generally, they require a minimum of 2 years (and often 3-5 years) after your bankruptcy discharge before they will even consider your application. They also require a strong re-established credit history and a significant down payment.

- B Lenders (Alternative Lenders): These lenders are more flexible and are often the first stop for individuals with a bankruptcy history. They typically require a minimum of 1-2 years after your discharge. They might also require a larger down payment and charge higher interest rates.

- Private Lenders: These are individuals or companies who lend money based on factors other than strict credit scores. They are the most flexible but also the most expensive. There might be no specific waiting period, but they will still look for some evidence of stability and usually require a very substantial down payment.

It’s crucial to understand that simply waiting out the period isn’t enough. During this time, you must actively work on rebuilding your credit and financial profile. ⏳

Rebuilding Your Financial Foundation

The period after your bankruptcy discharge is your opportunity to demonstrate to future lenders that you are financially responsible and a reliable borrower. This involves several key steps.

The Cornerstone: Re-establishing Excellent Credit

Your credit score is a crucial factor in mortgage approval. After bankruptcy, your focus must be on rebuilding it. This isn’t a quick fix, but a consistent effort.

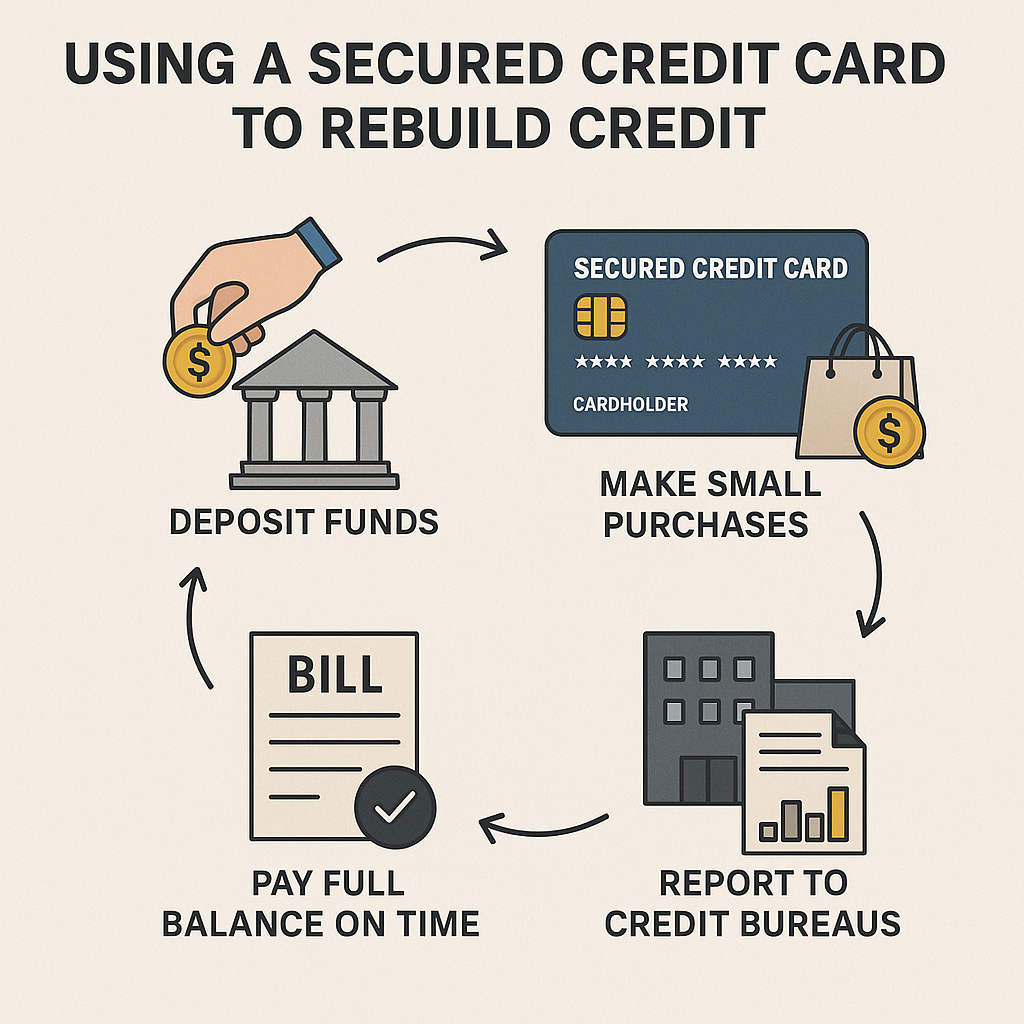

Secured Credit Cards

A secured credit card is one of the best tools to start rebuilding your credit. Here’s how it works:

