February 8, 2026

Current Self-Employed Mortgage Rates in Toronto: Best Fixed and Variable Options as of February 2026

Share this article:

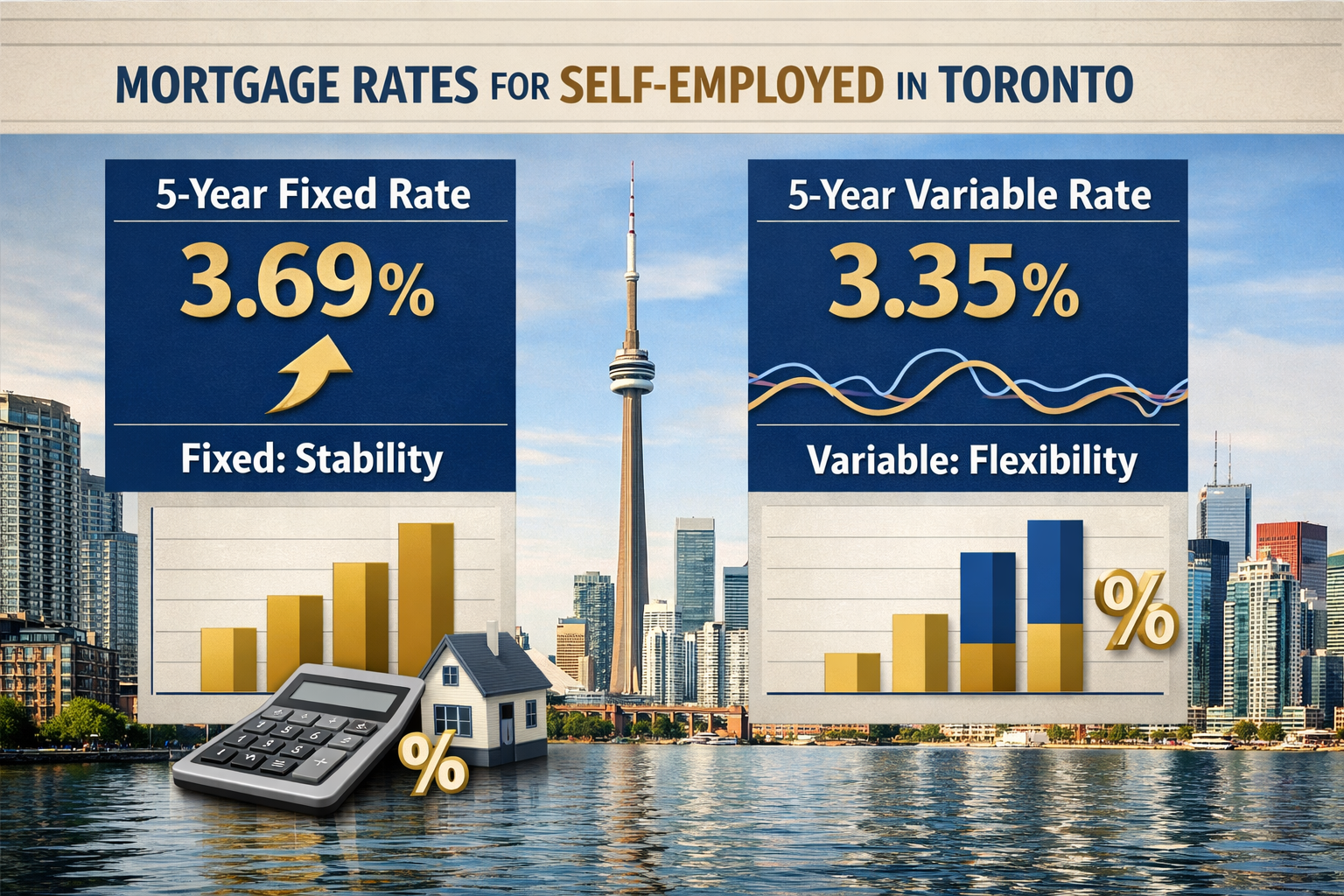

Securing a mortgage as a self-employed professional in Toronto has historically been more challenging than it is for traditional employees, but the landscape in 2026 offers competitive opportunities for those who know where to look. Current self-employed mortgage rates in Toronto are surprisingly competitive, with 5-year fixed rates as low as 3.69% and 5-year variable rates hovering around 3.35% for qualified borrowers in Ontario[2]. These rates represent some of the most attractive financing options available to entrepreneurs, contractors, freelancers, and business owners looking to purchase or refinance property in Canada’s largest city.

