March 24, 2025

How Does the Canada vs USA Tariff War Affect Your Mortgage?

Share this article:

Tariff War Mortgage Impact Calculator

The growing trade tensions between Canada and the United States have evolved into a full-blown tariff war with far-reaching consequences for Canadian homeowners and prospective buyers. With billions of dollars in goods now subject to retaliatory tariffs, these economic ripples are affecting everything from construction costs to mortgage rates. If you’re wondering “how does the Canada vs USA tariff war affect your mortgage?” – you’re asking the right question at a critical time.

The Escalating Trade Tensions: What’s Happening?

The tariff battle has intensified, with Canada now imposing retaliatory tariffs on approximately $30 billion worth of American goods. These measures directly respond to the U.S. implementation of 25% tariffs on Canadian steel, aluminum, and lumber – all essential materials for the housing market.

For Canadian homeowners and potential buyers, this economic standoff isn’t just international news – it’s a development that could significantly impact your largest financial investment: your home.

Rising Construction Costs and Housing Affordability

The Material Impact

The 25% tariffs on building materials are already causing noticeable price increases across the construction industry. Steel products, particularly wide-flange I-beams used in high-rise construction, have seen substantial price hikes. These increased costs are creating delays in construction projects and reducing the overall housing supply.

Key Impact: Experts warn this could worsen Canada’s existing housing shortage, which requires an estimated 5.8 million new homes by 2030 to restore affordability to the market.

What This Means for Homebuyers

If you’re planning to buy a new home, prepare for higher prices. Industry forecasts project new home prices to rise by approximately 6% in 2025 alone, adding to Canada’s already challenging affordability landscape.

Real-World Example: The retaliatory tariffs on U.S.-imported appliances and glass products are adding between $3,000 and $5,000 to the cost of a typical single-family home.

For Current Homeowners Planning Renovations

If you’re considering home improvements, the tariff war means you’ll likely face higher costs for materials. This situation makes it essential to explore cost-effective strategies such as:

- Prioritizing renovations with the highest return on investment

- Refinancing to fund necessary upgrades while interest rates are still relatively favorable

- Exploring home equity options to finance improvements

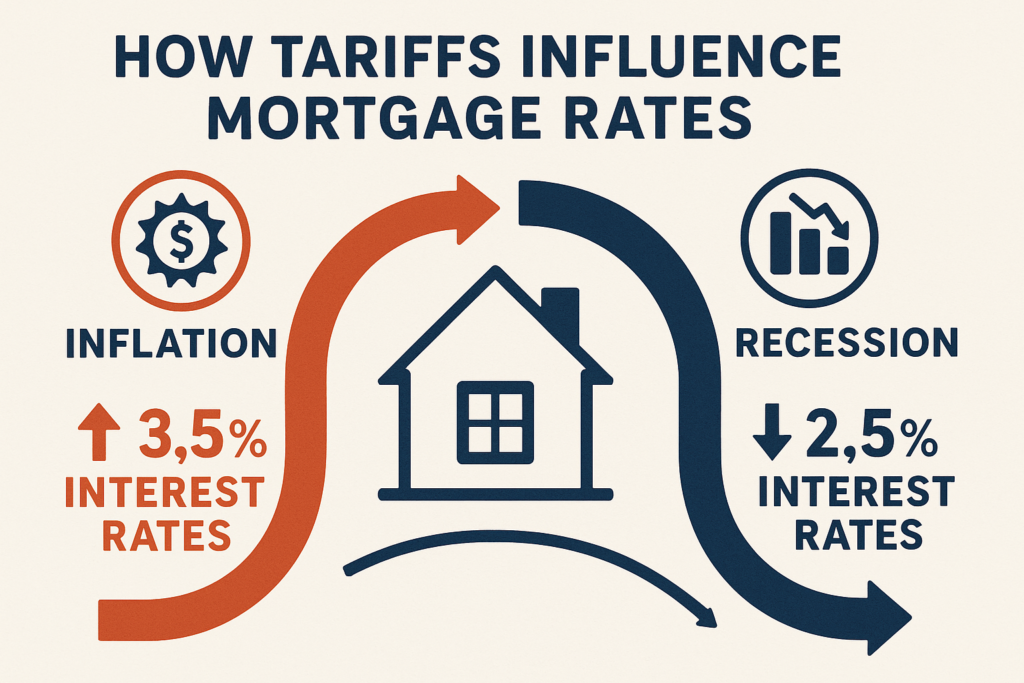

Mortgage Rate Volatility: The Inflation vs. Recession Dilemma

The tariff war creates a complex economic scenario that directly affects mortgage rates through two competing forces:

