February 6, 2026

How 2026 Mortgage Rate Forecasts (5.9%-6.5%) Impact Self-Employed Homebuyers

Share this article:

The mortgage landscape in 2026 presents a unique opportunity for self-employed Canadians looking to enter the housing market. With major financial institutions predicting mortgage rates to stabilize between 5.9% and 6.5% throughout the year, understanding How 2026 Mortgage Rate Forecasts (5.9%-6.5%) Impact Self-Employed Homebuyers has never been more critical. Unlike the volatile rate environment of recent years, this anticipated stability could create favorable conditions for freelancers, contractors, and business owners who have traditionally faced additional hurdles in the mortgage approval process.

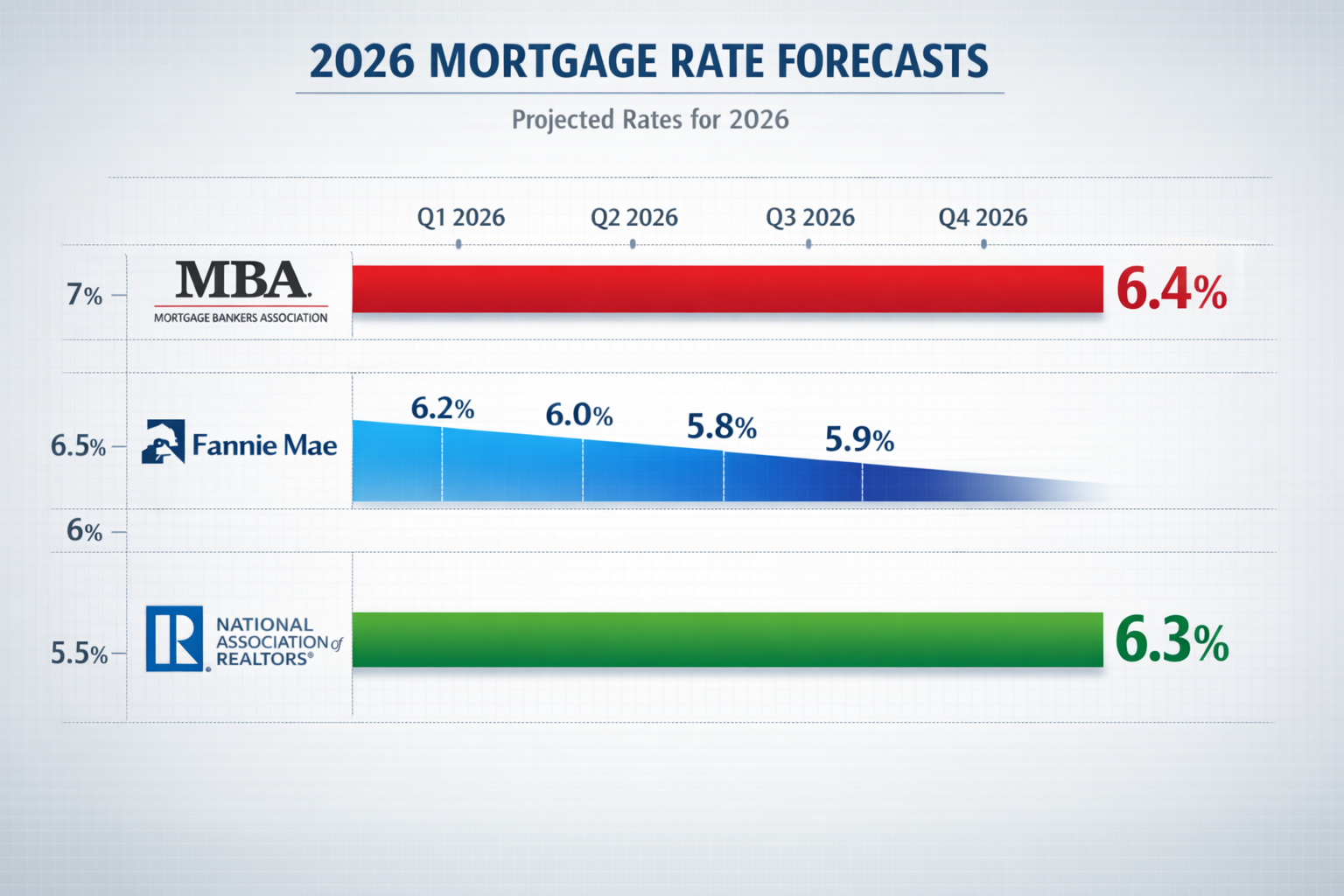

The convergence of predictions from the Mortgage Bankers Association (MBA), Fannie Mae, and the National Association of Realtors (NAR) suggests a relatively flat rate environment—a scenario that may actually benefit self-employed borrowers through alternative documentation pathways and improved planning opportunities.