The key to accessing these favorable rates lies in understanding the unique qualification requirements that lenders apply to self-employed applicants and knowing which mortgage products—fixed or variable—best align with your financial situation and risk tolerance. As we navigate through February 2026, the mortgage landscape continues to evolve with the Bank of Canada’s prime rate holding steady at 4.45%[2], creating a relatively stable environment for borrowers who can demonstrate consistent income and strong creditworthiness.

Key Takeaways

✅ Competitive rates are available: Self-employed borrowers in Toronto can access 5-year fixed rates as low as 3.69% and 5-year variable rates around 3.35% in February 2026[2]

✅ Documentation is critical: Lenders typically require two years of income verification through tax returns, Notices of Assessment, and financial statements to approve self-employed mortgages[1]

✅ Credit and debt ratios matter: A minimum credit score of 620 and total debt service (TDS) ratios between 32-42% are standard requirements for self-employed applicants[1]

✅ Fixed vs. variable decision: With rates expected to remain relatively stable through Q3 2026, both fixed and variable options offer distinct advantages depending on your risk profile[6]

✅ Alternative lenders expand options: B-lenders and private mortgage providers offer additional pathways for self-employed borrowers who don’t meet traditional A-lender criteria

Understanding Current Self-Employed Mortgage Rates in Toronto: Best Fixed and Variable Options as of February 2026

The mortgage rate environment in Toronto during February 2026 reflects a period of relative stability following the Bank of Canada’s series of rate adjustments over the previous two years. For self-employed borrowers specifically, understanding the current rate landscape is essential to making informed financing decisions.

Fixed Mortgage Rates for Self-Employed Borrowers

Fixed-rate mortgages provide payment certainty and protection against interest rate increases throughout the term. As of February 2026, self-employed borrowers in Toronto can access the following fixed rates:

- 1-year fixed: 4.19% (insured)[1]

- 3-year fixed: 3.99% (insured)[1]

- 5-year fixed: 3.69% to 3.89% (high-ratio/insured)[1][2]

The 5-year fixed rate remains the most popular choice among Canadian homebuyers, offering a balance between rate stability and competitive pricing. For self-employed professionals, the slightly higher rate of 3.89% on insured mortgages[1] compared to traditional employee mortgages reflects the perceived additional risk that lenders associate with variable income sources.

Fixed rates are particularly attractive in the current environment because mortgage rate forecasts suggest that the Bank of Canada’s overnight rate will likely hold steady for several months, possibly through Q3 2026[6]. This stability means that locking in a fixed rate now provides protection without necessarily sacrificing significant savings that might come from waiting for further rate decreases.

Variable Mortgage Rates for Self-Employed Borrowers

Variable-rate mortgages fluctuate with changes to the lender’s prime rate, which typically moves in tandem with Bank of Canada policy rate adjustments. Current variable rates in Ontario include:

- 5-year variable: 3.35% (Ontario)[2]

- Canada-wide lowest variable: Around 3.4%[3]

Variable rates currently sit below fixed rates, offering immediate savings on monthly payments. The spread between the 5-year fixed (3.69%) and 5-year variable (3.35%) is approximately 0.34 percentage points—a meaningful difference that can translate to substantial savings over the mortgage term.

However, self-employed borrowers considering variable rates must weigh the potential for rate increases against their income stability. With the Bank of Canada prime rate at 4.45%[2] and economic conditions showing mixed signals, variable-rate holders should be prepared for potential payment adjustments if economic conditions shift.

For a detailed comparison of these mortgage types, review our comprehensive guide on fixed vs. variable mortgages.

Rate Outlook for 2026 and Beyond

According to current forecasts, mortgage rates are unlikely to move significantly lower in 2026 unless economic conditions weaken substantially or Government of Canada bond yields decline from their current elevated levels near 2.8%[2]. This outlook suggests that the rates available in February 2026 represent a favorable window for self-employed borrowers to secure financing.

