May 27, 2025

Unlocking Your Home’s Potential: A Comprehensive Guide to Basement Rental Income Tax in Canada

Share this article:

Many Canadians are exploring new ways to make their homes work harder for them. One popular method is creating a basement apartment and renting it out. This can be a smart move, helping with mortgage payments, boosting your income, and adding value to your property. But while the idea of extra cash sounds great, it’s super important to understand the tax side of things. In Canada, the money you earn from renting out your basement is generally considered taxable income by the Canada Revenue Agency (CRA).

This detailed guide from Everything Mortgages will walk you through everything you need to know about basement rental income tax in Canada. We’ll break down complex tax rules into easy-to-understand language, helping you navigate your responsibilities, maximize your deductions, and avoid common mistakes. Whether you’re just thinking about becoming a landlord or you’re already collecting rent, this article is your go-to resource for making informed financial decisions. Let’s dive in! 🏡💰

Key Takeaways

- Rental Income is Taxable: All money you earn from renting out your basement must be reported to the CRA as income.

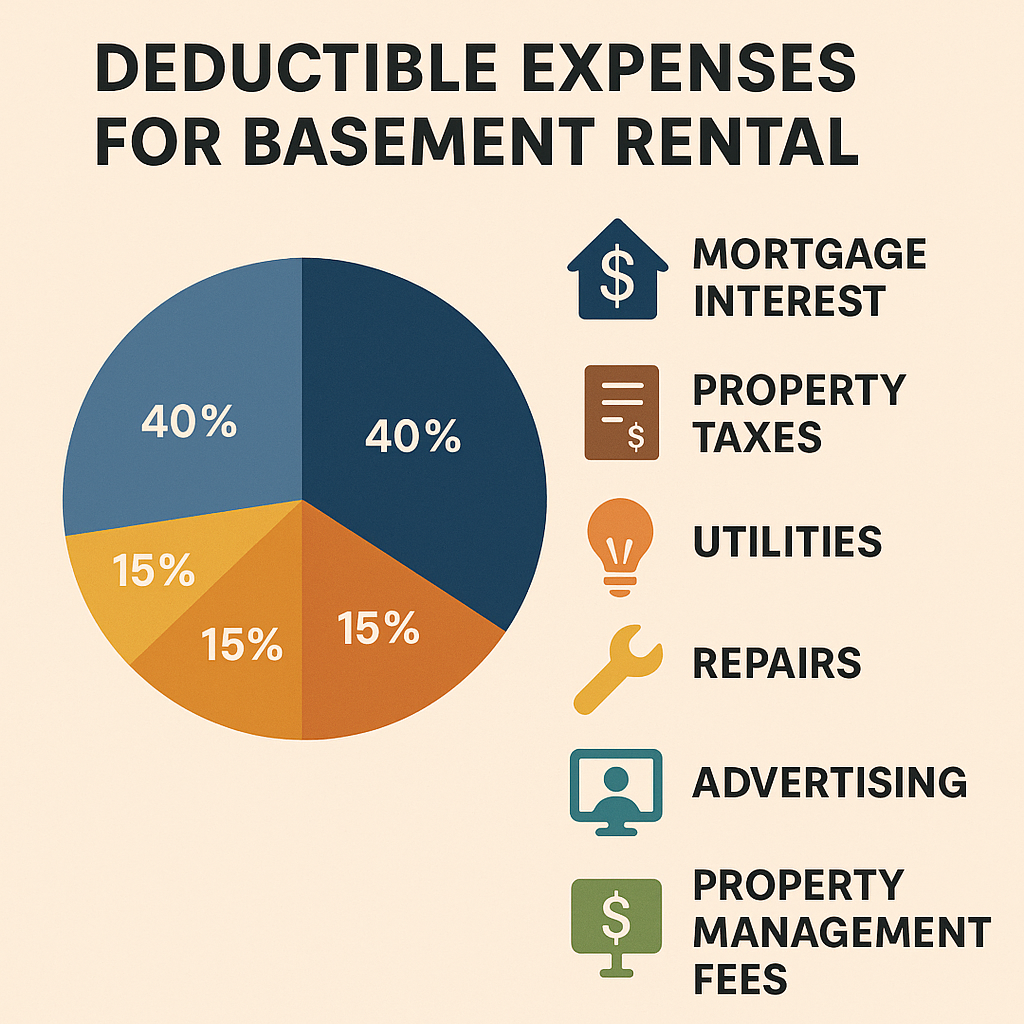

- Deductible Expenses are Key: You can claim many expenses related to your rental unit, like a portion of mortgage interest, property taxes, utilities, and repairs, to reduce your taxable income.

- Record Keeping is Crucial: Keep detailed and organized records of all your rental income and expenses. This is vital for tax purposes and can save you headaches later.

- Capital Gains & Changing Use: Be aware of how renting out a portion of your home can affect your Principal Residence Exemption when you sell, and understand the “changing use” rules.

- Professional Advice is Valuable: Don’t hesitate to consult with a tax professional or a mortgage broker like Everything Mortgages. They can provide personalized advice and help you optimize your financial situation.

Understanding Basement Rental Income in Canada

Renting out a basement apartment has become a common strategy for homeowners across Canada. It’s a fantastic way to generate extra cash flow, which can be used to help cover your mortgage payments, save for future goals, or simply improve your overall financial health. But before you put up that “For Rent” sign, it’s essential to grasp what rental income truly means in the eyes of the Canada Revenue Agency (CRA).

What Counts as Rental Income?

Simply put, rental income is any money you receive from renting out a property or a part of a property that you own. For a basement apartment, this includes:

- Rent Payments: The regular monthly or weekly payments from your tenant.

- Advance Rent: Any rent paid upfront for a future period.

- Damage Deposits (if applied to rent): If a damage deposit is later used by the tenant to cover a rent payment, it becomes rental income at that point.

- Payments for Services: If you charge extra for things like laundry facilities, parking, or specific utilities beyond what’s included in the rent, these amounts are also considered rental income.

- Reimbursements: If your tenant reimburses you for expenses you paid on their behalf (e.g., a portion of utilities that you paid initially), this is also rental income.

It’s important to differentiate between gross rental income (all the money you receive) and net rental income (gross income minus your eligible expenses). The CRA taxes your net rental income. This is great news because it means you can reduce the amount of income you pay tax on by claiming various costs associated with your rental unit.

Why is Basement Rental So Popular?

There are several compelling reasons why homeowners choose to rent out their basements:

- Financial Boost: This is often the primary driver. Rental income can significantly offset your mortgage payments, property taxes, and other homeownership costs. For some, it makes homeownership more affordable or allows them to qualify for a larger mortgage than they otherwise could.

- Increased Property Value: A legal, well-maintained basement apartment can increase your property’s resale value, as it appeals to future buyers looking for income potential or multi-generational living options.

- Debt Reduction: The extra income can be channeled towards paying down your mortgage faster or tackling other debts.

- Meeting Housing Demand: In many Canadian cities, there’s a high demand for affordable rental housing. By offering a basement apartment, you’re contributing to the local housing supply.

- Community Building: Having tenants can add a new dynamic to your household and neighbourhood.

The General Tax Principle for Rental Income

The core principle is simple: if you make money from renting, you need to report it. The CRA treats rental income much like income from a job or a business. You report it on your annual income tax return, specifically on Form T776, Statement of Real Estate Rentals.