Key Takeaways

✅ Major forecasters predict mortgage rates will stabilize between 5.9%-6.5% in 2026, with Fannie Mae projecting a gradual decline from 6.2% in Q1 to 5.9% by Q4[1]

✅ Self-employed borrowers can benefit from rate stability through better financial planning and access to alternative documentation methods that accommodate irregular income patterns

✅ Alternative lenders and B-lenders are expanding options for self-employed Canadians who may not fit traditional lending criteria but have strong business fundamentals

✅ Strategic timing and preparation can help self-employed homebuyers maximize their purchasing power in a predictable rate environment

✅ Working with specialized mortgage brokers who understand self-employed income verification can significantly improve approval odds and secure competitive rates

Understanding the 2026 Mortgage Rate Forecast Landscape

What Major Financial Institutions Are Predicting

The consensus among leading financial forecasters provides valuable insight into How 2026 Mortgage Rate Forecasts (5.9%-6.5%) Impact Self-Employed Homebuyers. Here’s what the major players are saying:

Mortgage Bankers Association (MBA) projects a consistent 6.4% rate across all quarters of 2026[1]. This stability represents a departure from the dramatic fluctuations experienced in previous years and suggests a more predictable borrowing environment.

Fannie Mae offers the most optimistic projection, forecasting rates to start at 6.2% in Q1 and gradually decline to 5.9% by Q4—approximately 10 basis points per quarter[1]. This downward trajectory could create strategic timing opportunities for self-employed buyers.

National Association of Realtors (NAR) predicts an average of 6.3% throughout 2026[1], while Wells Fargo anticipates a tight range of 6.15%-6.20%[1]. Both Redfin and the National Association of Home Builders align closely with these predictions at 6.3% and 6.17% respectively[2].

Comparing 2026 Forecasts: A Quick Reference

| Organization | 2026 Rate Forecast | Trend Direction |

|---|---|---|

| Fannie Mae | 6.2% → 5.9% | 📉 Declining |

| MBA | 6.4% (all quarters) | ➡️ Stable |

| NAR | 6.3% average | ➡️ Stable |

| Wells Fargo | 6.15%-6.20% | ➡️ Stable |

| Redfin | 6.3% | ➡️ Stable |

| NAHB | 6.17% | ➡️ Stable |

Why Rate Stability Matters for Self-Employed Borrowers

For self-employed Canadians, predictable mortgage rates create planning advantages that volatile markets cannot offer. When rates fluctuate wildly, lenders often tighten qualification criteria and become more conservative with non-traditional income sources. A stable rate environment typically means:

🏡 More consistent underwriting standards across lenders

💼 Greater willingness to consider alternative documentation methods

📊 Improved ability to plan and budget for homeownership costs

⏰ Reduced pressure to rush decisions based on rate fears

The projected stability in 2026 mortgage rates allows self-employed individuals to focus on strengthening their financial profiles rather than chasing rate windows.

How 2026 Mortgage Rate Forecasts (5.9%-6.5%) Impact Self-Employed Homebuyers: The Documentation Advantage