The stability in rates also means that self-employed professionals who have been waiting for lower rates may want to reconsider their strategy. With rates holding relatively steady and housing inventory in Toronto remaining competitive, delaying a purchase in hopes of dramatically lower rates could mean missing out on property opportunities.

Qualification Requirements for Self-Employed Mortgages in Toronto

Securing a mortgage as a self-employed individual requires meeting specific criteria that differ from traditional employment-based applications. Lenders scrutinize self-employed applications more carefully due to the perceived variability in income, but understanding these requirements can help borrowers prepare effectively.

Income Documentation Standards

The cornerstone of any self-employed mortgage application is comprehensive income documentation. Lenders typically require:

Two Years of Tax Returns: Most lenders want to see at least two consecutive years of personal tax returns (T1 Generals) to establish income consistency[1]. Some lenders may accept applications with only one year of self-employment history if the borrower has previous experience in the same industry.

Notices of Assessment (NOAs): Canada Revenue Agency Notices of Assessment verify the income reported on tax returns and confirm that taxes have been filed and assessed[1].

Financial Statements: For incorporated business owners, lenders may request corporate financial statements prepared by an accountant, including balance sheets and income statements.

Business License and Registration: Documentation proving the legitimacy and duration of your business operations strengthens your application.

The challenge many self-employed borrowers face is that their taxable income (after deductions and write-offs) may be significantly lower than their actual cash flow. While tax efficiency is smart business practice, it can limit mortgage qualification amounts. Our ultimate guide to securing a mortgage for self-employed Canadians provides strategies for navigating this common challenge.

Credit Score Requirements

Self-employed borrowers typically need a minimum credit score of 620 to qualify for traditional mortgage products[1], though many lenders prefer scores of 680 or higher for the best rates. Higher credit scores can help offset concerns about income variability and may provide access to more competitive rate offerings.

Key credit considerations include:

- Payment history: Consistent on-time payments for all credit obligations

- Credit utilization: Keeping credit card balances below 30% of available limits

- Credit mix: A healthy combination of credit types (credit cards, loans, lines of credit)

- Recent inquiries: Avoiding multiple credit applications in the months before applying for a mortgage

Self-employed professionals with credit challenges should explore easier qualification options for self-employed borrowers that may provide alternative pathways to homeownership.

Debt Service Ratios

Lenders evaluate your ability to carry mortgage debt using two key ratios:

Gross Debt Service (GDS) Ratio: This measures your housing costs (mortgage principal and interest, property taxes, heating, and 50% of condo fees if applicable) as a percentage of gross income. Most lenders prefer GDS ratios below 32-39%.

Total Debt Service (TDS) Ratio: This includes all debt obligations (housing costs plus credit cards, car loans, student loans, etc.) as a percentage of gross income. For self-employed borrowers, lenders typically look for TDS ratios between 32-42%[1], though some flexibility exists depending on other application strengths.

Self-employed applicants with higher debt loads may need to consider debt consolidation or reduction strategies before applying for a mortgage to improve their ratios.

Down Payment Considerations

While the minimum down payment requirements are the same for self-employed and traditionally employed borrowers (5% for properties under $500,000), larger down payments can significantly improve approval odds and access to better rates.

Down payment tiers include:

- 5-9.99%: Minimum for properties under $500,000; requires mortgage default insurance

- 10-19.99%: Reduces insurance premiums; still requires insurance

- 20% or more: Eliminates mortgage insurance requirement; provides access to conventional mortgage products and often better rates

For self-employed borrowers with complex income situations, a 20% or larger down payment can sometimes compensate for income documentation challenges and open doors to more lender options.

Tax Arrears and Compliance

A critical requirement often overlooked is that self-employed borrowers must be free of tax arrears[1]. Outstanding debts to the Canada Revenue Agency are a significant red flag for lenders and can result in automatic application denial, regardless of other qualification strengths.

Before applying for a mortgage, ensure:

- All personal and business taxes are filed and current

- Any outstanding tax balances are paid or have approved payment arrangements

- HST/GST remittances (if applicable) are up to date

- No tax liens exist against you or your business

Comparing Fixed and Variable Mortgage Options for Self-Employed Borrowers

Choosing between fixed and variable mortgage rates represents one of the most significant decisions self-employed borrowers face. Each option offers distinct advantages and considerations that should align with your financial situation, risk tolerance, and business income stability.