The good news is that you don’t pay tax on every dollar of rent you collect. Instead, you pay tax on your net rental income, which is your total rental income minus your eligible expenses. This is why understanding and tracking your expenses is so crucial. It directly impacts how much tax you’ll owe.

It’s important to remember that this income is added to your other income (like your job salary) to figure out your total taxable income. This means it could push you into a higher tax bracket, so careful planning and expense tracking are essential.

The Canada Revenue Agency (CRA) and Rental Income

The Canada Revenue Agency (CRA) is the government body responsible for collecting taxes in Canada. When it comes to rental income, the CRA has specific rules and expectations that landlords must follow. Understanding these rules is not just about staying on the right side of the law; it’s also about making sure you take advantage of all the deductions you’re entitled to.

Your Responsibilities as a Landlord

As a landlord earning rental income, you have several key responsibilities to the CRA:

- Report All Income: You must report all gross rental income you receive, regardless of the amount. Even if your expenses are higher than your income (resulting in a rental loss), you still need to report both the income and expenses.

- Keep Detailed Records: This is perhaps the most critical responsibility. The CRA expects you to keep complete and organized records of all your rental income and expenses. This includes:

- Rent receipts or bank statements showing rent deposits.

- Invoices and receipts for all expenses (repairs, utilities, insurance, etc.).

- Lease agreements.

- Records of when you bought the property and when you started renting it.

- Details of any major improvements or changes.

- These records must be kept for at least six years from the end of the last tax year they relate to. Think of it like homework – you need to show your work if the teacher asks! 📚

- File Form T776: As mentioned, rental income and expenses are reported on Form T776, Statement of Real Estate Rentals. This form is then submitted along with your personal income tax return (T1 General).

- Understand Deductible Expenses: Know what you can and cannot claim as an expense. This guide will go into detail on this, but it’s your responsibility to ensure your deductions are legitimate.

- Pay Your Taxes: If your net rental income results in you owing more tax, you are responsible for paying it by the deadline. For individuals, the tax filing deadline is April 30th each year (or June 15th if you’re self-employed, but the payment deadline is still April 30th).

What Happens if You Don’t Report Rental Income?

Ignoring your tax obligations can lead to serious consequences. The CRA has sophisticated systems to detect undeclared income. They can cross-reference information from various sources, including:

- Tenant complaints.

- Property records.

- Other government programs.

- Tips from the public.

If the CRA finds out you haven’t reported rental income, you could face:

- Penalties: You may be charged a penalty for failing to report income, which can be a percentage of the undeclared income.

- Interest: Interest will be charged on any overdue taxes, starting from the original payment deadline. This interest can add up quickly!

- Reassessment: The CRA can reassess your tax returns for previous years, meaning they will go back and recalculate your taxes, adding the unreported income.

- Tax Audit: You might be selected for a full tax audit, which can be a lengthy and stressful process.

- Legal Action: In severe cases of deliberate tax evasion, the CRA can pursue legal action, leading to fines or even jail time.

“The CRA’s message is clear: transparency is key. Reporting your rental income accurately and on time is not just a legal requirement, but a smart financial move that helps you avoid unnecessary stress and penalties.”

It’s always better to be proactive. If you realize you’ve made a mistake in past years, the CRA has a Voluntary Disclosures Program (VDP) that might allow you to correct past errors without penalties, provided you come forward voluntarily and before the CRA contacts you.

Getting a Business Number (BN)

For most individual landlords renting out a basement apartment, you do not need a business number (BN) or to register for GST/HST (more on GST/HST later). A BN is usually required if your rental activities are considered a “business” rather than a property investment, or if your gross rental income from all rental properties exceeds certain thresholds for GST/HST purposes. For a single basement unit, it’s generally not needed.

However, if your rental activities become more extensive (e.g., you own multiple rental properties, or you offer short-term rentals that include services like cleaning, which makes it more like a hotel business), you might need a BN and potentially register for GST/HST. When in doubt, it’s best to check with the CRA or a tax professional.

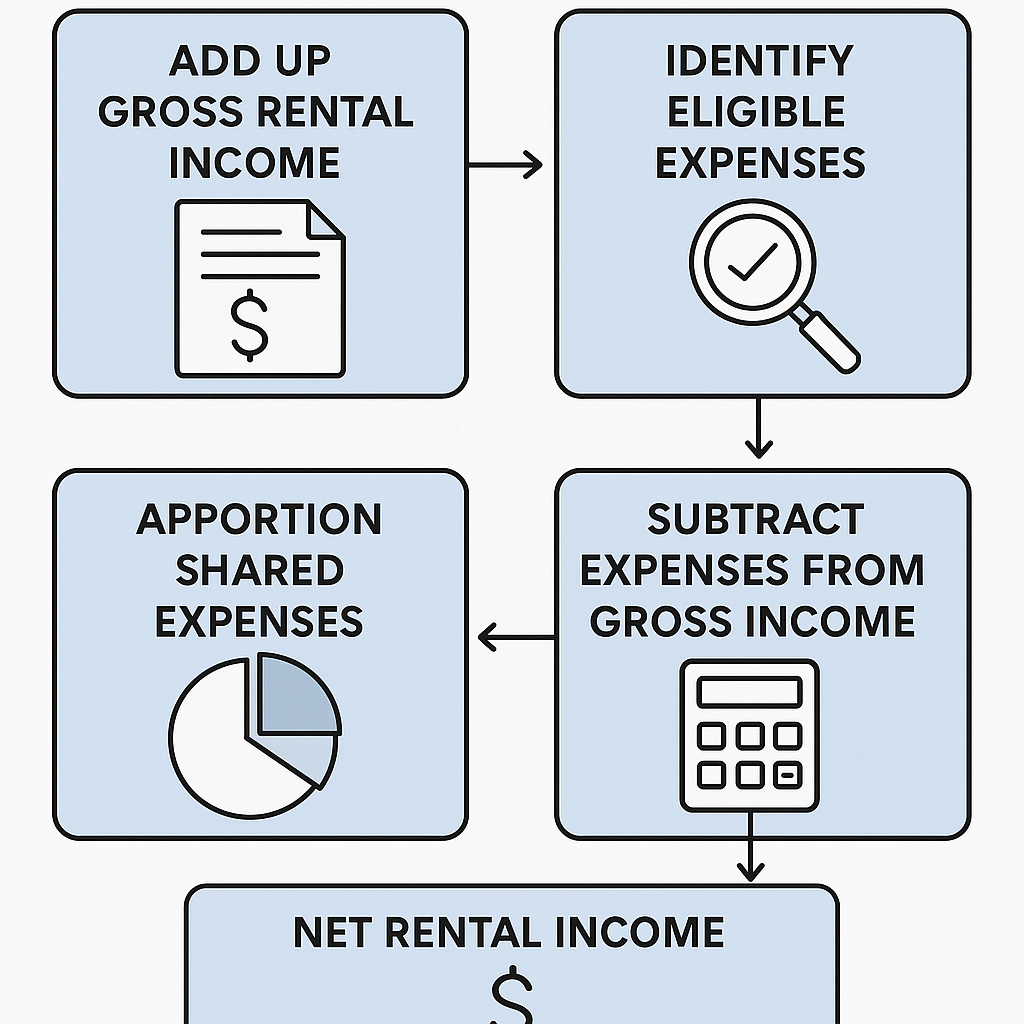

Calculating Your Rental Income: The Basics

Understanding how to calculate your net rental income is crucial for tax purposes. It’s not just about adding up the rent; it’s about subtracting what you spent to earn that rent. This section will guide you through the fundamental steps.