Alternative Documentation in a Stable Rate Environment

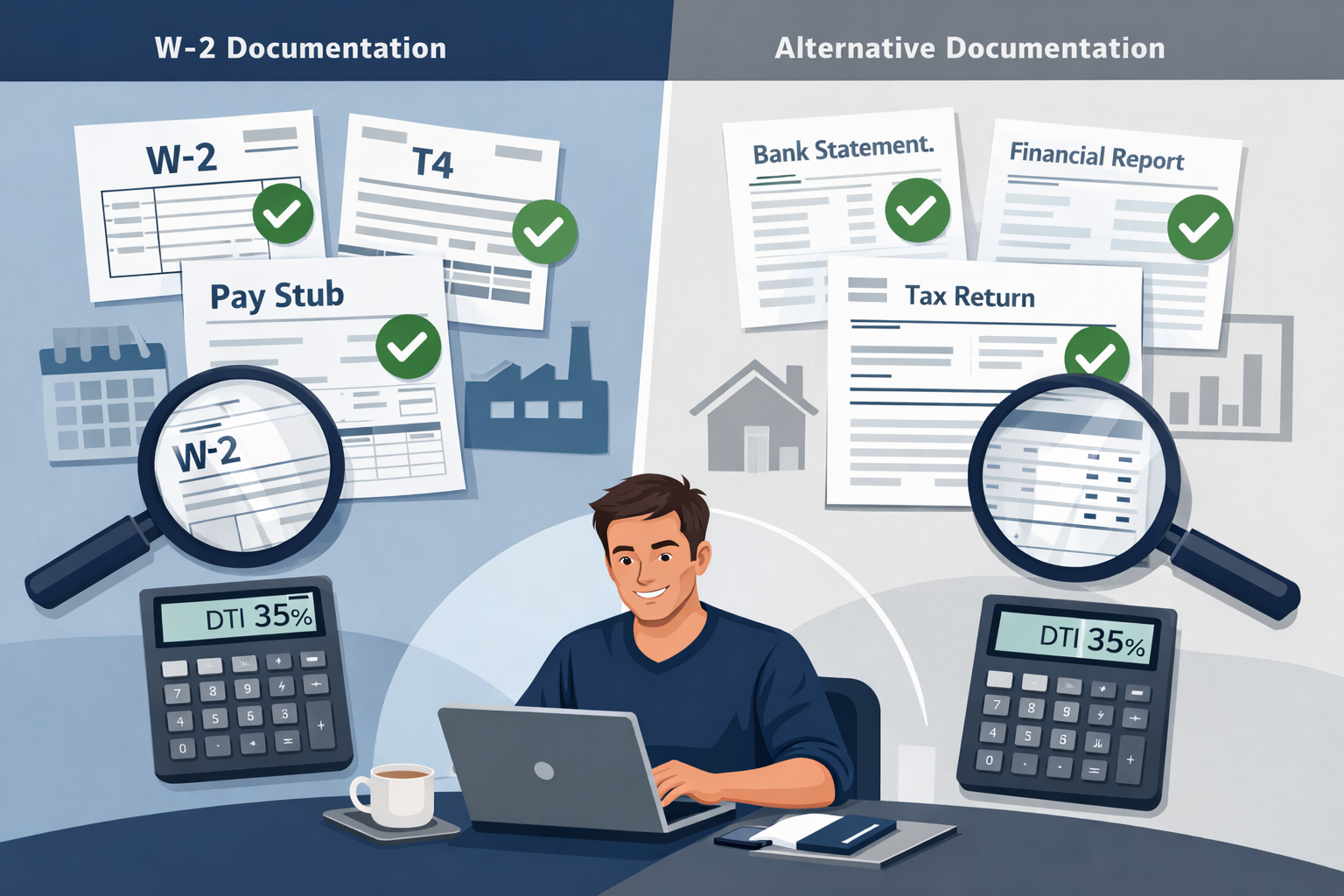

One of the most significant ways How 2026 Mortgage Rate Forecasts (5.9%-6.5%) Impact Self-Employed Homebuyers relates to alternative documentation pathways. When rates stabilize, lenders have more bandwidth to evaluate non-traditional income verification methods.

Self-employed Canadians typically face challenges with standard income verification because they:

- Write off business expenses that reduce taxable income

- Experience seasonal or project-based income fluctuations

- May have recently started their business (less than 2 years)

- Hold income in corporate structures that complicate personal qualification

Alternative documentation methods that become more accessible in stable rate environments include:

📄 Bank Statement Programs: Lenders review 12-24 months of business bank deposits to calculate average income, bypassing traditional tax return requirements

📄 Stated Income Programs: Available through select alternative lenders for borrowers with strong credit and substantial down payments

📄 Business Financial Statement Reviews: Analysis of profit and loss statements, balance sheets, and accounts receivable

📄 Portfolio Lending: Direct lender programs that use proprietary underwriting criteria rather than traditional guidelines

For self-employed Canadians seeking innovative mortgage solutions, understanding these alternative pathways is essential.