Fixed-Rate Mortgages: Stability and Predictability

Fixed-rate mortgages lock in your interest rate for the entire term, providing complete payment certainty regardless of market fluctuations. For self-employed professionals in Toronto, this stability offers several compelling benefits:

Budget Certainty 💰: With fixed payments, you can accurately forecast housing costs, which is particularly valuable when business income fluctuates seasonally or project-based. This predictability simplifies financial planning and cash flow management.

Protection Against Rate Increases: If interest rates rise during your term, your rate remains unchanged. Given the current 5-year fixed rate of 3.69-3.89%[1][2], borrowers lock in historically reasonable rates with protection against potential future increases.

Peace of Mind: The psychological benefit of knowing your rate won’t change can be significant, especially for self-employed individuals who already manage considerable business-related financial uncertainty.

Easier Qualification: Some lenders view fixed-rate applications as lower risk, potentially making approval slightly easier for borderline applications.

However, fixed rates also have drawbacks:

- Higher initial rates: Currently about 0.34 percentage points higher than variable rates

- Prepayment penalties: Breaking a fixed mortgage typically involves higher penalties calculated using interest rate differential (IRD) formulas

- Missed savings opportunities: If rates decline, you won’t benefit unless you refinance (incurring penalties)

Variable-Rate Mortgages: Flexibility and Potential Savings

Variable-rate mortgages offer rates that fluctuate with the lender’s prime rate, currently providing attractive options at around 3.35%[2]. For self-employed borrowers, variable rates present different strategic considerations:

Lower Initial Rates: The current variable rate advantage of approximately 0.34 percentage points translates to meaningful monthly savings. On a $500,000 mortgage, this difference amounts to roughly $90-100 per month in reduced payments.

Potential for Further Savings: If the Bank of Canada reduces rates further (though forecasts suggest stability through Q3 2026[6]), variable-rate holders benefit immediately without refinancing.

Lower Prepayment Penalties: Variable mortgages typically use a simple three-month interest penalty calculation, making them easier and less expensive to break if circumstances change.

Convertibility Options: Most variable-rate mortgages allow conversion to fixed rates at any time, providing flexibility to lock in if rates begin rising.

The risks of variable rates include:

- Payment uncertainty: Rates can increase, raising monthly payments and potentially straining budgets

- Stress test implications: Qualification requires proving you can afford payments at higher rates

- Psychological stress: Some borrowers find the uncertainty of fluctuating payments stressful

For self-employed professionals with stable, consistent business income and healthy cash reserves, variable rates currently offer attractive savings. Those with more volatile income streams or tight budgets may prefer the certainty of fixed rates.

Explore more details in our analysis of variable mortgages to determine which option aligns with your situation.

Hybrid Strategies: Splitting Your Mortgage

An often-overlooked option is splitting your mortgage between fixed and variable components. For example, you might place 60% of your mortgage in a 5-year fixed product at 3.69% and 40% in a variable product at 3.35%.

This hybrid approach offers:

- Partial protection against rate increases

- Partial benefit from rate decreases

- Balanced risk exposure

- Diversified interest rate strategy

For self-employed borrowers who value both stability and opportunity, this middle-ground approach can provide an optimal balance.

Lender Options for Self-Employed Mortgage Applicants in Toronto

Not all lenders approach self-employed mortgage applications with the same criteria or flexibility. Understanding the different lender categories available in Toronto can help you identify the best fit for your specific situation and maximize your chances of approval at competitive rates.