Gross Rental Income vs. Net Rental Income

Let’s clarify these two important terms:

- Gross Rental Income: This is the total amount of money you collect from your tenants before taking out any expenses. It’s the raw income.

- Example: If you charge $1,500/month for your basement apartment, your gross annual rental income would be $1,500 x 12 = $18,000.

- Net Rental Income: This is the amount left after you subtract all your eligible expenses from your gross rental income. This is the figure that the CRA uses to calculate how much tax you owe.

- Example: If your gross income is $18,000 and your total eligible expenses are $10,000, your net rental income is $8,000. This $8,000 is what gets added to your other income for tax calculation.

It’s possible to have a net rental loss if your eligible expenses are greater than your gross rental income. A rental loss can be used to reduce your other income for tax purposes, potentially lowering your overall tax bill. However, the CRA may scrutinize continuous or very large rental losses to ensure the rental activity is genuinely undertaken to make a profit.

Steps to Calculate Your Net Rental Income

Here’s a step-by-step approach to calculating your net rental income for tax purposes:

- Add Up All Gross Rental Income:

- Collect all rent payments received during the tax year (January 1 to December 31).

- Include any other amounts received from tenants (e.g., payments for specific services, reimbursements).

- Tip: A simple spreadsheet or ledger can help you track this monthly.

- Identify All Eligible Expenses:

- Go through all your receipts and invoices related to your rental property for the tax year.

- Categorize them according to the types of expenses allowed by the CRA (we’ll cover these in detail next).

- Remember to only claim the portion of expenses that relate to the rental unit. If your basement is 30% of your home’s total finished square footage, you generally claim 30% of shared expenses.

- Apportion Shared Expenses:

- Many expenses, like mortgage interest, property taxes, utilities, and insurance, cover your entire home, not just the basement unit.

- You must determine a reasonable way to divide these expenses between the rental part and your personal part. The most common method is based on square footage.

- Calculation: (Square footage of rental unit / Total square footage of the home) x Total Expense.

- Example: If your basement apartment is 800 sq ft and your entire home is 2,000 sq ft, then 800/2000 = 40%. You can claim 40% of shared expenses.

- Other methods might include the number of rooms, or the number of people living in each part, but square footage is usually preferred by the CRA as it’s more objective.

- Subtract Total Eligible Expenses from Gross Income:

- Once you have your total gross income and your total eligible expenses (including the apportioned shared expenses), simply subtract the latter from the former.

- Gross Rental Income – Total Eligible Expenses = Net Rental Income (or Loss)

Example Calculation

Let’s imagine you rent out your basement apartment.

Annual Gross Rental Income:

- Monthly Rent: $1,600

- Annual Rent: $1,600 x 12 = $19,200

Annual Expenses:

| Expense Category | Total Annual Cost | Rental Portion (e.g., 40%) | Deductible Amount |

|---|---|---|---|

| Mortgage Interest | $12,000 | 40% | $4,800 |

| Property Taxes | $4,000 | 40% | $1,600 |

| Utilities (Hydro, Gas, Water) | $3,000 | 40% | $1,200 |

| Home Insurance | $1,200 | 40% | $480 |

| Repairs (e.g., leaky faucet in basement) | $300 | 100% | $300 |

| Advertising for tenant | $100 | 100% | $100 |

| Total Deductible Expenses | $8,480 |

Net Rental Income Calculation:

- Gross Rental Income: $19,200

- Total Deductible Expenses: $8,480

- Net Rental Income: $19,200 – $8,480 = $10,720

This $10,720 is the amount you would report on your T776 and add to your other income for tax purposes. As you can see, the deductions significantly reduce the amount of income you pay tax on. This highlights why meticulous record-keeping and understanding eligible expenses are so important! 🧐

Deductible Expenses for Basement Rentals

This is where you can really save money on your taxes! The CRA allows landlords to deduct a wide range of expenses incurred to earn rental income. These deductions reduce your net rental income, which in turn lowers your overall taxable income. It’s like getting a discount on your taxes.

However, there’s a golden rule: only expenses that are reasonable and directly related to earning rental income can be deducted. You can’t deduct personal expenses. Also, if an expense benefits both your personal living space and the rental unit, you must divide the cost fairly (apportion it), usually based on the square footage of the rental unit compared to your total home.

Let’s explore the common deductible expenses in detail:

1. Mortgage Interest 🏦

This is often one of the largest deductions you can claim. You can deduct the interest portion of your mortgage payments that relates to the rental unit. You cannot deduct the principal portion of your mortgage payment.

- How to calculate: Get a statement from your mortgage lender (bank, credit union, etc.) that shows the breakdown of principal and interest paid during the year. Then, apply your apportionment percentage (e.g., if the basement is 40% of your home, you can deduct 40% of the total mortgage interest paid).

- Example: If you paid $12,000 in mortgage interest last year, and your basement apartment occupies 40% of your home’s total area, you can deduct $12,000 x 0.40 = $4,800.

- Important Note: If you refinanced your mortgage or got a second mortgage to fund renovations for the rental unit, the interest on that specific portion of the loan might be fully deductible, provided it was used directly for the rental property. This is a complex area where consulting a mortgage broker like Everything Mortgages can be beneficial. They can help you understand how different mortgage products (like a second mortgage or a HELOC vs. home equity loan) can impact your deductible interest.

2. Property Taxes 🏘️

The annual property taxes paid to your municipality are also deductible.

- How to calculate: Take your annual property tax bill and apply your apportionment percentage.

- Example: If your annual property tax is $4,000 and your rental unit is 40% of your home, you can deduct $4,000 x 0.40 = $1,600.

3. Utilities 💡💧🔥

If you pay for utilities (electricity, heating, water, internet) for the entire property and include them in the rent, you can deduct the portion related to the rental unit.

- How to calculate: Add up all your utility bills for the year and apply your apportionment percentage.

- Example: If your total utility bills for the year were $3,000, and the rental unit is 40% of your home, you can deduct $3,000 x 0.40 = $1,200.

- Tip: If the rental unit has its own separate meters for utilities, you can deduct 100% of those specific utility bills. This is ideal for clear expense tracking.

4. Insurance Premiums 🛡️

The cost of your home insurance (including fire insurance, property insurance, etc.) is deductible for the rental portion.

- How to calculate: Take your annual insurance premium and apply your apportionment percentage.

- Example: If your annual home insurance is $1,200, and the rental unit is 40% of your home, you can deduct $1,200 x 0.40 = $480.

- Important: Some insurance policies may increase due to having a rental unit. Make sure your insurance covers rental activities.

5. Repairs and Maintenance 🛠️

These are costs incurred to keep the property in good operating condition. They are generally deductible in the year they are incurred.

- Examples: Fixing a leaky faucet, repairing a broken window, painting the rental unit, replacing a damaged floorboard, general cleaning, lawn care, snow removal.

- Key Distinction:Repairs and maintenance are different from capital expenditures (also called capital improvements).

- Repairs restore something to its original condition. They are deductible.