The Self-Employed Income Verification Challenge

Traditional lenders typically require two years of tax returns showing consistent or increasing income. However, self-employed individuals often strategically minimize taxable income through legitimate business deductions. This creates a paradox: successful business owners may appear to earn less on paper than their actual cash flow suggests.

Example Scenario:

A freelance consultant earns $120,000 in gross business revenue but claims $40,000 in legitimate business expenses (home office, equipment, travel, professional development). Their net taxable income appears as $80,000—but traditional lenders may only qualify them at this lower amount, significantly reducing their borrowing power.

In the stable rate environment forecasted for 2026, lenders offering alternative documentation can more confidently serve this market segment. The predictability allows for better risk assessment and pricing models that accommodate self-employed income patterns.

Working with Specialized Mortgage Professionals

The complexity of self-employed mortgage qualification makes working with experienced professionals crucial. A specialized mortgage broker for self-employed Canadians understands:

✔️ Which lenders offer the most flexible self-employed programs

✔️ How to present income documentation for maximum qualification

✔️ When alternative lenders provide better value than traditional banks

✔️ Strategies to strengthen applications before submission

✔️ How to navigate stricter lending standards that particularly affect self-employed borrowers

Strategic Advantages of the 5.9%-6.5% Rate Range for Self-Employed Buyers

Planning and Budgeting Benefits

The forecasted rate stability between 5.9% and 6.5% creates exceptional planning opportunities for self-employed homebuyers. Unlike volatile markets where rates can swing 50-100 basis points in weeks, the 2026 forecast allows for:

Long-term financial preparation: Self-employed individuals can spend 6-12 months improving their financial profile without fear that rates will spike dramatically during their preparation period.

Accurate affordability calculations: Knowing rates will likely remain within a 60 basis point range allows for realistic budgeting and property search parameters.

Strategic timing flexibility: Rather than rushing to lock rates before an anticipated increase, buyers can focus on finding the right property and negotiating favorable terms.

Income optimization strategies: Self-employed borrowers have time to work with accountants on balancing tax efficiency with mortgage qualification income.

Comparing Rate Impact on Borrowing Power

Understanding how even small rate differences affect affordability is crucial. Here’s how the forecasted range impacts monthly payments on a $500,000 mortgage (25-year amortization):

| Rate | Monthly Payment | Total Interest (25 years) |

|---|---|---|

| 5.9% | $3,253 | $475,900 |

| 6.2% | $3,317 | $495,100 |

| 6.5% | $3,382 | $514,600 |

Difference between lowest and highest forecast: $129/month or $38,700 over the life of the mortgage.

For self-employed borrowers, this relatively narrow range means predictable monthly obligations that can be confidently incorporated into business cash flow planning.

Why Flat Rate Trends Favor Alternative Lenders

When mortgage rates are stable rather than declining rapidly, alternative and B-lenders become more competitive. Here’s why:

In a falling rate environment, traditional banks aggressively compete for prime borrowers, often ignoring self-employed and non-traditional applicants. However, when rates stabilize:

🔹 Alternative lenders can price competitively without constantly adjusting for market volatility

🔹 Underwriting capacity expands as lenders aren’t overwhelmed with refinance applications from existing customers

🔹 Risk assessment models stabilize, allowing more nuanced evaluation of self-employed income

🔹 Portfolio lenders can offer specialized programs tailored to business owners and freelancers

For those exploring the ultimate guide to securing a mortgage as a self-employed Canadian, understanding this dynamic is essential.

Avoiding Common Self-Employed Mortgage Mistakes

Even in favorable rate environments, self-employed borrowers must avoid critical errors that can derail approval. The top mistakes self-employed homebuyers make include:

❌ Claiming excessive business deductions in the years before applying for a mortgage

❌ Failing to maintain clean separation between personal and business finances

❌ Not building sufficient credit history or maintaining high credit utilization

❌ Attempting to qualify immediately after starting a business (most lenders require 2+ years)

❌ Underestimating down payment requirements for self-employed applicants

❌ Not preparing comprehensive financial documentation before approaching lenders

The stable rate forecast for 2026 provides time to address these issues proactively rather than reactively.