- You deposit a sum of money (e.g., $500) with the issuer.

- This deposit becomes your credit limit.

- You use the card like a regular credit card.

- Your payments are reported to credit bureaus.

Tips for using a secured card:

- Use it for small, regular purchases: Like groceries or gas.

- Keep your balance low: Ideally, use less than 30% of your credit limit.

- Pay the full balance on time, every time: This is the most important step for rebuilding credit.

- Do not carry a balance: You’re trying to prove you can manage credit, not get into debt.

Credit Builder Loans

Some financial institutions offer “credit builder loans.” With these loans, the money you borrow is held in a savings account or GIC (Guaranteed Investment Certificate) by the lender. You make regular payments on the loan, and these payments are reported to credit bureaus. Once the loan is fully paid, you receive the money. It’s a way to prove you can make consistent payments on a loan.

Authorized User Status

If a trusted family member (e.g., a parent) has excellent credit, they might add you as an authorized user on one of their credit cards. This can help your credit score, as their positive payment history may reflect on your report. However, be cautious:

- Ensure the primary cardholder has a perfect payment history and low credit utilization.

- Do not use the card unless agreed upon, and always pay your share if you do.

- This strategy is less impactful than building your own credit but can offer a small boost.

Paying Bills On Time

This might seem obvious, but it’s paramount. Every single payment you make, from utility bills to phone bills, if reported to a credit bureau, contributes to your credit history. Even if not reported directly, late payments can lead to collections, which severely damage your credit. Set up automatic payments or reminders to ensure you never miss a due date.

Avoiding New Debt

While you are rebuilding credit, it’s wise to avoid taking on new, unnecessary debt. Focus on demonstrating financial stability and responsible management of the credit you do have. This means:

- No new car loans unless absolutely essential.

- No personal loans unless they are specifically credit-builder loans.

- Resist the urge to open multiple new credit accounts.

“Rebuilding credit is like planting a tree. It takes time, consistent watering (on-time payments), and patience to see it grow strong and healthy.” 🌳

Saving a Substantial Down Payment

This is perhaps the most critical factor after the waiting period and credit rebuilding. For individuals with a bankruptcy history, a larger down payment is almost always required.

Why a Larger Down Payment Helps

- Reduces Lender Risk: A higher down payment means you are borrowing less money relative to the home’s value (lower Loan-to-Value, or LTV). This reduces the lender’s risk, as they have more equity to protect their investment if you default.

- Compensates for Credit History: Lenders are taking a bigger risk by lending to someone with a bankruptcy on their record. A larger down payment acts as a form of security and shows your commitment.

- Access to Better Rates/Terms: While still potentially higher than prime rates, a substantial down payment can open doors to more competitive interest rates and terms from B lenders.

- Reduces Need for Mortgage Insurance: With a down payment of 20% or more, you avoid the need for high-ratio mortgage loan insurance (like CMHC, Sagen, or Canada Guaranty). These insurers have stricter criteria, especially for borrowers with past bankruptcies, making a high-ratio mortgage (less than 20% down) very difficult to obtain after bankruptcy.

- Learn more about why mortgage loan insurance is important: Why Should We Have Mortgage Loan Insurance?

Minimum Down Payment Expectations Post-Bankruptcy:

- A Lenders: Typically require 20% or more.

- B Lenders: Often require a minimum of 15-20%, sometimes even 25%.

- Private Lenders: Could require 25-35% or even more.

Strategies for Saving

Saving a significant down payment requires discipline and a solid plan.

- Create a Detailed Budget: Track your income and expenses rigorously. Identify areas where you can cut back.