- Capital expenditures improve the property beyond its original condition or extend its useful life. They are generally not immediately deductible but are added to the cost of the property and can be depreciated over time using Capital Cost Allowance (CCA) – see below.

- How to tell the difference:

- Repair: Replacing a broken stove with a similar model.

- Capital Expenditure: Upgrading an old stove to a high-end, smart appliance that wasn’t there before.

- Repair: Patching a hole in a wall.

- Capital Expenditure: Adding a new room or a new bathroom.

- Important: If a repair is part of a larger renovation that significantly improves the property, the entire cost might be considered a capital expenditure. Always keep receipts and clearly label what the repair was for. If the repair only affects the rental unit, you can deduct 100% of the cost. If it affects the whole house, apportion it.

6. Advertising and Marketing 📢

Costs incurred to find a tenant are fully deductible.

- Examples: Fees for listing on rental websites (e.g., Kijiji, Facebook Marketplace, MLS), newspaper ads, “For Rent” signs.

- How to calculate: Deduct 100% of these costs.

7. Property Management Fees 🧑💼

If you hire a property management company to handle the day-to-day operations of your rental unit (e.g., finding tenants, collecting rent, arranging repairs), their fees are fully deductible.

- How to calculate: Deduct 100% of the fees paid.

8. Legal and Accounting Fees ⚖️📊

Fees paid to lawyers for drafting lease agreements or evicting a tenant, or to accountants for preparing your rental income tax return, are deductible.

- How to calculate: Deduct 100% of these fees if they are directly related to the rental activity.

9. Office Expenses 📎

Small costs associated with managing your rental, such as stationery, postage, or phone calls related to the rental.

- How to calculate: Deduct 100% of these minor costs.

10. Travel Expenses 🚗

If you incur travel expenses solely for the purpose of collecting rent, supervising repairs, or managing the property (e.g., driving to pick up supplies for the rental unit), these may be deductible.

- Important: You can only claim the portion related to the rental activity. Keep a logbook if you use your personal vehicle.

11. Capital Cost Allowance (CCA) – A Special Deduction 📈

This is one of the most complex deductions but can be very beneficial. CCA is the CRA’s way of allowing you to deduct the cost of certain depreciable property (like the building itself, or major renovations) over a period of several years, rather than all at once. It recognizes that assets wear out or become obsolete over time.

- What can you claim CCA on?

- The building portion of your property (you cannot claim CCA on the land value, as land is generally not considered to depreciate).

- Furniture, appliances, or equipment you buy for the rental unit.

- Major improvements or additions (capital expenditures) to the property.

- Key Rules for CCA:

- Optional: You don’t have to claim CCA. You can choose to claim all, part, or none of the CCA you’re entitled to in any given year.

- Cannot create or increase a rental loss: You cannot claim CCA if it would create or increase a rental loss for the year. This means if your expenses already exceed your income, you cannot claim CCA to make the loss even bigger.

- Recapture and Terminal Loss: When you sell the property, the CRA may “recapture” some of the CCA you claimed. This means if you sell the property for more than its undepreciated capital cost, the difference (up to the original cost of the asset) will be added back to your income. Conversely, if you sell for less, you might have a “terminal loss” you can deduct. This is why many landlords choose not to claim CCA on the building itself, especially if they plan to sell the property later and hope to benefit from the Principal Residence Exemption (more on this below).

- Separate Classes: Different types of property (e.g., building, furniture) fall into different “classes,” each with its own specific CCA rate. For a residential rental building, it’s usually Class 1 (4% annual rate).

- Half-Year Rule: In the first year you acquire a depreciable asset, you can generally only claim half of the normal CCA rate for that year.

- Example of CCA (for furniture/appliances):

- You buy a new fridge for your basement apartment for $1,000. This might be in Class 8 (20% CCA rate).

- Year 1: You can claim 10% (half of 20%) of $1,000 = $100.

- The remaining undepreciated capital cost (UCC) is $900.

- Year 2: You can claim 20% of $900 = $180.

- The remaining UCC is $720, and so on.

When to claim CCA on the building? This is a strategic decision.

- If you expect to hold the property for a very long time and don’t anticipate a large capital gain on sale, or if you need to reduce your taxable income significantly now, claiming CCA on the building might be attractive.

- However, if you plan to sell the property within a few years and are worried about recapture, or if you want to preserve your Principal Residence Exemption, it’s often advisable not to claim CCA on the building.

“Deciding whether to claim Capital Cost Allowance, especially on the building itself, is a complex tax planning decision. It’s highly recommended to discuss this with a tax professional to understand the long-term implications for your specific situation.”

Summary Table of Common Deductible Expenses

| Expense Category | Deductible? | Apportionment? | Notes |

|---|---|---|---|

| Mortgage Interest | Yes | Yes | Only interest portion; principal is NOT deductible. |

| Property Taxes | Yes | Yes | Based on the portion of the home used for rental. |

| Utilities (Heat, Hydro, Water) | Yes | Yes | Unless separately metered for the rental unit (then 100%). |

| Home Insurance | Yes | Yes | Ensure your policy covers rental activity. |

| Repairs & Maintenance | Yes | Yes/No | Yes if it restores to original condition. No if it’s a capital improvement (use CCA). 100% if solely for rental unit. |

| Advertising | Yes | No | 100% deductible. |

| Property Management Fees | Yes | No | 100% deductible if you use a management company. |

| Legal & Accounting Fees | Yes | No | For rental-related matters (e.g., lease, tax preparation). |

| Office Supplies | Yes | No | Small expenses like stationery, postage. |

| Travel Expenses | Yes | No | For rental-related purposes (keep logbook). |

| Capital Cost Allowance (CCA) | Optional | Yes | For depreciable assets (building, appliances). Cannot create/increase a loss. Has recapture implications upon sale. Consult a pro! |

Remember, keeping excellent records for all these expenses is paramount. No receipt, no deduction! 🧾

Capital Gains Implications

When you sell your principal residence in Canada, you usually don’t have to pay tax on any profit (capital gain) you make from the sale. This is thanks to the Principal Residence Exemption (PRE). However, if you’ve been renting out a portion of your home, like a basement apartment, this can complicate things.

The Principal Residence Exemption (PRE) Explained

Your principal residence is generally the home you ordinarily inhabit during the year. For the PRE to apply, you must:

- Own the property.

- Live in it as your main home.

- Designate it as your principal residence for the year.

If your home qualifies as your principal residence for every year you owned it, then any gain from its sale is completely tax-free.

How Renting Affects the PRE

When you start renting out a part of your principal residence, the CRA considers this a “change in use” of part of your property. This means that the portion of your home used for rental purposes may no longer qualify for the PRE.

This is a critical point: if you rent out a basement apartment, when you sell your home, the capital gain related to the rental portion might be taxable.

Scenario 1: Minor Rental Use (Generally No Impact on PRE)

The CRA generally considers that you have not changed the use of your principal residence if all of the following conditions are met:

- The rental use is ancillary (secondary) to the main use of the property as your principal residence. This means the rental unit is a small part of your home, not the majority.

- You do not make any structural changes to the property to accommodate the rental unit. (e.g., adding a separate entrance, kitchen, or bathroom specific to the rental unit could be seen as structural).

- You do not claim Capital Cost Allowance (CCA) on the property (or any part of it) while it’s being used as your principal residence.

If all three of these conditions are met, you might still be able to claim the full PRE when you sell your home, meaning the entire gain is tax-free. This is the ideal scenario for many landlords.