The Inflationary Pressure

Tariffs are inherently inflationary – they increase the cost of goods, which can push overall inflation higher. In a normal economic environment, this would pressure the Bank of Canada (BoC) to raise interest rates to combat inflation.

Recent Trend: The 10-year bond yield (which influences fixed mortgage rates) surged from 3.65% to 4.80% in late 2024, pushing fixed mortgage rates toward 7%.

The Recession Risk

Conversely, the economic slowdown caused by trade restrictions could trigger a recession, forcing the BoC to cut rates aggressively to stimulate the economy.

Economist Predictions: If the tariff situation triggers a recession, some economists predict the BoC may slash its benchmark rate to as low as 1.5% by October 2025.

What This Means for Different Mortgage Holders

This creates a tale of two outcomes for mortgage holders:

- Variable-rate mortgage holders: Could benefit if economic slowdown forces rate cuts

- Fixed-rate mortgage holders: May face higher payments when renewing if inflation drives rates up

Pro Tip: Use tools like the mortgage stress test to gauge your financial resilience to potential rate hikes. This test simulates how well you could handle increased mortgage payments under different scenarios.

Economic Slowdown and Employment Risks

The broader economic impact of the tariff war extends beyond direct housing costs and mortgage rates.

Job Market Concerns

Economic forecasts suggest a trade war-induced recession could lead to more than 100,000 job losses across Canada, potentially pushing the unemployment rate to 8%. Manufacturing and agricultural sectors are particularly vulnerable to these employment shocks.

The Ripple Effect on Mortgages

This employment uncertainty creates several mortgage-related challenges:

- Reduced buying power: As consumer confidence falls due to job insecurity, housing demand may decrease

- Increased default risk: Economic uncertainty may increase mortgage defaults, especially for those with variable or commission-based incomes

- Stricter lending criteria: Lenders may tighten approval standards in response to economic uncertainty

Mortgage Renewal Challenges

For homeowners approaching mortgage renewal during this volatile period, the stakes are particularly high. It’s crucial to:

- Start planning your renewal strategy at least 6 months in advance

- Avoid common mortgage mistakes that could limit your options

- Consider locking in rates if you believe they’ll rise before your renewal date

Currency Fluctuations and Foreign Investment

The tariff war is also affecting the value of the Canadian dollar, with significant implications for the housing market.

The Weakening Loonie

Economic projections suggest the Canadian dollar could weaken to approximately 67¢ USD if trade tensions continue. This currency depreciation creates a complex housing market dynamic.

The Double-Edged Sword for Housing

A weaker Canadian dollar has contradictory effects on the housing market:

- Attracts foreign buyers: Property becomes more affordable for international investors, potentially driving up prices in markets like Toronto and Vancouver

- Creates affordability challenges: For local buyers using Canadian dollars, the effective cost of housing rises as more foreign competition enters the market

Regional Impact Variations

The effects of foreign investment driven by currency fluctuations aren’t uniform across Canada:

- Major urban centers (Toronto, Vancouver): Likely to see increased foreign investment and price pressure

- Secondary markets: May benefit from spillover effects as buyers look for more affordable alternatives

- Rural areas: Generally less affected by foreign investment patterns

Strategies to Mitigate Tariff War Risks for Mortgage Holders

Despite the uncertain economic landscape, proactive homeowners can take several steps to protect their financial interests during this tariff war.

1. Consider Locking in Rates

If you currently have a variable-rate mortgage and are concerned about potential rate volatility, now might be the time to consider switching to a fixed rate. Compare your fixed vs. variable options carefully, weighing both current rates and future projections.

