March 25, 2021

Housing Market Forecast for 2021

Share this article:

The Canadian real estate market defied all expectations in 2020. New all-time sales records were hit in several local markets, despite sky-high prices.

But what about 2021?

If you are planning to buy or sell a home this year, you want to know what the housing market forecast for 2021 will be. And, after a year like no other, the housing market is proving to be harder to predict than ever before.

The Canadian Housing Market

Over the past year, the Canadian economy suffered. The shutdowns in April 2020 led to unprecedented declines in economic activity. Canada’s unemployment rate fell to a record low of 13% in April, almost 10 percentage points below the rate in February.

In January 2021, in Ontario, the unemployment rate fell again by 154,000 (-2.1%), the first notable decline since May 2020. This second consecutive monthly increase is the first notable decline since May 2020, and brought the unemployment rate to its highest level since August 2020.

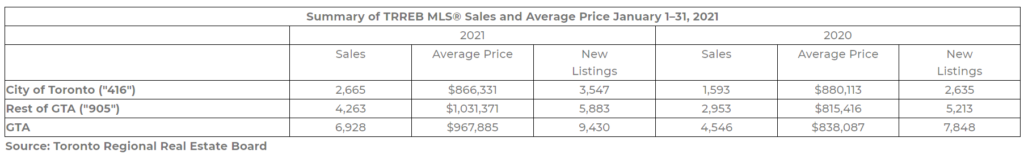

Yet, despite the worst economic slowdown in decades, the average house price in Canada shot up by 13.8% in 2020. Home sales recorded over Canadian MLS® Systems climbed 6.6% between January and February 2021 to set a new all-time record.

Source

In line with heightened activity since last summer, it was a new record for the month of February by a considerable margin (over 13,000 transactions). For the eighth straight month, sales activity was up in the majority of Canadian housing markets compared to the same month the previous year.

CREA reports that strong demand for housing may be hard to maintain, especially in traditionally busier spring months absent a surge of much-needed new supply. It’s quite possible as current COVID restrictions are eased and the weather starts to improve we will see an upward trend of housing supply shortages and demand.

The month-over-month increase in national sales activity from January to February was led by the Greater Toronto Area (GTA) and a number of other Ontario markets, along with Calgary and B.C.

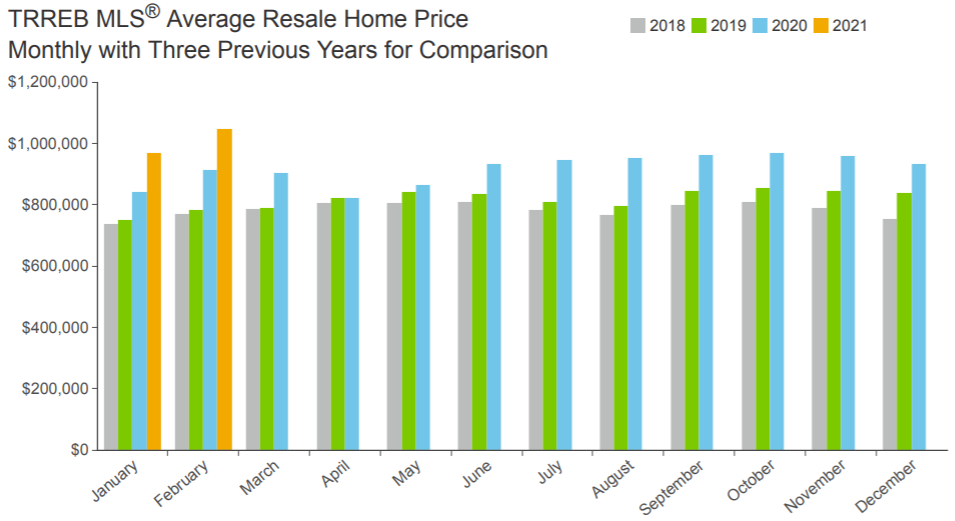

In fact, the Toronto and GTA real estate market remained strong and resilient throughout the pandemic. Home sales in Toronto reached a record average selling price over $1 million. The demand for low-rise, single-family homes was far exceeding the supply available.