Scenario 2: Significant Rental Use or Claiming CCA (Impacts PRE)

If you don’t meet all three conditions above (e.g., you made significant structural changes to create the basement apartment, or you claimed CCA on the building), the CRA considers that you have changed the use of a portion of your property.

In this case, when you sell your home, you will need to:

- Determine the portion of your home used for rental. (e.g., 30% of the home’s square footage).

- Calculate the capital gain on that specific rental portion.

- Pay tax on that capital gain.

The capital gain would be calculated as: (Selling Price of Rental Portion – Adjusted Cost Base of Rental Portion).

- Adjusted Cost Base (ACB): This is the original cost of the property plus any capital expenditures (major improvements, not repairs) made over the years.

- Example: If your home cost $500,000 and you sell it for $800,000, and 30% of it was used for a rental unit where you claimed CCA.

- Total gain: $300,000.

- Rental portion gain: $300,000 x 0.30 = $90,000.

- You would pay tax on this $90,000 gain.

Electing to Deem No Change in Use (Subsection 45(2) Election)

There’s a special election you can make under Subsection 45(2) of the Income Tax Act if you convert your principal residence to a rental property (or a part of it). This election allows you to treat your property as your principal residence for up to four additional years, even if you’re renting it out, provided you do not claim CCA during those years.

- Benefits:

- It preserves your PRE for those years, potentially making the entire gain tax-free upon sale.

- It allows you to continue deducting rental expenses (except CCA).

- Conditions:

- You must not claim CCA on the property during the election period.

- You must file the election with your tax return for the year the change in use occurred.

- You must still be a resident of Canada during the election period.

- Important: If you move out of the property entirely and rent out the whole thing, you must designate another property as your principal residence during these years, or you won’t be able to use the PRE for those years on any other property.

This election is usually very beneficial, but it’s a one-time choice for a specific period. If you later move back into the property and then rent it out again, you can’t use the same election again.

“Understanding the Principal Residence Exemption and its interaction with rental income is crucial for long-term financial planning. A misstep here could lead to a significant tax bill when you sell your home. Always consult a tax professional to discuss your specific situation, especially if you’ve claimed CCA or made significant structural changes.”

Recapture of Capital Cost Allowance (CCA)

As mentioned earlier, if you claim CCA on your rental property (or the rental portion of your principal residence), you might have a “recapture” of CCA when you sell the property. This means that if the selling price of the depreciable asset (e.g., the building, appliances) is higher than its Undepreciated Capital Cost (UCC), the difference (up to the original cost of the asset) is added back to your income in the year of sale.

- Example: You bought a fridge for $1,000 and claimed $300 in CCA over a few years, so its UCC is $700. If you sell the property and the fridge is valued at $900, the $200 difference ($900 – $700) is recaptured and added to your income. If you sell it for more than the original cost ($1,000), only up to the original cost is recaptured. Any amount above the original cost is a capital gain.

Recapture can be a significant amount, especially if you’ve claimed a lot of CCA on the building itself. This is another reason why many homeowners choose not to claim CCA on the building portion of their principal residence, opting instead to preserve their PRE.

GST/HST and Rental Properties

Many people get confused about Goods and Services Tax (GST) or Harmonized Sales Tax (HST) when it comes to rental properties in Canada. Let’s clear this up.

Long-Term Residential Rentals: Generally Exempt

For most homeowners renting out a basement apartment on a long-term basis (typically 12 months or more), your rental income is generally exempt from GST/HST. This means:

- You do not charge GST/HST on the rent you collect from your tenant.

- You cannot claim input tax credits (ITCs) for the GST/HST you pay on expenses related to your rental property (e.g., renovations, utilities, repairs).

This exemption applies to most residential rental properties, including houses, apartments, and condominiums, when they are rented for periods of at least one month.

When Might GST/HST Apply?

There are specific situations where GST/HST might apply to rental properties:

- Short-Term Rentals (e.g., Airbnb, VRBO): If you rent out your basement on a very short-term basis (less than 30-day periods) and also offer services like cleaning, linens, or meals, this is generally considered a “commercial activity” rather than a residential rental. In this case, you might need to register for GST/HST and charge it to your guests if your gross revenue from all taxable activities (including other short-term rentals, if any) exceeds $30,000 in a 12-month period.

- Commercial Properties: If you rent out a commercial space (e.g., an office, a retail store), GST/HST typically applies.

- New Residential Construction: If you’re a builder who builds a new residential property (including a house with a basement apartment) and then sells it or rents it out for the first time, specific GST/HST rules apply, often involving new housing rebates. This is usually not relevant for an individual homeowner renting out an existing basement.

- Significant Renovation and First Rental: If you undertake a “substantial renovation” of your property and then rent it out for the first time, you might be considered a “builder” for GST/HST purposes and may have to account for GST/HST on the fair market value of the property. A substantial renovation means 90% or more of the interior of a building has been removed or replaced. This is rare for a typical basement apartment conversion but something to be aware of.

For the vast majority of homeowners simply renting out a basement apartment to a long-term tenant, you can breathe a sigh of relief – no GST/HST to worry about! 🎉

“For most basement landlords, GST/HST is a non-issue. Focus on income tax, but if you’re dabbling in short-term rentals or major new builds, dig deeper into GST/HST rules or consult a professional.”

Changing Use of Property Rules

The CRA has specific rules for when you change the use of your property. This applies when you start using your principal residence (or part of it) to earn income, or vice versa.

From Personal Use to Rental Use (or Mixed Use)

When you convert your entire home or a portion of it (like your basement) from personal use to rental use, the CRA considers this a “deemed disposition” of the property (or the rental portion) at its fair market value.

- What does this mean? It’s as if you sold the property (or the rental part) to yourself at its current market value and then immediately reacquired it.

- Capital Gain/Loss: If the fair market value is higher than your original cost (plus capital improvements) for the rental portion, you could have a capital gain at that moment. However, if the property was your principal residence up to that point, the Principal Residence Exemption would generally cover any gain up to the date of the change in use.

- New Cost Base: The fair market value at the time of the change in use becomes the new “adjusted cost base” for the rental portion for future capital gains calculations. This is important because any future gain or loss on the rental portion will be calculated from this new, higher (or lower) cost base.

- Electing under Subsection 45(2): As discussed in the Capital Gains section, you can make an election under Subsection 45(2) to avoid the deemed disposition and continue to treat your property as your principal residence for up to four additional years, even while renting it out. This is highly recommended if you don’t claim CCA on the building and plan to move back in or sell within that timeframe.

From Rental Use to Personal Use

If you stop renting out your basement apartment and reclaim it for your personal use, this also triggers a “deemed disposition” at its fair market value.

- What happens? Again, it’s as if you sold the rental portion to yourself at fair market value.

- Capital Gain/Loss: You would calculate any capital gain or loss on the rental portion up to that point. If there’s a gain, it would be taxable. If there’s a loss, it could be deductible.

- Recapture of CCA: If you claimed CCA on the rental portion, you would also have to account for any recapture of CCA at this point.

- New Cost Base: The fair market value at the time you stop renting becomes the new adjusted cost base for that portion of the property, which will be relevant when you eventually sell the entire home.

- Electing under Subsection 45(3): If you previously used the Subsection 45(2) election and now move back into the property, you might be able to make an election under Subsection 45(3) to “reverse” the deemed disposition and treat the property as your principal residence again.