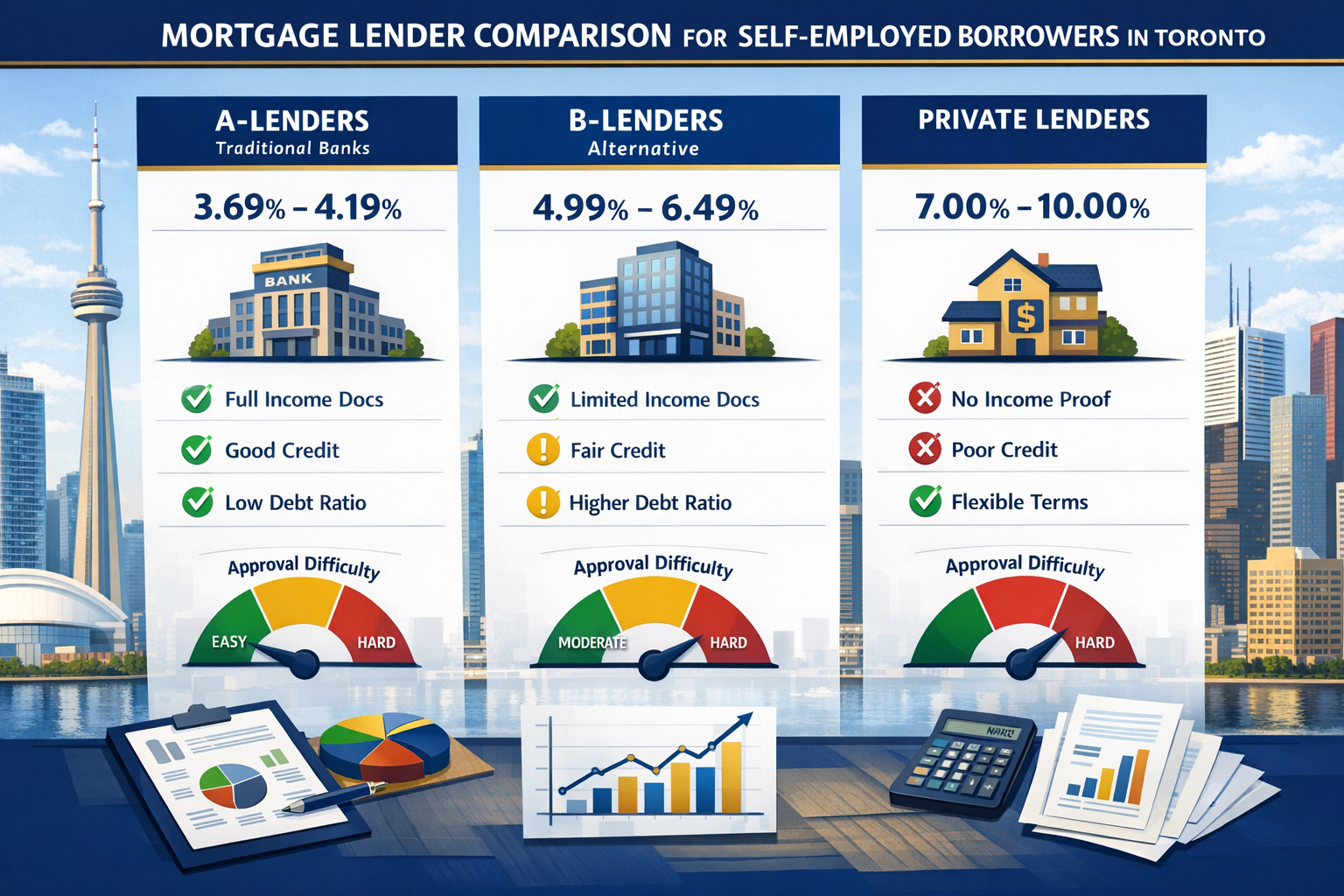

A-Lenders (Traditional Banks and Credit Unions)

A-lenders include major Canadian banks (RBC, TD, Scotiabank, BMO, CIBC) and credit unions. These institutions offer the most competitive rates—including the 3.69% 5-year fixed and 3.35% variable rates available in Ontario[2]—but maintain the strictest qualification requirements.

Advantages of A-Lenders:

- Lowest interest rates available in the market

- Full-service banking relationships with integrated products

- Established reputation and regulatory oversight

- Potential for relationship-based rate discounts

Qualification Requirements:

- Minimum two years of self-employment history

- Strong credit scores (typically 680+)

- Comprehensive income documentation

- Debt service ratios within standard parameters (32-42% TDS)[1]

- No tax arrears or compliance issues

- Typically require 20% down payment for best rates

A-lenders work well for self-employed borrowers with clean, well-documented income, strong credit, and straightforward financial situations. If you’ve been self-employed for several years with consistent income growth and maintain excellent credit, starting with A-lenders makes sense.