- Automate Your Savings: Set up automatic transfers from your chequing account to a dedicated savings account each payday. Treat it like a bill you must pay.

- Increase Your Income: Consider a side hustle, overtime, or negotiate a raise.

- Reduce Unnecessary Spending: Cut out non-essential luxuries. Every dollar saved contributes to your down payment.

- Sell Unused Items: Declutter your home and sell items you no longer need.

- Consider a First-Time Home Buyer Incentive: While more challenging after bankruptcy due to strict credit requirements, it’s worth understanding programs like the First-Time Home Buyer Incentive (FTHBI) if your credit has significantly recovered and you meet all criteria.

- Stay updated on such programs: Update: First-Time Home Buyers Incentive Program Launch

Demonstrating Income Stability

Lenders want to see that you have a steady and reliable source of income to make your mortgage payments. This is especially important after bankruptcy, as it reassures them of your ability to manage future financial obligations.

Consistent Employment

- Length of Employment: Lenders prefer to see a stable employment history, typically 2-3 years with the same employer or in the same line of work. Frequent job changes can be a red flag.

- Type of Employment: Full-time, salaried positions are generally preferred over part-time or contract work, as they offer more predictable income. If you are self-employed, you’ll need to provide more extensive financial records (typically 2 years of tax returns).

Documenting Income

Be prepared to provide extensive documentation of your income:

- Pay stubs (recent 2-3 months)

- Letters of employment (confirming salary, position, and start date)

- T4s (last 2 years)

- Notice of Assessments (NOAs) from the CRA (last 2 years)

- For self-employed individuals: Business financial statements, tax returns, and possibly a letter from your accountant.

Managing Your Debt-to-Income Ratio (DTI)

Your Debt-to-Income (DTI) ratio is a key metric lenders use to assess your ability to manage monthly payments. It compares your total monthly debt payments to your gross monthly income.

What is DTI?

There are two main types of DTI:

- Front-End DTI (Housing Ratio): This compares your total monthly housing costs (mortgage principal and interest, property taxes, home insurance, condo fees) to your gross monthly income. Lenders typically prefer this to be no more than 32-39%.

- Back-End DTI (Total Debt Ratio): This compares your total monthly debt payments (housing costs plus all other debts like car loans, credit card minimum payments, personal loans) to your gross monthly income. Lenders generally prefer this to be no more than 40-44%.

After bankruptcy, demonstrating a low DTI is crucial. It shows that even with your past financial challenges, you are now managing your current debts responsibly and have enough disposable income to handle a mortgage payment.

How to Improve Your DTI

- Pay Down Existing Debts: Focus on eliminating or significantly reducing any outstanding debts, especially high-interest ones like credit card balances.

- Avoid New Debts: As mentioned before, refrain from taking on new loans or increasing credit card balances.

- Increase Your Income: This directly impacts your DTI by increasing the denominator of the ratio.

- Choose a More Affordable Home: A lower mortgage amount means lower monthly payments, which helps keep your DTI low.

“A low Debt-to-Income ratio tells lenders you’re not just earning money, you’re managing it wisely. It’s a powerful signal of financial responsibility.”

Navigating the Mortgage Landscape Post-Bankruptcy

The mortgage market can seem complex, but understanding the different types of lenders and the role of a mortgage broker is vital when you’re looking for how to get approved for a mortgage if bankrupted.

Understanding Lender Categories

Not all lenders are created equal, especially when it comes to borrowers with a past bankruptcy. They are generally categorized into A, B, and Private lenders.

A Lenders (Prime Lenders)

These are the major banks (like RBC, TD, Scotiabank, BMO, CIBC), large credit unions, and other federally regulated financial institutions.

- Characteristics: Offer the most competitive interest rates and terms.

- Eligibility: Have the strictest lending criteria. They require excellent credit scores, stable income, and low debt ratios.

- Post-Bankruptcy: Very difficult to qualify with an A lender, even after the waiting period, unless you have exceptionally rebuilt your credit and have a substantial down payment (often 20% or more, allowing you to avoid mortgage insurance). They typically require 2-5 years post-discharge.