Why are these rules important?

These “change in use” rules are crucial for:

- Accurate Capital Gains Calculation: They ensure that the CRA can properly track the taxable portion of any capital gain when you eventually sell your home.

- CCA Recapture: They trigger the calculation of CCA recapture when the property is no longer used for rental income.

- Principal Residence Exemption: They directly impact how much of your home’s gain can be sheltered by the PRE.

“Navigating ‘change in use’ rules can be tricky. It’s a key area where professional tax advice can save you from unexpected tax bills down the line. Don’t guess; get clarity.”

Record Keeping: Your Best Friend

We’ve mentioned it multiple times, but it bears repeating: meticulous record keeping is absolutely essential when you’re a landlord. Think of your records as your shield against CRA questions and your key to maximizing your deductions.

Why is Record Keeping So Important?

- Tax Compliance: It allows you to accurately report your income and expenses on your tax return, fulfilling your legal obligations.

- Maximizing Deductions: You can only claim expenses if you can prove them. Receipts and invoices are your proof! Without them, you might miss out on valuable deductions, meaning you pay more tax than you need to.

- Audit Preparedness: If the CRA ever decides to audit your tax return, having organized and complete records will make the process much smoother and less stressful. It demonstrates that you’ve been diligent and honest.

- Financial Management: Good records help you understand the true profitability of your rental unit, allowing you to make better financial decisions. You can see where your money is going and identify areas for improvement.

- Capital Gains Calculation: Accurate records of your property’s original cost and any capital improvements are vital for calculating your adjusted cost base when you sell the property.

What Records Should You Keep?

Here’s a comprehensive list of what you should keep:

- Income Records:

- Lease Agreements: Clearly stating the rent amount, terms, and tenant details.

- Rent Receipts/Statements: Copies of rent payments received, or bank statements showing deposits.

- Records of any other income received from tenants (e.g., parking fees, laundry fees, reimbursements).

- Expense Records:

- Original Receipts and Invoices: For every expense you incur, no matter how small. This includes:

- Mortgage statements (showing interest paid).

- Property tax bills.

- Utility bills (electricity, gas, water, internet).

- Insurance policy and payment receipts.

- Receipts for all repairs and maintenance (e.g., plumbing, electrical, painting, cleaning supplies, lawn care, snow removal).

- Invoices for advertising.

- Statements from property management companies.

- Legal and accounting bills.

- Receipts for office supplies.

- Proof of purchase for any depreciable assets (appliances, furniture, major renovations).

- Credit Card Statements: While not sufficient on their own, they can help you trace transactions to find the original receipt.

- Bank Statements: To reconcile income and expenses.

- Original Receipts and Invoices: For every expense you incur, no matter how small. This includes:

- Property Information:

- Purchase Documents: Original purchase agreement, closing statements.

- Appraisal Reports: If you had an appraisal done, especially for the change in use.

- Floor Plans/Measurements: To help justify your apportionment percentage (e.g., square footage of rental unit vs. total home).

- Before and After Photos: Especially for major renovations or repairs, to distinguish between capital improvements and repairs.

- Correspondence:

- Any formal letters or emails with tenants, contractors, or the CRA related to the rental.

How to Organize Your Records

- Digital vs. Physical: You can keep records digitally (scanned copies, cloud storage) or physically (well-organized folders). Many prefer a hybrid approach.

- Digital: Use apps like Evernote, Google Drive, Dropbox, or dedicated accounting software. Take photos of receipts immediately.

- Physical: Use a filing cabinet with clearly labeled folders for each expense category and year.

- Categorize: Create separate folders or digital tags for different expense categories (e.g., “Utilities 202X”, “Repairs 202X”, “Mortgage Interest 202X”).

- Monthly/Quarterly Review: Don’t wait until tax time to sort everything out. Review your income and expenses monthly or quarterly to ensure nothing is missed and to catch any discrepancies early.

- Backup: If keeping digital records, ensure you have multiple backups. If physical, keep them in a safe, dry place.

How Long to Keep Records

The CRA requires you to keep all supporting documents for your income tax return for at least six years from the end of the last tax year they relate to. For example, records for your 2023 tax return (filed in 2024) should be kept until the end of 2029.

“Your financial records are not just for the CRA; they’re your personal financial compass. The better your records, the clearer your financial path and the stronger your peace of mind.”

Common Pitfalls and How to Avoid Them

Even with the best intentions, landlords can sometimes make mistakes that lead to tax issues. Being aware of these common pitfalls can help you avoid them.

- Not Reporting All Income:

- Pitfall: Thinking small amounts don’t need to be reported, or that the CRA won’t find out about cash payments.

- Avoidance: Report all rental income, no matter how small or how it’s paid. The CRA has many ways to identify undeclared income.

- Claiming Personal Expenses:

- Pitfall: Deducting costs that relate to your personal living space, not just the rental unit, or claiming expenses that aren’t truly for earning rental income.

- Avoidance: Be diligent about apportioning shared expenses. Only claim expenses directly related to the rental activity. When in doubt, consult a tax professional.

- Mixing Up Repairs and Capital Expenditures:

- Pitfall: Deducting major improvements (capital expenditures) as immediate repairs, or vice-versa.

- Avoidance: Understand the difference. Repairs are deductible immediately; capital expenditures are added to the cost base and depreciated via CCA (if chosen). Keep detailed descriptions of work done.

- Poor Record Keeping:

- Pitfall: Losing receipts, not tracking income, or having disorganized records.

- Avoidance: Implement a robust record-keeping system from day one. Use spreadsheets, dedicated software, or well-labeled physical folders. Keep everything for at least six years.

- Not Understanding Capital Cost Allowance (CCA):

- Pitfall: Claiming CCA on the building without understanding the recapture implications, or claiming CCA when it creates a loss (which is not allowed).

- Avoidance: Understand that CCA is optional and has long-term consequences, especially regarding the Principal Residence Exemption and recapture. Consult a tax professional before claiming CCA on the building portion.

- Ignoring “Change in Use” Rules:

- Pitfall: Failing to address the deemed disposition when converting part of your home to rental use, or not making the Subsection 45(2) election.

- Avoidance: Be aware that renting out a portion of your home triggers these rules. Consider making the 45(2) election if it benefits your situation.

- Not Designating Your Principal Residence:

- Pitfall: Failing to designate your home as your principal residence in the year of sale, or incorrectly designating it if you’ve had multiple properties or significant rental use.

- Avoidance: When you sell your home, you must complete Form T2091, Designation of a Property as a Principal Residence by an Individual, to claim the exemption.

- Not Getting Professional Advice:

- Pitfall: Trying to navigate complex tax rules on your own, leading to missed deductions or costly errors.

- Avoidance: While this guide provides comprehensive information, every situation is unique. Consider consulting a tax professional (accountant) for personalized advice, especially for your first year as a landlord or if your situation changes.

By being proactive and informed, you can steer clear of these common mistakes and ensure a smooth, tax-efficient experience as a basement landlord.

Benefits of Professional Advice

While this guide aims to be comprehensive, navigating Canadian tax law can be complex, especially when it comes to rental income and property. This is where professional advice becomes invaluable.