B-Lenders (Alternative or Subprime Lenders)

B-lenders are financial institutions that specialize in serving borrowers who don’t fit traditional lending criteria. While rates are typically 0.5-2.0 percentage points higher than A-lender rates, B-lenders offer significantly more flexibility in qualification.

When B-Lenders Make Sense:

- Self-employment history less than two years

- Credit scores between 550-680

- Recent credit issues (late payments, collections)

- Higher debt service ratios

- Income documentation challenges

- Previous bankruptcy or consumer proposal (discharged)

B-Lender Characteristics:

- Rates typically range from 4.5-6.5% in the current market

- More flexible income verification (may accept stated income with larger down payments)

- Shorter typical terms (1-3 years)

- Strategy often involves refinancing to A-lender once qualification improves

For self-employed professionals in transition or with recent business launches, B-lenders can provide a bridge to homeownership while you build the track record needed for A-lender qualification. Learn more about alternative lenders and how they serve self-employed borrowers.

Private Lenders

Private lenders are individuals or corporations that lend their own capital, typically secured by real estate. These lenders focus primarily on property equity rather than borrower income or credit.

Private Lender Scenarios:

- Significant credit challenges

- Tax arrears or compliance issues

- Minimal or no verifiable income

- Unique property types

- Time-sensitive transactions

- Bridge financing needs

Private Lending Characteristics:

- Rates typically range from 7-12%+ in 2026

- Loan-to-value ratios usually capped at 65-75%

- Short terms (6-24 months typical)

- Higher fees (lender fees, broker fees, legal costs)

- Focus on exit strategy (how you’ll refinance out)

Private mortgages should generally be viewed as short-term solutions rather than long-term financing. They work well for self-employed borrowers who need immediate financing while resolving qualification issues or waiting for income documentation to accumulate.

Discover more about how private mortgages work in Ontario and current private mortgage rates.

Specialty Programs for Specific Professions

Certain self-employed professionals benefit from specialized mortgage programs designed for their occupations:

Doctors and Medical Professionals: Many lenders offer preferential programs for physicians, dentists, and other medical professionals, recognizing their high earning potential and low default rates. These programs may accept minimal income history for newly established practices. Explore self-employed mortgages for doctors for detailed information.

Contractors and Tradespeople: Specialized programs exist for construction professionals, electricians, plumbers, and other trades, often with more flexible income verification recognizing the contract-based nature of the work. Review self-employed mortgages for contractors to understand these options.

Commissioned Sales Professionals: Some lenders have programs specifically for real estate agents, insurance brokers, and other commission-based professionals.

Working with Mortgage Brokers

For self-employed borrowers navigating Toronto’s mortgage landscape, working with an experienced mortgage broker offers significant advantages:

- Access to multiple lenders (A, B, and private) through a single application

- Expertise in self-employed qualification strategies

- Knowledge of which lenders are most flexible for specific situations

- No direct cost (brokers are compensated by lenders)

- Advocacy and application optimization

A knowledgeable Toronto mortgage broker can identify lenders most likely to approve your specific situation and help structure your application for maximum success.

Strategies to Secure the Best Self-Employed Mortgage Rates in Toronto

Getting approved for a mortgage as a self-employed borrower is one challenge; securing the best possible rates is another. Implementing strategic preparation and optimization can mean the difference between premium and standard rate offerings.

Optimize Your Income Reporting

The tension between tax efficiency and mortgage qualification represents a common challenge for self-employed borrowers. While minimizing taxable income through legitimate business deductions reduces tax liability, it also reduces the income lenders use for qualification.

Strategic Approaches:

Plan Ahead: If you’re considering a home purchase within 1-2 years, consult with your accountant about balancing tax deductions with mortgage qualification needs. You may choose to claim fewer discretionary deductions in the years preceding your mortgage application.

Use Corporate Income Wisely: If you’re incorporated, consider the mix of salary versus dividends. Some lenders give full credit to dividends, while others discount them. Understanding lender-specific policies helps optimize your compensation structure.

Document Add-Backs: Work with your accountant to prepare a statement showing legitimate add-backs (depreciation, one-time expenses, non-recurring costs) that demonstrate stronger cash flow than taxable income suggests. Some lenders consider these adjustments.

Consider Stated Income Programs: With a larger down payment (typically 35%+), some lenders offer stated income programs that rely less heavily on tax return verification. These carry higher rates but can work for borrowers with strong cash flow but lower reported income.