2. Build a Financial Buffer

Creating a financial cushion can help you weather potential mortgage payment increases:

- Aim to save 3-6 months of mortgage payments as an emergency fund

- Consider making extra payments while rates are lower to reduce your principal

- Learn strategies for paying down your mortgage faster to build equity more quickly

3. Explore Refinancing Options

For some homeowners, refinancing during this period of uncertainty might make sense:

- Lock in a lower rate before potential increases

- Consolidate higher-interest debt into your mortgage

- Access home equity for necessary expenses or investments

4. Consult with Mortgage Professionals

Mortgage brokers and financial advisors can provide personalized guidance during this volatile period. They can help you:

- Navigate refinancing or debt consolidation options

- Find the best available rates across multiple lenders

- Develop a strategy tailored to your specific financial situation

Special Considerations for Different Homeowner Groups

The tariff war affects different types of homeowners in unique ways. Here’s what specific groups should consider:

First-Time Homebuyers

If you’re entering the market during this tariff war:

- Be extra cautious with your budget and factor in potential rate increases

- Consider starting with a more modest property than you might have originally planned

- Look into government programs designed to assist first-time buyers

- Be prepared for potentially higher closing costs due to material price increases

Self-Employed Homeowners

Self-employed individuals face particular challenges during economic uncertainty:

- Maintain meticulous financial records to strengthen your mortgage application

- Consider specialized mortgage solutions for self-employed Canadians

- Work with lenders familiar with alternative income verification methods

- Build a larger down payment to offset lending concerns about variable income

Homeowners Near Retirement

If you’re approaching retirement during this period of economic volatility:

- Consider accelerating mortgage payments to reduce debt before retirement

- Evaluate whether downsizing might be beneficial given market conditions

- Explore options for converting home equity into retirement income

- Reassess your retirement timeline if mortgage costs increase significantly

The Regional Impact: How Different Canadian Markets Are Affected

The effects of the tariff war aren’t uniform across Canadian housing markets. Here’s how different regions might experience the impact:

Urban Centers (Toronto, Vancouver, Montreal)

- Higher sensitivity to construction material cost increases due to the predominance of high-rise development

- More vulnerable to foreign investment fluctuations driven by currency changes

- Generally better equipped to absorb economic shocks due to diverse employment bases

Suburban Markets

- Potentially benefiting from urban exodus if economic uncertainty continues

- More affected by construction costs for new developments

- May see more stable pricing than urban cores, especially for existing homes

Rural and Remote Areas

- Less direct impact from construction material tariffs due to lower development activity

- More vulnerable to broader economic slowdowns that affect resource-based employment

- Potentially more stable housing markets with less speculative investment

Long-Term Outlook: Beyond the Immediate Tariff Impact

While the immediate effects of the tariff war are concerning, it’s also important to consider the longer-term implications for Canadian mortgages and housing.

Potential Scenarios

Scenario 1: Extended Trade Tensions If the tariff war continues for years, we could see:

- Permanently higher construction costs

- A structural shift in Canadian housing supply

- Long-term pressure on affordability

Scenario 2: Resolution and Recovery If trade relations normalize:

- Construction costs would gradually stabilize

- Mortgage rates would likely follow more traditional economic patterns

- Housing supply could increase as building becomes more economical

Scenario 3: Broader Economic Restructuring A prolonged trade war might lead to:

- Reshoring of manufacturing to avoid tariffs

- New regional economic patterns affecting employment and housing demand

- Innovation in construction methods to reduce dependence on tariffed materials

What to Watch: Key Indicators for Mortgage Holders

To stay ahead of the tariff war’s impact on your mortgage, monitor these key indicators:

Economic Signals

- Bank of Canada announcements: Policy decisions directly affect variable mortgage rates

- Bond yields: Movements in the 10-year government bond yield typically precede changes in fixed mortgage rates

- Inflation data: Rising inflation may pressure the BoC to raise rates despite economic concerns

- GDP growth: Significant slowdowns may trigger rate cuts to stimulate the economy