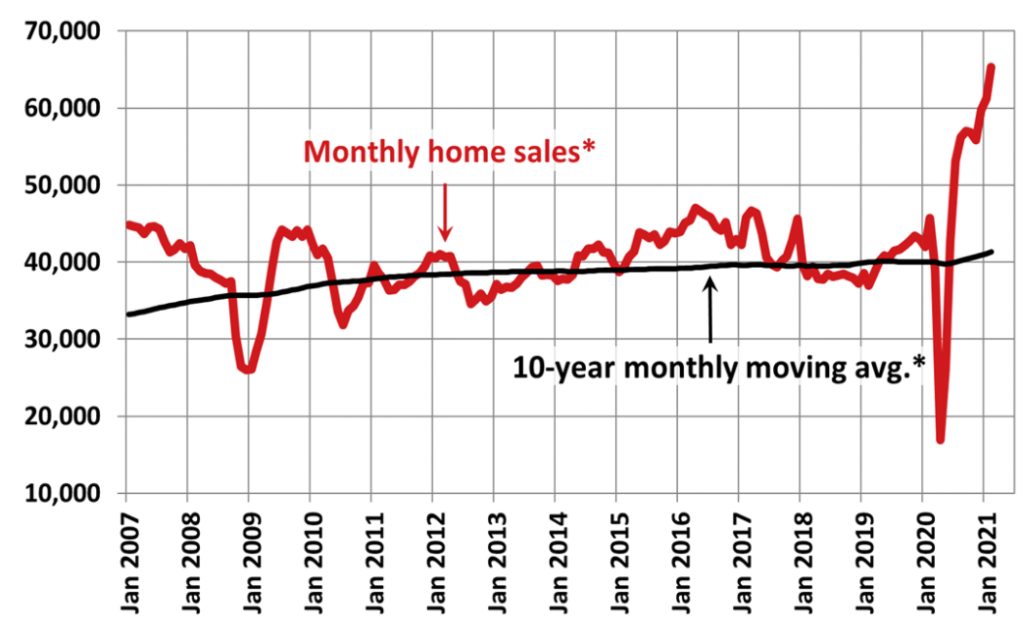

comparisons to previous years for each month.

Source

Based on the graphs above, it seems like there is no hint of global pandemic. So… what gives?

Canadian homebuyers across the country snatched up homes faster than they could be listed. It’s no wonder why national and provincial housing market forecasts vary. With predictions of rapid growth to warnings of a market crash, it’s safe to say the housing market forecast for 2021 will be the toughest year to predict.

Unfortunately, there is no way to predict the future to 100% accuracy, but we can see what notable experts are saying and make our conclusions from there.

What’s for certain is the pandemic has changed the way we live and work. The future of real estate in Canada will largely depend on housing trends that will shape Canadian real estate now, and in the future.

What follows is the top trends that will shape Canadians real estate and predictions from notable real estate and mortgage experts– Let’s dive in!

Toronto and GTA Housing Market Forecast for 2021

Get ready for a big BOOM! Experts predict a strong post-pandemic rebound– steady mortgage rates, job recoveries and a clear housing supply and demand will work together to create strong economic growth in the second half of 2021.

Record breaking borrowing costs combined with the rise of remote working with flexible schedules will push more people outside major cities to suburban areas.

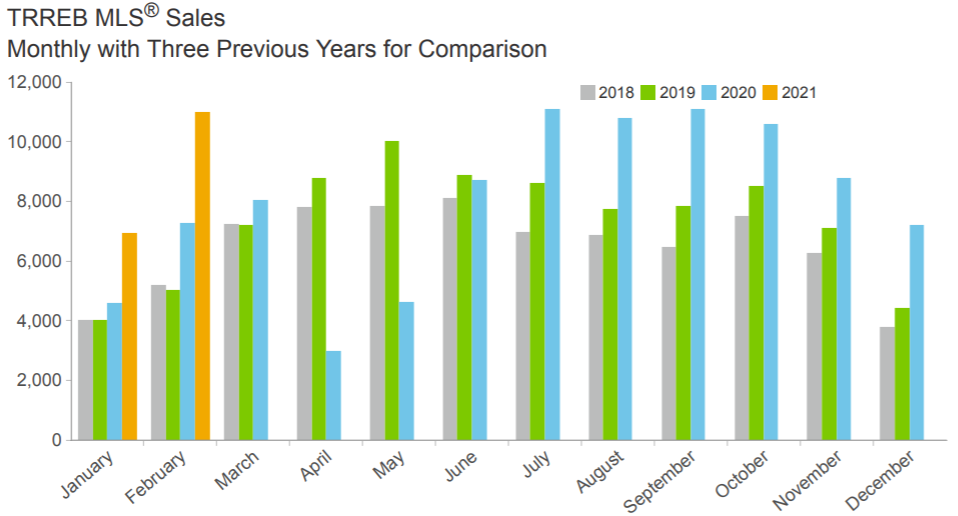

Population growth in the Greater Toronto Area will continue to increase demand for both ownership and rental housing. The strong demand and lack of supply of single-family homes will remain an issue which will continue to drive prices up and push more buyers further from urban centres.

examined along with comparisons to previous years for each month.