B Lenders (Subprime Lenders / Alternative Lenders)

These lenders specialize in helping borrowers who don’t quite meet the strict criteria of A lenders. Examples include Equitable Bank, Home Trust, and MCAP.

- Characteristics: More flexible with credit history, income sources, and debt ratios. They offer a viable pathway for individuals with past bankruptcies or consumer proposals. However, they typically charge higher interest rates than A lenders and may require larger down payments.

- Eligibility: They still require a good re-established credit history and a reasonable down payment (often 15-20% minimum). They typically require 1-2 years post-discharge.

- Post-Bankruptcy: This is often the most realistic option for your first mortgage after bankruptcy. The higher interest rate is the cost of the increased risk they are taking. The goal is to qualify with a B lender, make consistent payments for a few years, and then potentially refinance with an A lender once your credit is fully restored.

- Considering a refinance? Learn more here: All About Mortgage Refinancing

Private Lenders

These are individuals or companies that lend money outside of traditional financial institutions.

- Characteristics: The most flexible option. They focus heavily on the equity in the property and the borrower’s ability to make payments, rather than solely on credit scores. They are often used for short-term financing.

- Eligibility: Can sometimes approve mortgages immediately after discharge, but they come with the highest interest rates, significant fees (broker fees, lender fees, legal fees), and often require a very large down payment (25-50%).

- Post-Bankruptcy: May be an option if you need a mortgage immediately after discharge and have a very large down payment, or if you can’t qualify with a B lender. This is usually a short-term solution (1-3 years) with the goal of transitioning to a B or A lender as quickly as possible.

The Indispensable Role of a Mortgage Broker

When you’re dealing with a bankruptcy on your record, a mortgage broker is not just helpful; they are essential.

Why a Broker is Your Best Ally

- Access to Multiple Lenders: A mortgage broker works with a wide network of lenders, including A, B, and private lenders. They know which lenders are most likely to approve a mortgage for someone with a bankruptcy history.

- Expertise in Complex Cases: Brokers specializing in “exceptions” or “alternative lending” are skilled at packaging your application in the best possible light, highlighting your financial recovery and stability.

- Saves You Time and Effort: Instead of applying to multiple banks and facing repeated rejections, a broker can quickly identify suitable lenders, saving you frustration and potential negative impacts on your credit score from multiple inquiries.

- Negotiation Power: Brokers often have established relationships with lenders and can sometimes negotiate better terms or rates than an individual could on their own.

- Guidance and Advice: They can advise you on the specific steps you need to take to improve your chances of approval, such as the exact waiting period, credit rebuilding strategies, and down payment requirements for different lenders.

- Understanding Stress Testing: A good broker will also help you understand how factors like the mortgage stress test might impact your application, especially with alternative lenders.

- Get a cheat sheet on stress testing: Stress Testing in the Canadian Mortgage Market: Your Cheat Sheet

What a Broker Does for You

- Assess Your Situation: They will review your credit report, income, assets, and liabilities to understand your financial standing post-bankruptcy.

- Educate You: Explain the different lender types, their requirements, and what you can realistically expect.

- Develop a Strategy: Create a personalized plan, whether it’s waiting longer, saving more, or targeting a specific type of lender.

- Prepare Your Application: Help you gather all necessary documents and present your application to lenders in the most favourable way.

- Submit and Follow Up: Submit your application to suitable lenders and manage the communication and negotiation process on your behalf.

- Guide You Through Closing: Assist you through the entire mortgage process, from approval to closing.

- Understand what to expect during the process: What to Expect During the Mortgage Process Part 1

“A mortgage broker isn’t just a facilitator; they’re your advocate, especially when navigating the complexities of a post-bankruptcy mortgage.” 🤝

Mortgage Loan Insurance and Bankruptcy

In Canada, if your down payment is less than 20% of the home’s purchase price, your mortgage is considered “high-ratio” and must be insured against default. This insurance protects the lender, not you. The main providers are CMHC (Canada Mortgage and Housing Corporation), Sagen (formerly Genworth Canada), and Canada Guaranty.

Why Insurance is Crucial for High-Ratio Mortgages

- Enables Lower Down Payments: Without this insurance, lenders would typically require a 20% down payment or more.