For detailed guidance, review our article on how to get approved for a mortgage using your business income.

Strengthen Your Credit Profile

Credit score optimization can unlock better rates and more lender options. Even small improvements can yield meaningful benefits:

Target Score Ranges:

- 680+: Access to best A-lender rates (3.69% fixed, 3.35% variable)[2]

- 650-679: Good A-lender access, may not qualify for absolute best rates

- 620-649: Limited A-lender options, consider B-lenders[1]

- Below 620: B-lender or private options

Improvement Strategies:

- Pay down credit card balances below 30% utilization (below 10% is ideal)

- Ensure all payments are on time for at least 6-12 months before applying

- Don’t close old credit accounts (credit history length matters)

- Dispute any errors on your credit report

- Avoid new credit applications in the 3-6 months before mortgage application

- Consider becoming an authorized user on a family member’s established account

Increase Your Down Payment

Larger down payments provide multiple benefits for self-employed borrowers:

20% Down Payment Benefits:

- Eliminates mortgage default insurance requirement and premiums

- Accesses conventional mortgage products with more lender options

- May compensate for borderline income or credit situations

- Demonstrates financial discipline and stability

25-35% Down Payment Benefits:

- May qualify for stated income or reduced documentation programs

- Provides stronger negotiating position for rate discounts

- Significantly reduces monthly payments and total interest costs

Where to Source Down Payment Funds:

- Personal savings (most straightforward)

- RRSP Home Buyers’ Plan (up to $35,000 per person)

- Gift from immediate family (with proper documentation)

- Sale of existing property or investments

- Business retained earnings (properly documented)

Reduce Debt Service Ratios

Lowering your debt obligations before applying improves your qualification and may unlock better rates:

Strategic Debt Reduction:

- Pay off or significantly reduce credit card balances

- Consider paying off car loans or personal loans

- Consolidate high-interest debt

- Avoid taking on new debt (new car, business loans) before applying

- If carrying business debt, ensure it’s properly structured and documented

Income Optimization:

- If married or common-law, consider whether dual application or single application works better based on income and credit profiles

- Explore co-signer options (parent, business partner) if needed

- Consider including rental income from existing properties (if applicable)

Time Your Application Strategically

Market timing can influence the rates available:

Rate Environment Considerations: With rates expected to hold relatively stable through Q3 2026[6], there’s less advantage to waiting for dramatic decreases. Current rates of 3.69% fixed and 3.35% variable[2] represent reasonable entry points.

Seasonal Factors: Lender competition tends to increase in spring (March-May) when housing market activity peaks, potentially creating more favorable rate offerings.

Personal Timing: Ensure you apply when your financial situation is strongest—after tax filing when NOAs are available, after completing profitable business quarters, or after credit improvements have been reflected in your score.

Consider Rate Hold and Pre-Approval Strategies

Rate holds allow you to lock in current rates (typically for 90-120 days) while you shop for properties. For self-employed borrowers, obtaining pre-approval offers several advantages:

- Confirms your qualification and maximum purchase price

- Locks in current rates against potential increases

- Demonstrates seriousness to sellers in competitive markets

- Identifies documentation gaps before finding your ideal property

Use our best mortgage rates calculator to estimate your qualification amount and monthly payments at current rates.

Explore Refinancing and Renewal Opportunities

If you’re already a homeowner with an existing mortgage, refinancing or renewal can provide opportunities to access better rates or terms. Self-employed borrowers often find that after several years of business operation, they qualify for better products than when they initially purchased.

Refinancing Considerations:

- Access equity for business investment, renovations, or debt consolidation

- Switch from B-lender to A-lender if qualification has improved

- Move from private to conventional financing

- Consolidate high-interest debt into lower-rate mortgage debt

Learn more about mortgage refinancing and switching lenders at renewal to understand your options.

Professional Documentation and Presentation

The quality of your application matters significantly for self-employed borrowers:

Professional Preparation:

- Work with an accountant to prepare clear, professional financial statements

- Organize documentation logically with cover sheets and explanations

- Prepare a brief business overview explaining your industry, experience, and stability

- Include client contracts, recurring revenue documentation, or business growth evidence

- Address potential concerns proactively with explanations

A well-prepared, professional application signals competence and reliability, potentially influencing lender decisions, especially in borderline situations.