Source

Based on above, the bottom line is crystal clear: Home sales and prices are likely to be higher in 2021 compared to last year. What does that mean for you? Let’s take a dive deeper.

More Homebuyers Will Enter the Market

Working from home has freed so many Canadians. They no longer need to live within a commuting distance from their jobs. Buyers have more freedom to purchase properties where they want and where they can afford to live more comfortably.

The COVID-19 pandemic trigged a demand for larger properties among homeowners and first-time homebuyers. But finding more space at an affordable price forced homebuyers outside the city.

A significant trend we saw emerge was the wave of homebuyers leaving the city and flocking to smaller, more remote communities. Perhaps where they can weather next global pandemic.

Remote and flexible working arrangements fueled a buyer demand so intense that home prices soared to new heights in a matter of months. The GTA and even areas hours from the city of Toronto experienced the largest growth. Now, buyers are happy to sacrifice big city amenities for more space and affordable housing.

This increased demand hints that the housing market shows no signs of slowing down. Single-family homes outside of urban centres will see the strongest demand in 2021.

Competition is already heating up in smaller communities such as Bancroft, where the average home price in November 2020 was 23.4% higher than a year before, and in Woodstock Ontario where the price for a single-family home increased 28.4% year-over-year in November.

In February 2021, the hottest real estate market in the GTA was the region of Halton where the average sale price was $1,212,303, surpassing the city of Toronto for the first time ever.

Detached Homes Beat Condos & Small Cities Beat Large

Remote working and the desire for more space was bad news for condo owners and investors. Three key demographic groups which are crucial to keep condo properties profitable– students, travelers and immigration– disappeared and haven’t returned.

As a result, there was an excess of supply on condo and apartments for rent in the city. For the first time ever, the Toronto rental market became a renter’s market.

REMAX Canada reported the monthly rent of a one-bedroom apartment in Toronto has fallen as much as 23% year-over-year, with prices coming down as low as $1,500 in some of the most appealing locations in the city.

The Toronto Real Estate Board (TREBB) reported condo inventories in the city more than doubled and sale prices tumbled 4.7% year-over-year in December 2020 to $625,828.

During the pandemic, rent decreased which was blessing for renters. But, what about condo owners? The pandemic certainly impacted the condo market in Toronto. Condo owners who wished to escape the city had two options: ride the wave or sell at a discount. Luckily, the fear of a mass sell-off did not materialize as many condo owners chose the latter.

Condo owners remain optimistic and confident that the market will equalize. A combination of COVID-19 vaccinations and the federal government’s increased immigration targets for 2021 will most likely boost condo demand back to pre-pandemic levels.

But what’s interesting is how fast things change. In the last year, we saw a major shift in demand as people were moving away from the urban core and relocating themselves and their families further from their workplace to new areas.

As more middle-income families are being priced out of the one of the most expensive cities in North America, more homebuyers will seek housing in alternative housing markets.

As things begin to again this begs the question: will it last? Are companies going to ditch commercial workspaces for good? Will they mandate employees return to work in their downtown offices? Or, will there be more flexible work options available for those who prefer to work from home?

And, more importantly: What lies ahead for the future of condo living in a post-COVID world?

The pandemic resulted in a new craving for space– inside and outside the unit. In a world where everyone wants more space, perhaps the micro condo unit may be loosing it’s appeal.

After all, condos were built to accommodate growing populations. Now may the time to reimagine the Toronto skyline and perhaps adapt to meet the changing demands of buyers who have been rattled by a pandemic.

Advice for Homebuyers in 2021

With more homebuyers than sellers this year, you must be ready to bring your A Game if you want to purchase the home of your dreams. With more competition and heated price wars, you may feel like you’re at a disadvantage but don’t be discouraged– there’s hope for you yet!

If you’re purchasing a condo in an urban centre this year, the odds are in your favour. Demand for condo units have dropped so you can likely negotiate with the seller and snag a good deal.