Housing Market Indicators

- New housing starts: Declining starts may signal construction cost pressures

- Days on market: Increasing time to sell suggests weakening demand

- Price-to-rent ratios: Widening ratios may indicate unsustainable price growth

- Foreign buyer activity: Sudden changes could signal currency-driven investment shifts

Practical Steps: A Mortgage Action Plan During the Tariff War

Here’s a practical action plan for different mortgage situations during this uncertain period:

If You’re Shopping for a New Mortgage

- Get pre-approved: Lock in a rate guarantee while you shop

- Budget conservatively: Ensure you can handle potential rate increases

- Consider a slightly shorter amortization: Build equity faster as a buffer against market volatility

- Explore different lenders: Some may be less affected by economic shifts than others

If You Have an Existing Mortgage

- Review your renewal date: Know exactly when your current term ends

- Explore early renewal options: Some lenders allow renewal up to 6 months early

- Stress-test your budget: Ensure you can handle potential payment increases

- Consider making lump-sum payments: Reduce your principal while rates are lower

If You’re Considering Refinancing

- Calculate your break-even point: Understand how long it will take to recover any penalties

- Compare total borrowing costs: Look beyond just the interest rate

- Consider your employment stability: Refinancing may be more challenging if job security decreases

- Explore purpose-specific options: Renovation financing might have different terms than general refinancing

Government Responses and Potential Relief Measures

As the tariff war impacts housing affordability, government responses may help mitigate some effects:

Federal Level Possibilities

- Temporary expansion of first-time homebuyer incentives

- Modifications to the mortgage stress test to reflect economic conditions

- Tax credits for residential construction to offset material cost increases

- Special lending programs through CMHC for affected regions

Provincial Considerations

- Property tax adjustments to offset affordability challenges

- Regional development incentives to boost housing supply

- Expanded rent control or tenant protections in tight markets

- First-time homebuyer grant programs

Municipal Actions

- Expedited building permit processes to reduce construction delays

- Zoning adjustments to allow for more efficient land use

- Development fee holidays to encourage continued building

- Local economic development initiatives to maintain employment

Case Studies: Real-World Examples of Tariff Impact

Case Study 1: The New Home Buyer

Sarah and Michael were planning to purchase a new construction home in suburban Toronto. The builder informed them that due to tariff-related material cost increases, their home price would increase by $18,000. Additionally, their mortgage rate quote rose from 4.5% to 5.2% during the purchase process due to market volatility.

Result: Their monthly payment increased by $450 compared to initial estimates, forcing them to delay other financial goals.

Case Study 2: The Variable-Rate Mortgage Holder

David has a variable-rate mortgage that initially benefited from the economic uncertainty as the Bank of Canada cut rates in response to recession concerns. His payment decreased by $200 monthly.

Result: David used the savings to make extra principal payments, building more equity as a buffer against future market volatility.

Case Study 3: The Renovation Project

The Patel family planned a major home renovation estimated at $85,000. After the tariffs took effect, their contractor revised the estimate to $102,000 due to increased material costs.

Result: They scaled back certain aspects of the renovation and explored a HELOC instead of a traditional renovation loan to maintain flexibility.

The Bottom Line: Navigating Mortgage Decisions in Uncertain Times

The Canada-U.S. tariff war creates unprecedented uncertainty for mortgage holders and prospective homebuyers. While the situation continues to evolve, these principles can help guide your decisions:

- Stay informed: Monitor economic indicators and Bank of Canada policy decisions that affect mortgage rates

- Build flexibility: Where possible, maintain financial buffers and avoid stretching your budget to its limit

- Think long-term: Make mortgage decisions based on your long-term housing needs rather than attempting to time the market perfectly

- Seek professional guidance: Work with mortgage professionals who understand how to navigate volatile economic conditions

- Consider your unique situation: Your employment stability, equity position, and financial goals should guide your mortgage strategy during this period

By understanding how the Canada-U.S. tariff war affects your mortgage and taking proactive steps to mitigate risks, you can protect your financial interests even as economic conditions fluctuate. Remember that housing remains both a necessity and typically a good long-term investment, even during periods of economic uncertainty.