Maximizing Your Position: Actionable Strategies for Self-Employed Homebuyers in 2026

Timing Your Application Strategically

Based on Fannie Mae’s projection of rates declining from 6.2% to 5.9% throughout 2026[1], self-employed buyers should consider:

Q1-Q2 2026 (Rates: 6.2%-6.1%)

- Ideal for buyers with strong applications ready to go

- Use this period to secure pre-approval and begin property search

- Lock in rates if you find the right property

Q3-Q4 2026 (Rates: 6.0%-5.9%)

- Optimal timing if you need several months to strengthen your financial profile

- Potentially lower rates but also potentially increased competition

- Consider this window if you’re still building your down payment

Strengthening Your Financial Profile

Self-employed applicants can take specific actions to improve qualification odds:

📊 Optimize Your Tax Strategy Work with an accountant to balance tax efficiency with mortgage qualification. Consider:

- Reducing discretionary business deductions in the 2-3 years before applying

- Documenting add-backs (one-time expenses that won’t recur)

- Maintaining detailed records of all income sources

💳 Improve Your Credit Profile

- Target credit scores above 680 (minimum) or 720+ (ideal)

- Pay down revolving credit to below 30% utilization

- Avoid opening new credit accounts in the 6 months before applying

- Dispute any errors on credit reports well in advance

💰 Build a Larger Down Payment Self-employed borrowers often benefit from:

- 20%+ down payment to avoid mortgage insurance

- 25-35% down payment for access to better alternative lender programs

- Documented savings history showing consistent deposits

📁 Organize Comprehensive Documentation Prepare a complete file including:

- 2-3 years of personal tax returns (T1 Generals)

- 2-3 years of business tax returns (T2s for corporations)

- Year-to-date profit and loss statements

- Business bank statements (12-24 months)

- Contracts or letters from clients showing ongoing work

- Professional license or business registration documents

Exploring Alternative Lending Options

Given the forecasted rate stability, self-employed buyers should actively explore:

B-Lenders and Alternative Lenders These institutions specialize in non-traditional borrowers and often provide:

- More flexible income verification methods

- Faster approval processes

- Willingness to consider unique situations

- Competitive rates (typically 0.5%-2% higher than A-lenders)

Private Lenders For borrowers who don’t qualify with traditional or alternative lenders:

- Short-term solutions (1-2 years) to bridge qualification gaps

- Higher rates but minimal income verification requirements

- Opportunity to improve financial profile for future refinancing

Credit Unions Often overlooked, credit unions may offer:

- Relationship-based lending with more flexibility

- Competitive rates for members

- Willingness to consider full financial picture beyond just tax returns

Understanding how private mortgages work in Ontario can provide valuable backup options.

Leveraging Rate Stability for Negotiation

The predictable rate environment creates negotiation opportunities:

With Sellers:

- Less urgency means more room for price negotiation

- Ability to include longer due diligence periods

- Opportunity to negotiate seller concessions for closing costs

With Lenders:

- Shop multiple lenders knowing rates won’t dramatically shift during comparison

- Negotiate rate holds and terms with confidence

- Request lender credits or fee waivers in competitive situations

Monitoring Economic Factors That Could Shift Forecasts

While forecasts suggest stability, self-employed buyers should monitor:

🌐 Global economic conditions that could impact Canadian rates

🏦 Bank of Canada policy decisions and inflation trends

📈 Employment data and GDP growth affecting lending appetite

🏘️ Housing market dynamics in your target area

External factors like potential U.S. tariffs could influence rate trajectories[3][4].

Building a Support Team

Successful self-employed homebuyers assemble a professional team:

Mortgage Broker: Specializing in self-employed clients with access to multiple lenders

Accountant: Understanding both tax optimization and mortgage qualification

Real Estate Agent: Experienced with self-employed buyers and their unique challenges

Financial Planner: Helping balance business growth, homeownership, and long-term wealth building

Lawyer: Reviewing contracts and ensuring proper legal structure for property ownership

Understanding the Broader Context: Economic Factors Behind the Forecasts

Why Are Rates Expected to Stabilize?

The consensus forecast of rates between 5.9%-6.5% reflects several economic factors:

Inflation Moderation: As inflation approaches central bank targets, the pressure for aggressive rate increases diminishes[5]

Economic Growth Balance: Moderate growth supports stable rates without triggering significant monetary policy changes

Bond Market Expectations: Government bond yields, which heavily influence mortgage rates, are expected to remain relatively steady[6]

Housing Market Equilibrium: Neither overheating nor crashing, the housing market should support stable lending conditions

How This Differs from Recent Years

The 2026 forecast represents a dramatic shift from recent volatility:

- 2022-2023: Rapid rate increases from historic lows to combat inflation

- 2024: Gradual stabilization as inflation moderated

- 2025: Continued adjustment and market recalibration

- 2026: Projected stability within a narrow range

For self-employed borrowers who may have delayed homebuying during volatile periods, 2026 represents a return to predictability.