If you’re purchasing a house this year, you may be up against some heavy competition. But, there’s always a silver lining. If you’re getting a mortgage, you may still get a low interest rate in 2021.

The average price in urban centres like Toronto are rising at a rate so fast that buyers are flocking to secondary housing markets. But, these communities will not remain affordable for long as demand grows.

Once the pandemic subsides and house prices equalize, there is a chance home prices will drop again so a “wait and see” approach may be appropriate. However, in a post-COVID world there is no telling what the housing market will look like.

Advice for Home Sellers in 2021

If you’re a home seller you can feel pretty confident about 2021. There are plenty of buyers in the market and less sellers to compete with. Whether you own a home in an urban or suburban area, you should have no problem selling your home this year.

Right now, mortgage rates are still very competitive. If you want to sell your home or refinance to access some equity, you can feel confident knowing that right now, you’re in the hot seat.

Your Mortgage Rate Forecast for 2021

Bank of Canada Guidance

The Bank of Canada will hold the current policy interest rate at 0.25% until the economy recovers and an inflation level of 2% is achieved.

In Canada, the economy is proving to be more resilient than anticipated. Businesses and consumers have successfully adapted to containment measures and the housing market has remained strong throughout the pandemic.

In the near-term, they are still wary of the evolution of the virus and the state of the economy as the labour market is “a long way from recovery.” They say a third wave will set us back so interest rates will remain low until at least the second half of 2022.

Canadian Mortgage Rates Will Rise

Fixed rates are currently near record lows. The sharp decline in interest rates increased homebuying budgets which explains why home prices were able to rise quickly in areas with little housing supply.

The Bank of Canada’s commitment to keep the policy rate at the “effective lower bound” of 0.25% indicates the economy will not recover until 2022.

Deputy Governor Lawrence Schembri shared that right now, Canadian household savings increased by an average of $5,800 per Canadian in 2020. Strong activity in the housing market suggests that some people are trading up for more space.

He warns that it will take a while for the economy to return to pre-pandemic levels and will largely rely on if there is a third wave of infections, lockdown measures, delays in the vaccine rollout and overall uncertainty around the COVID-19 variants.

For now, there’s no risk of a dramatic overnight rate increase but fixed rates will keep rising as the economy reopens. Most major banks increased their fixed rates this past week and the gap between fixed and variable rates will keep growing. Experts predict that fixed rates will more than double in 12-24 months from now.

Time to Lock It In?

The neutral policy rate implies that once Canada emerges from a recession, interest rates will rise again. This will impact homebuying budgets and will most likely force home prices down again.

The advice for borrowers is to expect a rate hike considerably sooner than 2023. Once the BoC deems the economy to be stable they will begin to ease off the emergency rate hold. What you need to know is any changes in the BoC’s outlook will impact fixed rates well before variable rates.

In the near-term, borrowers should consider locking in at today’s historically low fixed rates. Low mortgage rates provide more purchasing power which is a gift to homebuyers. However, in markets with low supply, competition may play a factor. As for homebuyers interested in getting a variable rate mortgage, you may wait until the economy is more stable.

You can take advantage of this by getting a pre-approved mortgage up to 120 days before closing on a home purchase or renewal of your existing mortgage.

By the time you find a place you like, rates may have risen and your homebuying budget may be smaller than anticipated. Talk to a mortgage broker about getting a pre-approval with a rate guarantee.

For sellers, it may be worthwhile for you to sell sooner rather than later. There is no doubt the pandemic has caused record-breaking market conditions but there is still a lot of uncertainty about how the market will be once the pandemic is over.

Homeowners can also take advantage of the low rates with a mortgage refinance. If you are considering taking equity out of your home, now is a good time to lock in and secure a new rate for the future.

Regarding the COVID-19 pandemic, in Ontario, there seems to be a light at the end of the tunnel. Cases are declining, the economy is reopening, and vaccines are rolling out. This begs the question: will we return to some semblance of pre-pandemic life?

It may be too early to tell. But, if you are planning (or hoping) to move forward with your home ownership goals, the good news is you can.

How to Buy with Confidence in Any Market

The housing market is not easy to predict. That’s why it’s important to have an expert by your side. Whether you are home buyer, seller or owner, speak to a Mortgage Broker as early as possible to discuss your options and lock in the best rate available to you. You can feel confident about your home ownership strategy no matter what the market is doing.

Subscribe below to get more insights delivered right to your inbox.