- Protects Lenders: In case you default on your mortgage, the insurer pays the lender back.

Impact of Bankruptcy on Mortgage Insurance

This is a significant hurdle. Mortgage insurers (CMHC, Sagen, Canada Guaranty) have very strict rules regarding past bankruptcies.

- General Rule: They typically require a minimum of 2 years (and often 5 years) after your bankruptcy discharge, with a strong re-established credit history and a good reason for the bankruptcy (e.g., job loss, medical emergency). They also require a significant down payment (usually the minimum 5% for first-time buyers, but possibly more depending on the case).

- Difficulty: It is extremely challenging, if not impossible, to get an insured mortgage with a bankruptcy on your record, especially soon after discharge.

What this means for you:

- Aim for 20% Down or More: The most effective way to avoid the mortgage insurance hurdle is to save at least 20% of the home’s purchase price for your down payment. This makes your mortgage “conventional” and does not require insurance.

- Work with B or Private Lenders: If you can’t reach 20% down, you will likely need to work with B lenders or private lenders who often offer conventional mortgages (20% down) and are not subject to the same strict insurer rules, or they have their own internal insurance or risk assessment methods.

The Application Process: What to Expect

Once you’ve rebuilt your credit, saved a down payment, and identified a potential lender with the help of a mortgage broker, it’s time to go through the application process.

Getting Pre-Approved: A Vital Step

Before you even start looking at homes, getting pre-approved for a mortgage is highly recommended.

Why Pre-Approval Matters

- Know Your Budget: A pre-approval tells you exactly how much mortgage you can qualify for, helping you narrow down your home search to properties within your price range.

- Shows Seriousness: Real estate agents and sellers take pre-approved buyers more seriously, as it demonstrates you are a qualified and ready buyer.

- Identify Potential Issues Early: The pre-approval process is a preliminary assessment of your financial health. It allows you and your broker to identify any remaining hurdles (like an unexpectedly low credit score or income verification issues) before you fall in love with a home.

- Understand the importance: The Importance of Qualifying for a Mortgage Before Buying Property

The Pre-Approval Process

- Gather Documents: Your broker will ask for income verification, employment history, bank statements, and details about your bankruptcy discharge.

- Credit Check: The lender (or broker on their behalf) will pull your credit report and score.

- Financial Review: Your income, debts, and assets will be assessed.

- Conditional Approval: If approved, you’ll receive a pre-approval letter stating the maximum mortgage amount you qualify for, a locked-in interest rate (for a certain period, usually 90-120 days), and any conditions you need to meet.

Remember, a pre-approval is not a guarantee of a mortgage. It’s a conditional offer that becomes final once the property is approved and all conditions are met.

Essential Documents You’ll Need

Being prepared with all necessary documents will streamline your application process. Your mortgage broker will provide a comprehensive list, but here are some common requirements:

Personal Identification

- Valid government-issued photo ID (e.g., driver’s license, passport)

- Social Insurance Number (SIN)

Income Verification

- Recent pay stubs (2-3 months)

- Employment letter (confirming position, salary, start date)

- T4 slips (past 2 years)

- Notice of Assessments (NOAs) from CRA (past 2 years)

- For self-employed: Business financial statements, tax returns (past 2 years), articles of incorporation, business license.

Employment History

- Details of past employment (if recent job changes)

Financial Statements

- Bank statements (past 3-6 months for all accounts, showing income deposits and down payment savings)

- Investment statements

- Account statements for any outstanding loans or credit cards (even if paid off, to show history)

Bankruptcy Discharge Papers

- Official bankruptcy discharge certificate

- Statement of affairs from your Licensed Insolvency Trustee (LIT)

Credit Report and Score

- While lenders will pull their own, it’s good to have a copy of your own credit report (from Equifax and TransUnion) to review for errors and understand your standing.

Down Payment Verification

- Proof of funds for your down payment (e.g., bank statements showing savings, investment statements).

- If receiving a gift: A gift letter from the donor stating the funds are a non-repayable gift and the relationship to you.