Conclusion: Taking Action on Current Self-Employed Mortgage Rates in Toronto

The mortgage landscape in February 2026 presents genuine opportunities for self-employed professionals in Toronto to secure competitive financing for their home ownership goals. With 5-year fixed rates available at 3.69% and 5-year variable rates at 3.35%[2], the current environment offers reasonable entry points for qualified borrowers who understand the unique requirements and strategies that apply to self-employed mortgage applications.

The key differentiators between successful and unsuccessful self-employed mortgage applications typically come down to preparation, documentation, and strategic positioning. Unlike traditionally employed borrowers who can often secure approval with minimal preparation, self-employed applicants benefit significantly from advance planning—ideally beginning 12-24 months before intended purchase.

Your Next Steps

If you’re planning to purchase within 3-6 months:

- Gather documentation immediately: Collect two years of tax returns, NOAs, financial statements, and business registration documents

- Check your credit: Obtain your credit report and score, addressing any issues or errors

- Calculate your ratios: Determine your GDS and TDS ratios to understand your qualification range

- Consult a mortgage broker: Connect with a Toronto mortgage professional experienced in self-employed applications to assess your specific situation

- Get pre-approved: Secure rate holds and confirmation of your maximum purchase price

If you’re planning to purchase within 1-2 years:

- Optimize income reporting: Work with your accountant to balance tax efficiency with mortgage qualification needs

- Build your credit score: Implement credit improvement strategies to reach 680+ if possible

- Increase savings: Focus on building your down payment to 20% or higher

- Reduce debt: Pay down credit cards, loans, and other obligations to improve debt ratios

- Maintain tax compliance: Ensure all personal and business taxes are filed and current

If you’re currently a homeowner considering refinancing:

- Assess your equity position: Determine how much equity you’ve built

- Review your current rate: Compare against current market rates (3.69% fixed, 3.35% variable)[2]

- Calculate break penalties: Understand the cost of breaking your current mortgage

- Identify your goals: Clarify whether you’re seeking lower payments, debt consolidation, or accessing equity

- Explore renewal timing: If renewal is within 6-12 months, consider waiting versus breaking early

The Importance of Expert Guidance

While this guide provides comprehensive information about current self-employed mortgage rates in Toronto and strategies for securing approval, every situation is unique. The interplay between your specific income structure, credit profile, down payment, property type, and lender policies creates a complex decision matrix that benefits from professional navigation.

Working with mortgage professionals who specialize in self-employed applications—whether brokers, accountants, or financial advisors—can help you optimize your approach, avoid costly mistakes, and access lender options you might not find independently. The investment in professional guidance typically pays for itself many times over through better rates, terms, and approval odds.

Looking Ahead

The mortgage rate environment through 2026 appears relatively stable, with the Bank of Canada expected to maintain current policy rates through at least Q3 2026[6]. This stability means that waiting for dramatically lower rates may not be a productive strategy, especially if it means delaying your home ownership goals or missing favorable property opportunities in Toronto’s competitive market.

Instead, focus on positioning yourself as the strongest possible applicant, understanding your options across the lender spectrum (A-lenders, B-lenders, and private sources), and making informed decisions about fixed versus variable products based on your risk tolerance and financial situation.

The path to mortgage approval as a self-employed professional may require more documentation and preparation than traditional employment, but the rewards of homeownership remain equally accessible to those who approach the process strategically. With competitive rates currently available and a stable economic outlook, February 2026 represents an opportune time to pursue your Toronto real estate goals.

Take the first step today by assessing your current financial position, gathering necessary documentation, and connecting with professionals who can guide you through the process. Your entrepreneurial success in business can translate equally well to successful homeownership—with the right preparation and approach.

References

[1] Self Employed – https://rates.ca/guides/mortgage/self-employed

[2] Current Mortgage Rates Ontario – https://www.ratehub.ca/current-mortgage-rates-ontario

[3] Current Mortgage Rates – https://www.nerdwallet.com/ca/p/best/mortgages/current-mortgage-rates

[6] Mortgage Rate Forecast – https://www.truenorthmortgage.ca/blog/mortgage-rate-forecast