When to Consult a Tax Professional (Accountant) 🧑💼

A qualified accountant or tax specialist can offer personalized advice and ensure you’re fully compliant while maximizing your deductions. Consider seeking their help if:

- It’s Your First Time: The first year of renting can be overwhelming. An accountant can set you up correctly.

- Complex Situations: If you have multiple rental properties, significant renovations, or are unsure about capital gains, CCA, or “change in use” rules.

- Tax Optimization: They can help you strategically plan to minimize your tax burden legally.

- Audit Support: If you’re ever audited by the CRA, an accountant can represent you and help you prepare your documentation.

- Staying Up-to-Date: Tax laws can change. An accountant stays current on all regulations.

“Investing in professional advice is not an expense; it’s an investment in your financial peace of mind. A good accountant pays for themselves by saving you money and preventing costly errors.”

When to Consult a Mortgage Broker (Like Everything Mortgages) 🏠

While accountants handle taxes, mortgage brokers like Everything Mortgages specialize in financing your home. They play a crucial role when considering a basement rental, especially regarding your mortgage.

- Mortgage Qualification: How does potential rental income affect your ability to qualify for a mortgage (or a larger mortgage)? Mortgage brokers can help you understand how lenders view rental income.

- Financing Renovations: If you need to borrow money to convert your basement into a legal apartment, a mortgage broker can explore options like a home equity line of credit (HELOC) or a home equity loan, or even a mortgage refinance to access your home’s equity.

- Investment Property Mortgages: If you’re considering buying a new property specifically for rental income, a mortgage broker can guide you through the process of securing an investment property mortgage.

- Stress Testing and Affordability: Mortgage brokers can help you understand how “stress testing” might impact your ability to qualify for a mortgage if you’re relying on future rental income. They can also help you assess the overall affordability of your home with or without rental income. Learn more about stress testing in the Canadian mortgage market.

- First-Time Home Buyers: If you’re a first-time home buyer looking to purchase a property with a rental unit, a mortgage broker can help you avoid common first-time home buyer mistakes and ensure you qualify for the right mortgage. They can also provide insights into programs like the First-Time Home Buyer Incentive Program.

- Overall Financial Strategy: Everything Mortgages can help you integrate your rental income goals with your broader mortgage strategy, ensuring you have the right financing structure in place. They emphasize the importance of qualifying for a mortgage before buying property to ensure your financial success.

“At Everything Mortgages, we don’t just find you a mortgage; we provide solutions that align with your financial goals, whether that includes leveraging rental income or exploring refinancing options to enhance your property’s value. We’re your trusted partner through the entire mortgage process.”

Impact of Rental Income on Mortgage Eligibility

One of the most exciting aspects of having a basement rental is its potential to help you qualify for a larger mortgage or make your existing mortgage more manageable. Lenders often look favourably on stable rental income, as it improves your overall financial picture.

How Lenders View Rental Income

When you apply for a mortgage or refinance, lenders assess your Gross Debt Service (GDS) and Total Debt Service (TDS) ratios. These ratios determine how much of your income goes towards housing costs and all your debts, respectively. Rental income can significantly improve these ratios.

Lenders typically consider a percentage of your gross rental income when calculating your qualifying income. This percentage varies by lender and depends on factors like:

- Stability of Income: Is the rental income consistent? Do you have a signed lease agreement?

- Property Type: Is it a legal, registered basement apartment?

- Your Experience: Are you an experienced landlord?

Common approaches lenders take:

- Adding a Percentage of Gross Rents to Your Income:

- Many lenders will add 50% to 80% of your gross rental income to your total qualifying income. The remaining percentage (20-50%) is assumed to cover expenses like vacancies, maintenance, and property management.

- Example: If you earn $1,500/month in gross rent, a lender might add $750 (50%) to $1,200 (80%) to your annual income for qualification purposes. This can make a big difference!

- Using Net Rental Income (Less Common for Qualification): Some lenders might look at your net rental income (gross rent minus actual expenses) if you can provide detailed tax returns (T776 forms) for previous years. This is usually preferred for experienced landlords with a proven track record.

- Deducting a Flat Percentage for Expenses: Instead of adding a percentage, some lenders might add the full gross rent but then deduct a flat percentage (e.g., 50%) of the rent as an expense against the property’s carrying costs.

Why This Matters for Your Mortgage

- Increased Borrowing Power: By boosting your qualifying income, rental income can help you borrow more money, allowing you to afford a larger home or a property in a more desirable location.

- Improved Affordability: Even if you don’t need a larger mortgage, the rental income makes your current mortgage payments easier to manage, reducing financial stress.

- Qualifying for Refinancing: If you want to refinance your mortgage to access equity for renovations or debt consolidation, showing stable rental income can strengthen your application.

- Meeting Stress Test Requirements: Canada’s mortgage stress test requires borrowers to qualify at a higher interest rate than their actual mortgage rate. Rental income can help you meet these stricter qualification standards. Learn more about the stress test.

Working with a Mortgage Broker

This is precisely where Everything Mortgages excels. A skilled mortgage broker will:

- Assess Your Full Financial Picture: They will look at your salary, existing debts, and crucially, your rental income.

- Navigate Lender Policies: Different lenders have different rules for how they treat rental income. Your broker knows these nuances and can match you with the lender whose policies best suit your situation.

- Optimize Your Application: They can help you present your rental income in the most favorable light to potential lenders, ensuring you qualify for the best possible rates and terms.

- Advise on Renovation Financing: If you’re planning to create or upgrade a basement apartment, they can advise on the best way to finance these renovations, whether through a HELOC, a second mortgage, or refinancing.

- Provide Strategic Advice: They can help you understand how your mortgage decisions fit into your broader financial goals, including becoming a successful landlord. They can also help you understand the importance of qualifying for a mortgage before buying property.

“Don’t let your basement apartment be a secret to your mortgage lender! Leveraging that income can significantly boost your borrowing power. Talk to Everything Mortgages to see how your rental income can work for your next mortgage.”

Strategies for Maximizing Your Net Rental Income

Beyond understanding the tax rules, there are proactive strategies you can employ to maximize the net income you keep from your basement rental. This involves smart financial planning and operational efficiency.

- Legalize Your Basement Apartment:

- Why: A legal basement apartment is safer for your tenants, protects you from liability, and can increase your property’s value. Crucially, some lenders may only consider rental income from a legal secondary unit for mortgage qualification purposes. Municipalities have specific zoning, building code, and fire safety requirements.

- Action: Check your local municipal bylaws. Obtain all necessary permits and inspections. While there might be upfront costs, it’s a worthwhile investment.

- Set Competitive Rent:

- Why: Setting the right rent is key to attracting good tenants quickly and minimizing vacancies, which are periods of no income.

- Action: Research comparable rental units in your area. Consider factors like size, amenities, proximity to public transit, and overall condition. Online rental platforms are great for this.

- Screen Tenants Thoroughly:

- Why: Good tenants pay on time, take care of your property, and reduce your stress. Bad tenants can lead to costly evictions, property damage, and lost income.

- Action: Conduct credit checks, employment verification, and reference checks (previous landlords, employers). Use a clear and comprehensive lease agreement.

- Keep Property Well-Maintained:

- Why: Regular maintenance prevents small issues from becoming expensive problems. A well-maintained property also attracts and retains good tenants.

- Action: Address repairs promptly. Schedule routine maintenance (e.g., furnace checks, filter changes). Keep records of all maintenance costs for tax deductions.