- Avoid common first-time home buyer mistakes: First-Time Home Buyer Mistakes

Underwriting: What Lenders Look For

Once your application is submitted, it goes through the underwriting process. This is where the lender thoroughly assesses your risk.

Credit History Review

- Re-established Credit: Lenders will scrutinize your credit report for new credit accounts (secured cards, small loans) and perfect payment history since your discharge. They want to see consistent, responsible behaviour.

- Credit Utilization: How much of your available credit you are using. Lower is better.

- Inquiries: Too many recent credit inquiries can be a red flag.

Income and Employment Stability

- They verify your income sources and confirm your employment history, ensuring it’s stable and likely to continue.

Debt Obligations

- They calculate your Debt-to-Income (DTI) ratios to ensure you can comfortably afford the new mortgage payment along with any existing debts.

Property Appraisal

- The lender will order an appraisal of the property you intend to buy to ensure its value supports the loan amount.

Overall Risk Assessment

- The underwriter compiles all this information to create a comprehensive risk profile. They are looking for reasons to approve you, but also for any red flags that might lead to rejection. They want to be confident you won’t default.

Specific Strategies and Considerations

Beyond the general requirements, there are specific situations and strategies that can impact your ability to get a mortgage after bankruptcy.

Consumer Proposal vs. Bankruptcy: Different Paths, Different Rules

While both are options for debt relief, a consumer proposal is generally viewed more favourably by lenders than a bankruptcy.

Consumer Proposal: A Closer Look

A consumer proposal is a legal agreement between you and your creditors where you offer to pay back a portion of your debts over a period (up to 5 years), often without interest.

- Impact on Credit: It still negatively impacts your credit score, but generally less severely than bankruptcy. It appears on your credit report for 3 years after the proposal is completed (paid off) or 6 years from the date it was filed, whichever comes first.

- Lender View: Lenders often view a consumer proposal as a more responsible approach to debt repayment, as you are actively paying back a portion of what you owe.

- Mortgage Qualification:

- A Lenders: May consider you after 2-3 years of completing your proposal and rebuilding credit.

- B Lenders: Can often approve mortgages once the consumer proposal is paid in full, and you’ve had 1-2 years of re-established credit. Sometimes, they may even consider you if you are actively making payments on the proposal, provided you have a strong down payment and good re-established credit outside the proposal.

| Feature | Bankruptcy | Consumer Proposal |

|---|---|---|

| Debt Type | Forgives most unsecured debt | Repays a portion of unsecured debt |

| Credit Impact | Severe, stays 6-7 years (1st time) | Significant, stays 3 years after completion or 6 from filing |

| Lender View | More challenging, signals full inability to pay | More favourable, signals effort to repay |

| Mortgage Access | Longer waiting periods, often B/Private lenders | Shorter waiting periods, potentially A lenders sooner |

| Assets | Some assets may be surrendered | You typically keep your assets |

Co-Signers and Guarantors: Boosting Your Application

If you’re struggling to meet lender requirements on your own, having a co-signer or guarantor can significantly strengthen your mortgage application.

- Co-Signer: A co-signer is someone who agrees to be equally responsible for the mortgage debt. Their income and credit history are used to help you qualify. If you default, they are legally obligated to make the payments.

- Guarantor: A guarantor agrees to pay the mortgage if you default, but they don’t have an ownership interest in the property. Their role is primarily to provide financial backing.

Benefits:

- Increased Borrowing Power: Their income can help you qualify for a larger mortgage.

- Reduced Risk for Lender: Their strong credit history provides additional security to the lender.

- Access to Better Rates: With a strong co-signer, you might qualify for better rates or terms than you would on your own.

Considerations:

- Risk for Co-Signer/Guarantor: They are taking on significant financial risk.

- Impact on Their Credit: The mortgage will appear on their credit report and affect their own borrowing capacity.

- Long-Term Plan: Discuss with your broker how long the co-signer might be needed and if there’s a plan to remove them from the mortgage in the future (e.g., through refinancing once your financial standing improves).

Gifts for Down Payment: Rules and Regulations

A gift from a family member can be a valuable source for your down payment, especially when trying to reach that 20% threshold. However, lenders have specific rules:

- Source of Funds: The gift must come from an immediate family member (parent, grandparent, sibling, etc.).