Regional Considerations for Canadian Buyers

While this article focuses on general trends, self-employed Canadian homebuyers should consider regional variations:

Toronto and Vancouver: Higher property values may require larger down payments and stronger income documentation

Calgary and Edmonton: More affordable markets where self-employed buyers may qualify more easily

Ottawa and Montreal: Balanced markets with diverse lender options

Smaller Markets: May have fewer alternative lender options but also lower property costs

Understanding mortgage news specific to Toronto and other major markets can provide localized insights.

Conclusion: Seizing the Opportunity in 2026’s Stable Rate Environment

Understanding How 2026 Mortgage Rate Forecasts (5.9%-6.5%) Impact Self-Employed Homebuyers reveals significant opportunities for freelancers, contractors, and business owners ready to enter the housing market. The convergence of predictions from major financial institutions—with rates expected to remain between 5.9% and 6.5%—creates a rare window of predictability that self-employed Canadians can leverage to their advantage.

The relatively flat rate environment forecasted by the MBA (6.4%), NAR (6.3%), and Fannie Mae (6.2% declining to 5.9%)[1][2] means that self-employed borrowers can:

✨ Plan with confidence knowing rates won’t likely spike dramatically

✨ Access alternative documentation programs as lenders expand capacity in stable markets

✨ Take time to strengthen financial profiles without fear of missing narrow rate windows

✨ Work strategically with specialized professionals who understand self-employed qualification

✨ Explore diverse lending options from traditional banks to alternative and private lenders

Your Action Plan for 2026

Immediate Steps (Next 30 Days):

- Review your last 2 years of tax returns and assess qualification income

- Check your credit score and identify any issues to address

- Calculate realistic affordability based on the 6.0%-6.5% rate range

- Research mortgage brokers specializing in self-employed clients

- Begin organizing comprehensive financial documentation

Short-Term Preparation (3-6 Months):

- Consult with an accountant about optimizing income documentation

- Build or increase your down payment savings

- Improve credit profile by paying down debts and correcting errors

- Get pre-approved to understand your borrowing capacity

- Research target neighborhoods and property types

Long-Term Strategy (6-12 Months):

- Monitor rate trends and economic indicators

- Continue strengthening financial profile and documentation

- Build relationships with lenders and mortgage professionals

- Time your application to align with optimal rate periods

- Execute your homebuying plan with confidence

The forecasted stability in 2026 mortgage rates represents a genuine opportunity for self-employed Canadians who have historically faced additional challenges in the mortgage approval process. By understanding the predictions, leveraging alternative documentation pathways, and working with experienced professionals, self-employed homebuyers can successfully navigate the market and achieve their homeownership goals.

The key is preparation, patience, and partnership with the right professionals who understand your unique financial situation. The stable rate environment gives you the time to do it right—take advantage of this window to position yourself for success.

References

[1] 2026 Mortgage Rate Predictions – https://www.thetruthaboutmortgage.com/2026-mortgage-rate-predictions/

[2] Mortgage Interest Rates Forecast – https://www.rocketmortgage.com/learn/mortgage-interest-rates-forecast

[3] Current Mortgage Rates 01 28 2026 – https://fortune.com/article/current-mortgage-rates-01-28-2026/

[4] Mortgage Rates January 21 2026 – https://www.bankrate.com/mortgages/analysis/mortgage-rates-january-21-2026/

[5] Mortgage Outlook January 2026 – https://www.nerdwallet.com/mortgages/news/mortgage-outlook-january-2026

[6] Display – https://www.fanniemae.com/media/56586/display

[7] Mortgage Rates Forecast For 2026 Experts Predict Whether Rates Will Keep Dropping – https://www.firstcbt.bank/blog/post/mortgage-rates-forecast-for-2026-experts-predict-whether-rates-will-keep-dropping

[8] 2026 Mortgage Rate Forecast – https://www.acrisure.com/blog/2026-mortgage-rate-forecast