- Budget for Vacancy and Unexpected Expenses:

- Why: Rentals aren’t always 100% occupied, and unexpected repairs can pop up. Having a buffer prevents financial strain.

- Action: Set aside 1-2 months’ rent per year for potential vacancies and an emergency fund for repairs (e.g., 10-15% of gross income).

- Understand Your True Costs:

- Why: Knowing your exact expenses (including the apportioned shared costs) helps you price your rent correctly and understand your actual profitability.

- Action: Use a detailed spreadsheet or accounting software to track all income and expenses. This also makes tax time much easier.

- Consider Capital Improvements Strategically:

- Why: While not immediately deductible, smart capital improvements can increase your property’s value, allow you to charge higher rent, and potentially be depreciated over time via CCA.

- Action: Focus on improvements that add significant value or appeal (e.g., modern kitchen, updated bathroom, energy-efficient windows). Discuss financing options with Everything Mortgages if needed, as they can help you explore solutions like using a HELOC or home equity loan for renovations.

- Explore Tax-Efficient Debt Management:

- Why: The interest on debt used to acquire or improve a rental property is tax-deductible.

- Action: If you have personal debt and a mortgage, talk to Everything Mortgages about strategies like refinancing to consolidate debt, potentially making more of your interest payments tax-deductible. They can also provide a guide to refinancing personal loans to help you manage your finances more effectively.

- Stay Informed on Landlord-Tenant Laws:

- Why: Each province has its own landlord-tenant legislation. Understanding your rights and responsibilities (and your tenant’s) helps prevent disputes and legal issues.

- Action: Familiarize yourself with your provincial Residential Tenancies Act.

By applying these strategies, you can not only manage your basement rental more effectively but also significantly boost your net rental income, leading to greater financial success.

Provincial/Territorial Specifics (Briefly)

While this article focuses on federal income tax rules (governed by the CRA), it’s important to be aware that provinces and territories also have their own specific rules and regulations that impact landlords. These typically fall into two main categories:

- Landlord-Tenant Laws:

- Each province and territory has its own Residential Tenancies Act (or similar legislation) that governs the relationship between landlords and tenants. These laws cover:

- Lease agreements and standard lease forms.

- Rent increase guidelines and limits.

- Rules for evictions.

- Repair and maintenance responsibilities.

- Rules for security deposits (e.g., damage deposits, key deposits).

- Dispute resolution mechanisms (e.g., Landlord and Tenant Board in Ontario, Residential Tenancy Branch in BC).

- Action: Before you rent out your basement, research your specific provincial/territorial residential tenancy laws. Ignorance of these laws is not an excuse and can lead to costly legal disputes.

- Each province and territory has its own Residential Tenancies Act (or similar legislation) that governs the relationship between landlords and tenants. These laws cover:

- Municipal Bylaws:

- Cities and towns often have their own bylaws regarding secondary dwelling units (like basement apartments). These bylaws can dictate:

- Zoning requirements (is a secondary unit allowed in your area?).

- Building code compliance (e.g., separate entrance, ceiling height, window size, fire safety, electrical, plumbing).

- Parking requirements.

- Registration or licensing requirements for rental units.

- Action: Contact your municipal planning or building department to understand the specific requirements for legalizing a basement apartment in your area. This is crucial for safety, property value, and avoiding potential fines.

- Cities and towns often have their own bylaws regarding secondary dwelling units (like basement apartments). These bylaws can dictate:

“Federal tax rules are universal, but your provincial and municipal regulations are just as vital. Make sure your basement rental is legal and compliant at all levels of government.”

Future Trends and Considerations

The landscape of housing and taxation is constantly evolving. Staying informed about potential future trends and considerations can help you plan strategically for your basement rental.

- Changing Housing Policies:

- Governments at all levels are increasingly focused on housing affordability and supply. This could lead to:

- Incentives for secondary suites: More programs or grants to encourage homeowners to create legal basement apartments.

- Stricter regulations: New rules regarding rental standards, rent control, or tenant protections.

- Tax changes: Potential adjustments to how rental income is taxed or new deductions/credits.

- Governments at all levels are increasingly focused on housing affordability and supply. This could lead to:

- Interest Rate Fluctuations:

- Interest rates directly impact your mortgage interest deductions. Rising rates mean higher interest payments and potentially larger deductions, but also higher overall mortgage costs.

- Action: Stay in touch with your mortgage broker (like Everything Mortgages) to understand how interest rate changes might affect your mortgage and overall financial strategy. They can provide insights into options like mortgage renewal or refinancing to manage costs.

- Inflation and Cost of Living:

- Inflation affects the cost of everything, including repairs, utilities, and insurance for your rental property.

- Action: Factor inflation into your budgeting for rental expenses. This might also influence your decisions on rent increases (within provincial guidelines).

- Technological Advancements:

- Smart Home Technology: Can improve energy efficiency (reducing utility costs) and offer better security or convenience for tenants, potentially justifying higher rent.

- Property Management Software: Makes record-keeping, rent collection, and maintenance tracking easier.

- AI for Market Analysis: Tools that can help you analyze rental market trends and set optimal rent prices.

- Environmental and Green Initiatives:

- Governments are pushing for greener homes. This could lead to:

- Rebates for energy-efficient upgrades: Which could reduce your costs and make your rental more attractive.

- New building code requirements: For energy efficiency, which might impact future renovations.

- Action: Consider investing in energy-efficient appliances or insulation for your rental unit.

- Governments are pushing for greener homes. This could lead to:

By keeping an eye on these trends, you can proactively adapt your landlord strategy, ensuring your basement rental remains a profitable and compliant venture for years to come.

Conclusion

Renting out your basement in Canada can be a fantastic way to boost your income, help with mortgage payments, and increase your home’s value. However, it’s clear that navigating the world of basement rental income tax requires careful attention to detail and a solid understanding of the rules set by the Canada Revenue Agency (CRA).

From meticulously tracking all your income and eligible expenses to understanding the nuances of Capital Cost Allowance and the Principal Residence Exemption, every step plays a crucial role in ensuring you comply with tax laws and maximize your net rental income. Remember, good record-keeping isn’t just a recommendation; it’s your best defense and your key to unlocking all the tax benefits available to landlords.

While the tax landscape can seem daunting, with the right information and professional guidance, you can transform your basement into a thriving and tax-efficient asset. Don’t hesitate to seek advice from a qualified tax professional for your tax obligations and, for all your financing needs, reach out to Everything Mortgages.

Whether you’re looking to finance your basement renovation, understand how potential rental income impacts your mortgage qualification, or simply want to ensure your overall financial strategy is sound, our award-winning mortgage brokers are here to help. We simplify your financing experience, offering expert rate and loan matching from over 35 lenders, and committed support every step of the way.

Ready to explore your mortgage options or get a free consultation?

Your trusted mortgage broker company in Canada is here to help you turn your home’s potential into financial reality. 🏠✨

Disclaimer: This blog post provides general information about Canadian income tax rules for basement rental income and should not be considered professional tax advice. Tax laws are complex and can change. Every individual’s financial situation is unique. It is highly recommended to consult with a qualified tax professional (e.g., a Chartered Professional Accountant – CPA) for personalized advice tailored to your specific circumstances before making any tax-related decisions. Everything Mortgages specializes in mortgage financing and can provide expert advice related to your mortgage needs.