- Non-Repayable: The gift must be a true gift, with no expectation of repayment. You will need a signed gift letter from the donor stating this.

- Proof of Funds: The lender will want to see the funds in your account and may even request bank statements from the donor to verify the source of the funds (to prevent money laundering).

Understanding Interest Rates and Terms

When you get a mortgage after bankruptcy, especially from a B lender or private lender, you should expect different terms than someone with perfect credit.

Higher Rates Initially

- Risk Premium: Lenders charge higher interest rates to compensate for the increased risk associated with your past bankruptcy. This is a “risk premium.”

- Fees: You might also face higher setup fees, appraisal fees, or broker fees, particularly with private lenders.

Opportunities for Refinancing

The good news is that this initial mortgage doesn’t have to be your permanent solution.

- Strategic Stepping Stone: View your first post-bankruptcy mortgage as a strategic stepping stone. Make all your payments on time, continue to rebuild your credit, and demonstrate consistent financial responsibility.

- Refinancing to a Better Rate: After 1-3 years of perfect mortgage payments and continued credit improvement, you can typically refinance your mortgage to a lower interest rate with a B lender, or even an A lender if your credit has fully recovered.

- Explore refinancing options: Guide: Refinancing Personal Loans (This link is about personal loans, but the principles of refinancing to improve terms are similar). Also, All About Mortgage Refinancing is a better fit.

Beyond Approval: Maintaining Your Mortgage and Financial Health

Getting approved for a mortgage after bankruptcy is a huge accomplishment, but the journey doesn’t end there. It’s crucial to maintain your financial health and ensure you keep your home.

Responsible Mortgage Payments

- On-Time, Every Time: This is non-negotiable. Missing even one mortgage payment can severely damage your re-established credit and put your home at risk.

- Automate Payments: Set up automatic payments from your bank account to ensure you never miss a due date.

- Emergency Fund: Build and maintain an emergency fund (3-6 months of living expenses) to cover mortgage payments and other essential bills in case of unexpected events like job loss or illness.

Continuing to Build Credit

Even after getting your mortgage, don’t stop your credit rebuilding efforts.

- Keep Credit Utilization Low: Continue to use your credit cards responsibly and keep balances well below 30% of your limit.

- Monitor Your Credit Report: Regularly check your credit report from Equifax and TransUnion for accuracy and to track your progress. You can get a free copy annually.

- Diversify Credit (Cautiously): Once your credit is very strong, you might consider a small, responsible loan (e.g., a small car loan if needed) to show you can handle different types of credit. Do this only if financially stable.

Future Financial Planning

- Budgeting is Key: Continue to live within your means and stick to a budget.

- Debt Management: Avoid accumulating new, high-interest debt.

- Financial Goals: Set new financial goals beyond just paying your mortgage, such as retirement savings, education funds, or investment.

- Professional Advice: Consider working with a financial planner to help you manage your money and plan for the future.

The Path to Prime Lending

Your ultimate goal should be to move from a B lender (or private lender) to an A lender. This transition offers the best interest rates and terms, saving you a significant amount of money over the life of your mortgage.

When can you transition?

- Typically, after 1-3 years of perfect mortgage payments with your B lender.

- When your credit score has significantly improved (e.g., above 680-700).

- When your income is stable, and your DTI is low.

Your mortgage broker can help you assess when you’re ready for this transition and guide you through the refinancing process.

Common Challenges and How to Overcome Them

Even with the best intentions, you might face specific challenges on your journey to getting a mortgage after bankruptcy.

Low Credit Score Hurdles

- The Challenge: Even after the waiting period, your credit score might still be lower than desired by some lenders.

- Overcoming It:

- Patience: Credit rebuilding takes time. Continue with secured credit cards, credit builder loans, and perfect payment history.

- Credit Report Review: Dispute any errors on your credit report immediately.

- Target B Lenders: Be realistic and target B lenders who are more flexible with lower scores.

- Larger Down Payment: Compensate for a lower score with a higher down payment.

Insufficient Down Payment

- The Challenge: Saving a substantial down payment can be difficult, especially if you’re rebuilding finances.

- Overcoming It:

- Aggressive Saving: Implement a strict budget, cut non-essential spending, and automate savings.

- Increase Income: Explore side jobs or overtime.

- Consider a Co-Signer: If a family member can provide a gift or co-sign, it can significantly help.

- Start Small: Consider a more affordable property initially to reduce the required down payment.

Unstable Employment

- The Challenge: Frequent job changes, gaps in employment, or reliance on contract/gig work can make lenders nervous.

- Overcoming It:

- Seek Stability: Aim for at least 1-2 years of stable, full-time employment with the same employer.

- Document Everything: If you’re self-employed, meticulously document all income and expenses for at least two years.

- Explain Gaps: Be prepared to clearly explain any employment gaps or career changes to your broker and lender.

Dealing with Lender Rejection

- The Challenge: Despite your best efforts, you might still face rejections.

- Overcoming It:

- Don’t Give Up: Rejection is a setback, not a failure.

- Get Feedback: Ask your mortgage broker for specific reasons for the rejection. This feedback is invaluable for improving your next application.

- Adjust Your Strategy: It might mean waiting longer, saving more, paying down more debt, or targeting a different type of lender (e.g., from B to private).

- Learn from Success Stories: Understand that many people have overcome this hurdle.

- Read a success story for inspiration: Oshawa Residential Mortgage Success Story

Success Stories and What They Teach Us

Stories of individuals who successfully navigate the path to homeownership after bankruptcy are not rare. They underscore the power of perseverance, strategic planning, and professional guidance.

General Examples

- The Patient Rebuilder: Sarah filed for bankruptcy after a business failure. She waited 3 years post-discharge, diligently paid off a secured credit card, and saved a 20% down payment by working a second job. With the help of a mortgage broker, she secured a mortgage with a B lender, knowing she could refinance to a prime lender in a few years.

- The Co-Signer Advantage: Mark, after a consumer proposal, found it hard to qualify due to a slightly lower income. His parents, with excellent credit, agreed to co-sign the mortgage. This allowed him to qualify for an A lender mortgage right away, with the understanding that he would take over the mortgage fully once his income increased and credit improved.

- The Strategic Private Lender: Emily needed a home quickly after her bankruptcy discharge due to family circumstances. She had a substantial inheritance for a 30% down payment but little re-established credit. Her broker found a private lender for a 1-year term. During that year, she focused on building credit and then successfully refinanced to a B lender, paying a much lower rate.

Lessons Learned

These stories highlight key lessons:

- Patience and Persistence Pay Off: The journey isn’t fast, but it’s achievable.

- Every Positive Step Counts: Each on-time payment, every dollar saved, contributes to your goal.

- Professional Help is Crucial: A knowledgeable mortgage broker is your most valuable asset. They can navigate the complexities and open doors you didn’t know existed.

- Flexibility is Key: Be prepared to start with a B or private lender and higher rates, viewing it as a temporary step towards a prime mortgage.

- Financial Discipline is a Lifestyle: Homeownership after bankruptcy requires ongoing commitment to responsible financial habits.

Conclusion

Getting approved for a mortgage after bankruptcy is a challenging but entirely attainable goal. It’s a journey that demands patience, disciplined financial rebuilding, and strategic planning. While the path might involve higher initial interest rates or working with alternative lenders, it’s a proven route to re-establishing your financial stability and achieving the dream of homeownership.

Remember the key components:

- Wait out the required period after your bankruptcy discharge.

- Aggressively rebuild your credit through secured credit cards and consistent on-time payments.

- Save a substantial down payment, ideally 20% or more, to reduce lender risk and avoid mortgage insurance hurdles.

- Demonstrate stable income and a low debt-to-income ratio.

- Leverage the expertise of a mortgage broker who specializes in complex financial situations. They are your best advocate in finding the right lender.

Your past financial difficulties do not define your future. With a clear plan, unwavering commitment, and the right professional support, you can absolutely secure a mortgage and proudly take the keys to your new home. Your journey after bankruptcy is a testament to resilience, and homeownership can be the ultimate symbol of your financial comeback.